| CMP# | 1969.3 |

| Idea | BUY |

| Buy Range | 1962 – 1988 |

| Target | 2100 – 2200 |

| StopLoss* | 1905 |

| Duration | 15 – 20 Trading Sessions |

| Potential Return^ | 7 – 12% |

| CMP# | Idea | Buy Range | Target | StopLoss* | Duration | Potential Return^ |

| 1969.3 | BUY | 1962 – 1988 | 2100 – 2200 | 1905 | 15 – 20 Trading Sessions | 7 – 12% |

# CMP on Oct 07, 2019

* Maintain recommended StopLoss by daily closing basis.

Once 1st target hit, reset StopLoss at 2035.

^ The returns are calculated based on CMP#

COMPANY OVERVIEW

HDFC offers loans for the construction or purchase of the house, home improvement, plot buys and top-up loans to retail and corporate clients, loans for agriculture and dairy farmers, loans for NRI and commercial plots, education loan etc. The company also provides cross-selling products, investment advisory services, life insurance products, general insurance including motor, travel, home, health, accidental, mutual fund, venture funds, portfolio management, project consultancy etc.

| Stock Data | |

| NSE Code | HDFC |

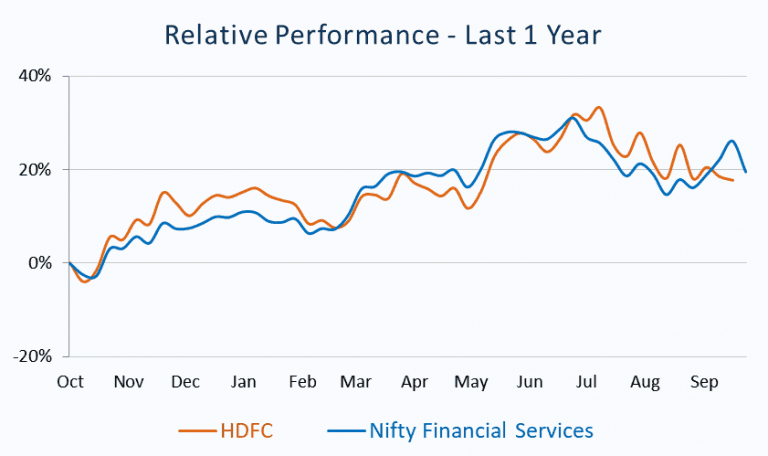

| Sectoral Index | Financial Sevices |

| 52W High | 2357.85 |

| 52W Low | 1644.5 |

| Face Value | 2 |

TECHNICAL OBSERVATIONS (WEEKLY)

- The share price of HDFC witnessed a strong rally since 2016, rallying from ₹ 1010 to lifetime high of ₹ 2757.

- As we see in the Weekly chart, there is a steady support baseline which is moving upwards along with price rise. Current price is just above the support line.

- We expect the stock to remain in a rising trajectory and extend the up move towards 2100-2200in coming months.

TECHNICAL OBSERVATIONS (DAILY)

- On a daily chart, the stock has given a breakout of it’s falling trendline in which it had been trading for last eight trading sessions, suggest robust upside movement.

- The current closing is just above the long term support line. We may expect price to move up from here in the coming days.

CONCLUSION - HDFC SHARE PRICE FORECAST

Based on our short term trading share tips, HDFC share price target will be 2100 – 2200 in the next few days.