| CMP# | 65.65 |

| Idea | BUY |

| Buy Range | 64 – 66.5 |

| Target | 75 – 77 |

| StopLoss* | 60 |

| Duration | 6 – 8 Weeks |

| Potential Return^ | 14 – 17% |

| CMP# | Idea | Buy Range | Target | StopLoss* | Duration | Potential Return^ |

| 65.65 | BUY | 64 – 66.5 | 75 – 77 | 60 | 6 – 8 Weeks | 14 – 17% |

# CMP on June 06, 2019

* Maintain recommended StopLoss by daily closing basis.

Once 1st target hit, reset StopLoss at 70.

^ The returns are calculated based on CMP#

COMPANY OVERVIEW

AXISCADES Engineering Technologies Ltd is engaged in the business of product design, engineering and research solutions In Europe, America and Asia. It offers software and hardware development services for aerospace, defense, homeland security, automotive, heavy engineering, energy, healthcare and medical sector. AXISCADES standalone revenue from operations increased 17% to Rs 607.74 crore from Rs 519.16 crore in the last year.

| Stock Data | |

| NSE Code | AXISCADES |

| Sectoral Index | NIFTY IT |

| 52W High | 135.8 |

| 52W Low | 43.75 |

| Face Value | 10 |

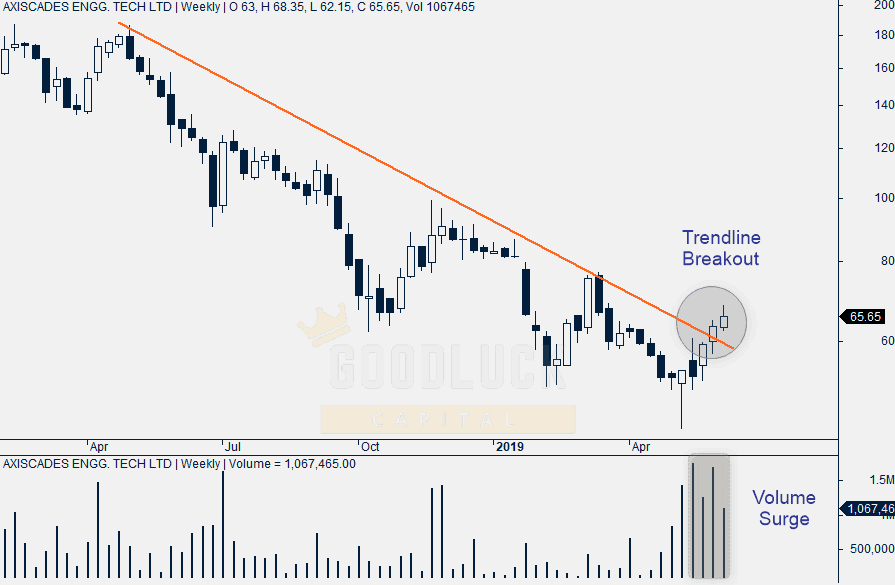

TECHNICAL OBSERVATIONS (WEEKLY)

- After a consistent downtrend in the last 18 months, the stock price has shifted into a sharp upside bounce in last month. The recent development on the price front may indicate conclusion of the downtrend phase.

- This long-term trendline breakout comes with a significant jump in volumes.

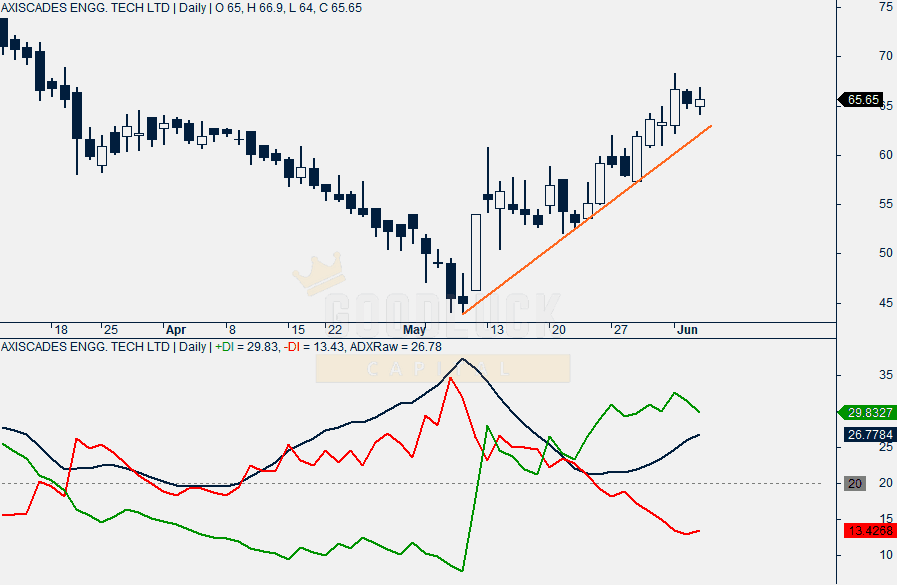

TECHNICAL OBSERVATIONS (DAILY)

- On a daily chart, the stock has been trading with it’s upward rising trend line for the last four weeks and it seems that it could continue with its ongoing move.

- Oscillator like ADX has been showing supportive strength.

CONCLUSION - AXISCADES Engineering Technologies SHARE PRICE FORECAST

Our best positional trading advice, recommends to buy AXISCADES Engineering Technologies with share price target 75 – 77 in the next few days.