- June 18, 2025

- 1:06 pm

- admin

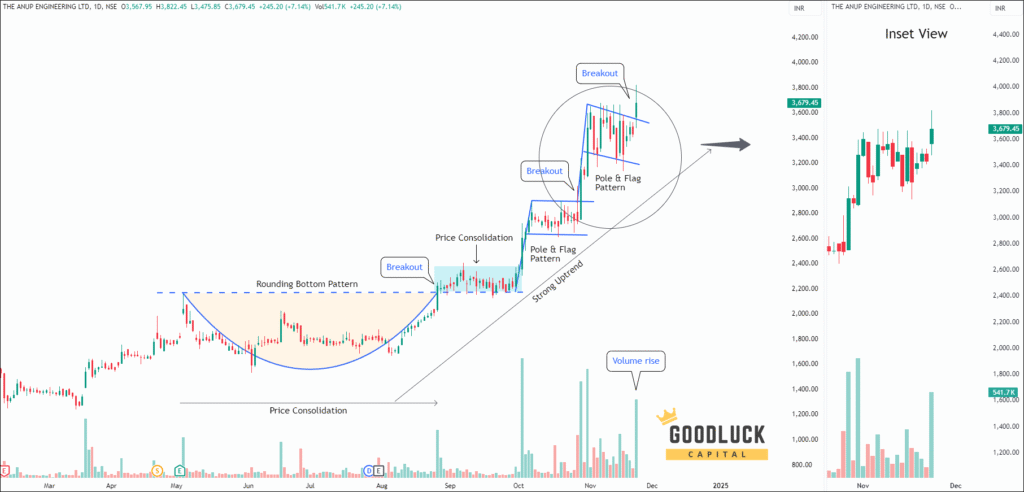

13-June-2024 | Swing Stock Advice | Premium

# CMP on July 11, 2019

* Maintain recommended StopLoss by daily closing basis.

Once 1st target hit, reset StopLoss at 243.

^ The returns are calculated based on CMP#

DCB Bank is an Indian commercial bank operates through Treasury operations, Retail Banking, Wholesale banking and other segments. The company

offers different products such as Current accounts, savings accounts, fixed deposits, portfolio investment schemes, small credit, MSME credit, car and

home finance etc. As of March 2019, the bank has operated through 333 branches and 504 ATMs across India.

https://goodluckcapital.com/wp-content/uploads/2025/02/Group-23-1.png

DCB Bank is an Indian commercial bank operates through

Treasury operations, Retail Banking, Wholesale banking

and other segments.

The company offers different products such as Current

accounts, savingAttached weekly timeframe chart of

DCB Bank Ltd is signalling that the stock price was

moving in a larger consolidation pattern in the last few

years and is currently making an attempt to reach the

upper boundary of the pattern.s accounts, fixed

deposits, portfolio investment schemes, small credit,

MSME credit, car and home finance etc. As of March

2019, the bank has operated through 333 branches

and 504 ATMs across India.

DCB Bank is an Indian commercial bank operates through

Treasury operations, Retail Banking, Wholesale banking

and other segments.

The company offers different products such as Current

accounts, savingAttached weekly timeframe chart of

DCB Bank Ltd is signalling that the stock price was

moving in a larger consolidation pattern in the last few

years and is currently making an attempt to reach the

upper boundary of the pattern.s accounts, fixed

deposits, portfolio investment schemes, small credit,

MSME credit, car and home finance etc. As of March

2019, the bank has operated through 333 branches

and 504 ATMs across India.

The stock price has taken support above the

trendline, which also acted as strong support in

recent past too.

The closing is above 5 EMA and 10 EMA

crossover on daily charts.

The stock price has taken support above the

trendline, which also acted as strong support in

recent past too.

The closing is above 5 EMA and 10 EMA

crossover on daily charts.

Based on our short term trading calls, DCB Bank share price target will be 248 – 250 in the next few days.

Money Management And Trading Rules

1) It's advisable not to enter/exit beyond the recommended range.

2) Strictly follow the StopLoss as mentioned. Honour it.

3) Use trailing StopLoss to retain profits.

4) Diversify trading capital into our other technical recommendations.

5) Risk only the money what you can afford to lose. Hedge accordingly.

Based on our short term trading calls, DCB Bank share price target will be 248 – 250 in the next few days.

Money Management And Trading Rules

1) It's advisable not to enter/exit beyond the recommended range.

2) Strictly follow the StopLoss as mentioned. Honour it.

3) Use trailing StopLoss to retain profits.

4) Diversify trading capital into our other technical recommendations.

5) Risk only the money what you can afford to lose. Hedge accordingly.

Analyst Summary

The research analysis is prepared by Arijit Banerjee, CMT, CFTe. He is a veteran trader and an active investor having in-depth

knowledge in financial market research, advanced technical analysis, market cycle, algorithmic trading and portfolio management.

