| CMP# | 494.35 |

| Idea | BUY |

| Buy Range | 485 – 494 |

| Target | 520 – 530 |

| StopLoss* | 475 |

| Duration | 12 – 15 Trading Sessions |

| Potential Return^ | 5 – 7% |

| CMP# | Idea | Buy Range | Target | StopLoss* | Duration | Potential Return^ |

| 494.35 | BUY | 485 – 494 | 520 – 530 | 475 | 12 – 15 Trading Sessions | 5 – 7% |

# CMP on Aug 02, 2019

* Maintain recommended StopLoss by daily closing basis.

Once 1st target hit, reset StopLoss at 507.

^ The returns are calculated based on CMP#

COMPANY OVERVIEW

This life insurance company provides individual and group insurance plans and policies such as Protection, Pension, Savings and Investment, Health, Retirement, unit linked insurance, NRI plans along with Children’s and Women’s Plans. Founded in 2000 with a strong network presence over 900 cities in India, HDFC Life Insurance is a subsidiary of HDFC Limited. The Insurance company posted 11.84% jump in net profit at Rs 425.71 crore in Q1FY20; revenue up 29.11%.

| Stock Data | |

| NSE Code | HDFCLIFE |

| Sectoral Index | Financial Services |

| 52W High | 533 |

| 52W Low | 344.4 |

| Face Value | 10 |

TECHNICAL OBSERVATIONS (WEEKLY)

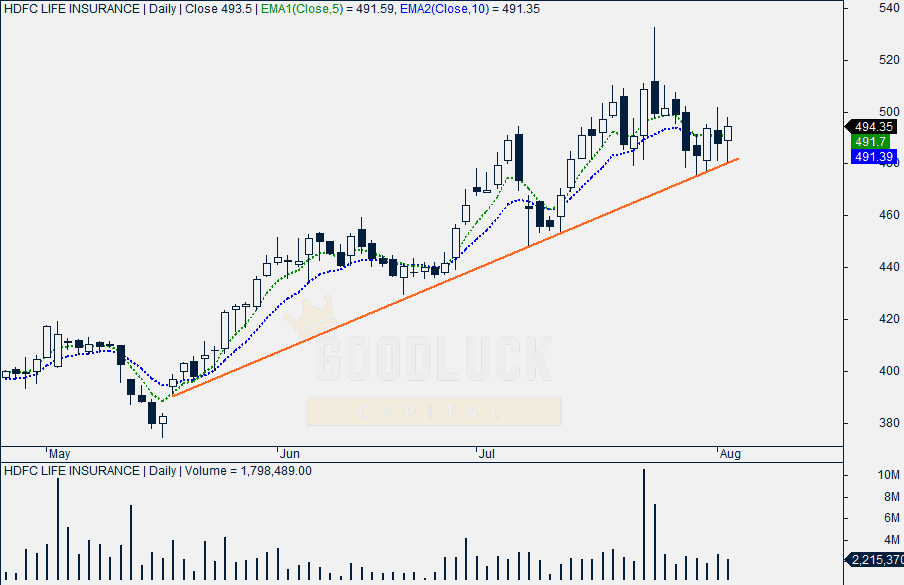

- HDFC Life has taken support several times on weekly trendline which is moving higher.

- The trendline is acting as strong support over the past 12 weeks.

TECHNICAL OBSERVATIONS (DAILY)

- Looking at the daily chart, stock has seen spectacular rally from the bottom of around 375 (May 17, 2019) and extended towards north direction with a strong support line.

- The recent closing 494.35 is above 5 days and 10 days EMA, indicating stock is ready for an up move.

CONCLUSION - HDFC Life SHARE PRICE FORECAST

Based on our positional trading tips for equity market, HDFC Life share price target will be 520 – 530 in the next few days.