POSITIONAL TRADING ADVICE

SELL Tata Elxsi Limited (NSE: TATAELXSI)

TATA ELXSI STOCK RECOMMENDATION

| CMP# | 912.8 |

| Idea | SELL |

| Sell Range | 930 – 910 |

| Target | 850 – 820 |

| StopLoss* | 950 |

| Duration | 25 – 30 Trading Sessions |

| Potential Return^ | 7 – 10% |

| CMP# | Idea | Sell Range | Target | StopLoss* | Duration | Potential Return^ |

| 912.8 | SELL | 930 – 910 | 850 – 820 | 950 | 25 – 30 Trading Sessions | 7 – 10% |

# CMP on Jan 25, 2019

* Maintain recommended StopLoss by daily closing basis.

Once 1st target hit, reset StopLoss at 881.

^ The returns are calculated based on CMP#

TATA ELXSI COMPANY OVERVIEW

Tata Elxsi limited (NSE: TATAELXSI) provides product design and engineering, system integration and support services in India, US and Europe. The company offers solutions for product engineering, design, Big Data analytics, Internet of Things, content development, artificial intelligence, virtual reality, and systems integration etc. Tata Elxsi caters to various industries such as Aerospace, defense, consumer electronics, healthcare, telecom and transportation industries, entertainment etc. The company Tata Elxsi limited posts 15% decline in net profit at Rs 27.76 crore in Q3FY19; revenue up 7.5% on a quarterly basis.

| Stock Data | |

| NSE Code | TATAELXSI |

| Sector | Nifty IT |

| 52W High | 1490.9 |

| 52W Low | 908.1 |

| Face Value | 10 |

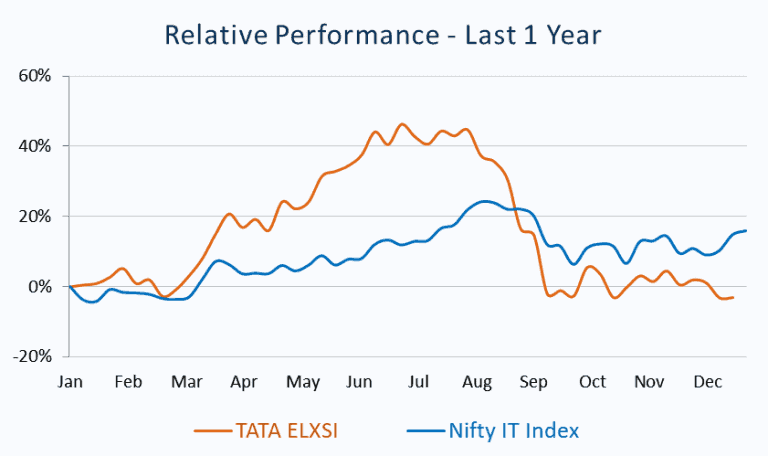

TATA ELXSI TECHNICAL ANALYSIS (WEEKLY)

- Tata Elxsi Limited share price formed well defined Symmetrical Triangle Pattern over last 14 weeks and breakout below the lower side shows further bullishness.

- Stock Price of Tata Elxsi recently makes Breakout below the true crucial Weekly Multiple Support, at Rs.920.

TATA ELXSI TECHNICAL ANALYSIS (DAILY)

- The registered a resolute breakout past the eight weeks consolidation signalling resumption of the primary downtrend.

- The stock is trading well below its EMA-5, EMA-10 & EMA -20, indicating a strong negative trend for the stock.