Arijit is a Chartered Market Technician (CMT) accredited by CMT Association USA, the leading global authority of Technical

Analysis and has been honoured by Certified Financial Technician (CFTe) from the International Federation of Technical Analysts,

USA. SEBI, the regulatory body of Indian financial market also recognizes him as a Research Analyst (INH300006582).

Your Return Could be Much Better

Increase your Profitable!

- 10—12 swing trade advice / month

- expected upside 6%—8% per trade

- short term trade holding 1-2 weeks

- minimum capital required ₹2.5 lakh

- receive trade advice before 9:00 am

- Stocks only — no intraday or F&O

Months

01

Price

₹ 6666

Months

03

20% OFF

₹ 20000

Price

₹ 15900

Months

06

35% OFF

₹ 40000

Price

₹ 25900

Months

12

50% OFF

₹ 80000

Price

₹ 39900

Months are referred as calendar months

- e.g. 12 January — 12 April (3 Months)

- 20 June — 20 December (6 Months)

Looking for more information?

Ultra Swing Trading Benefits

- Receive advices via Whatsapp

- Generally 9-10 top trading ideas in a month

- Risk-Reward ratio ranges from 1:2 to 1:4.

- Multi target based research.

- Cover stocks, largecap and midcap

- Precise Entry, Target and StopLoss.

- Precise Entry, Target and StopLoss.

