| CMP# | 380.8 |

| Idea | SELL |

| Sell Range | 395 – 380 |

| Target | 360 – 350 |

| StopLoss* | 400 |

| Duration | 15 – 20 Trading Sessions |

| Potential Return^ | 5 – 8% |

| CMP# | Idea | Sell Range | Target | StopLoss* | Duration | Potential Return^ |

| 380.8 | SELL | 395 – 380 | 360 – 350 | 400 | 15 – 20 Trading Sessions | 5 – 8% |

# CMP on July 24, 2019

* Maintain recommended StopLoss by daily closing basis.

Once 1st target hit, reset StopLoss at 370.

^ The returns are calculated based on CMP#

COMPANY OVERVIEW

Adani Ports and Special Economic Zone Limited is India’s largest private multi-port operator in India accounting for nearly one-fourth of the cargo movement in the country. Its presence has widespread in 10 ports across 6 states: Gujarat, Goa, Kerala, Andhra Pradesh, Tamil Nadu and Odisha. The company provides logistics and infrastructure services, port services include marine, handling intra-port transport, storage etc.

| Stock Data | |

| NSE Code | ADANIPORTS |

| Sectoral Index | Nifty 500 |

| 52W High | 430.6 |

| 52W Low | 292.1 |

| Face Value | 2 |

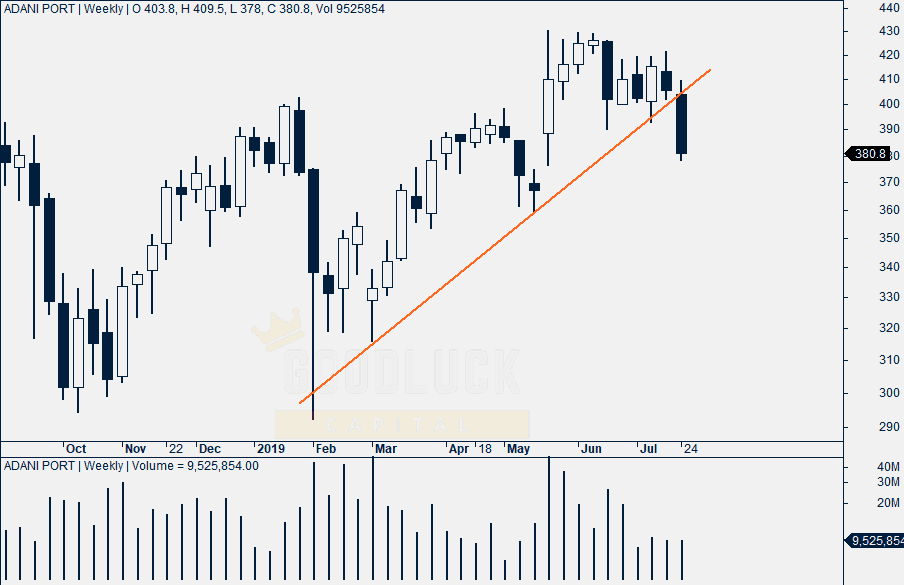

TECHNICAL OBSERVATIONS (WEEKLY)

- Stock Price recently make Breakout below the true crucial Weekly support as shown below.

TECHNICAL OBSERVATIONS (DAILY)

- The stock formed well defined Ascending Triangle Pattern over the last 2 months and breakout below the lower side shows further bearishness.

- Last few days stock is trading below the 5 days and 10 days Moving Average.

CONCLUSION - Adani Ports SHARE PRICE FORECAST

Based on our free positional trading tips, Adani Ports share price target will be 360 – 350 in the next few days.