-

Buy Piramal Pharma

nse: pplpharma

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 190 - 194

- : 204 - 207

- : below 180

- : 7% - 8%

- : 12-14 days

-

Buy Le Travenues Technology

nse: ixigo

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 215 - 220

- : 240 - 240

- : below 195

- : 10% - 13%

- : 14-15 days

-

Buy Privi Speciality Chemicals

nse: priviscl

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 1845 - 1875

- : 1975 - 2000

- : below 1770

- : 6% - 8%

- : 12-14 days

-

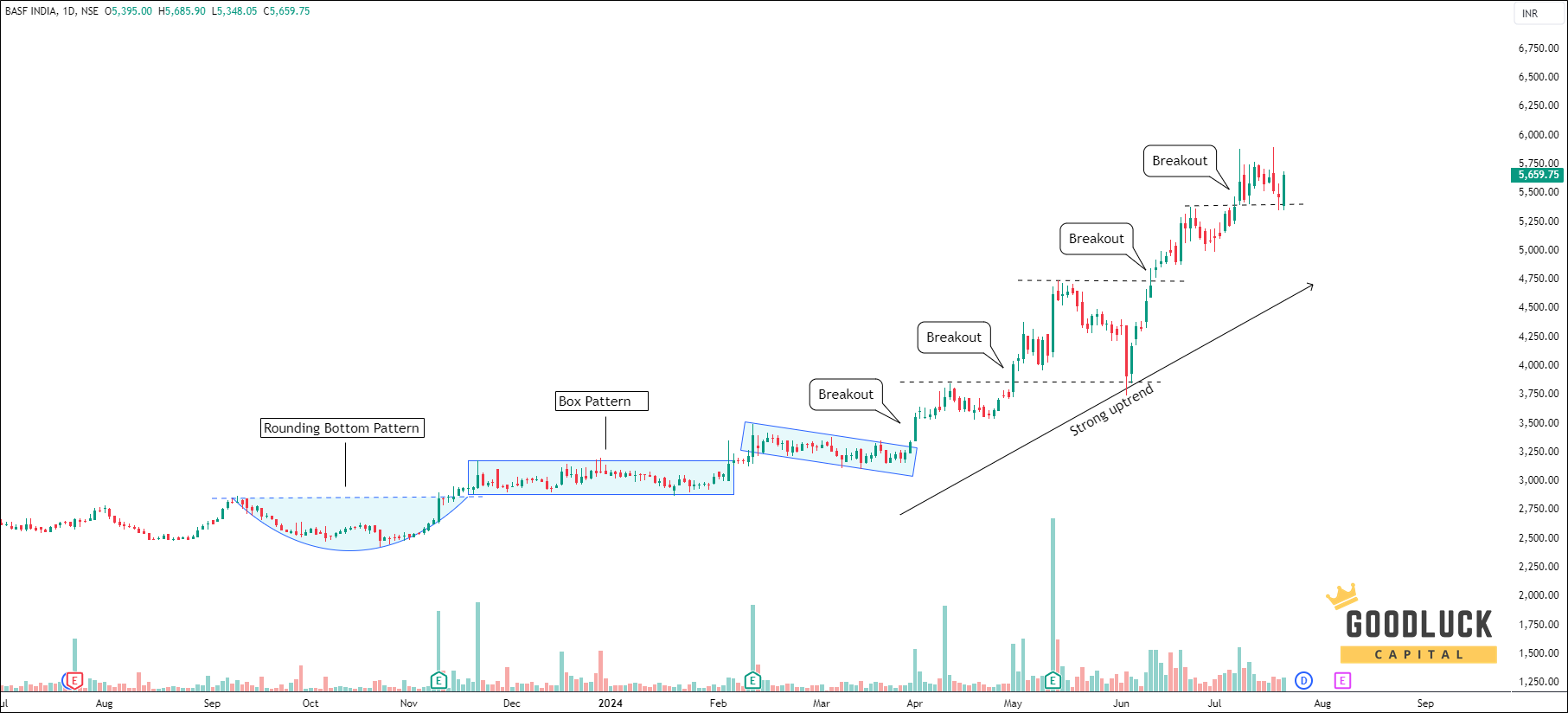

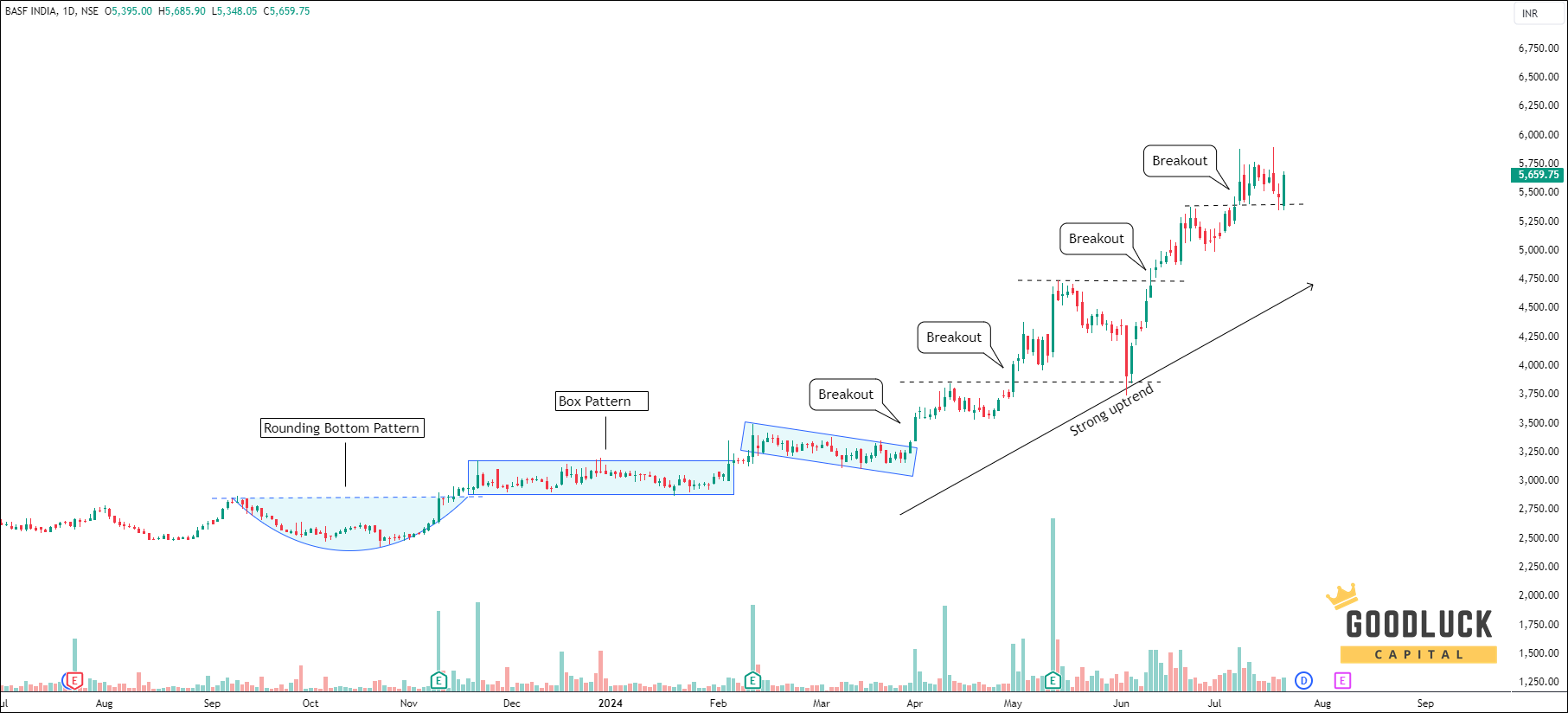

Buy BASF India

nse: basf

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 5450 - 5600

- : 6050 - 6200

- : below 5200

- : 10% - 12%

- : 12-14 days

-

Buy S H Kelkar

nse: shk

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 285 - 300

- : 330 - 340

- : below 270

- : 13% - 16%

- : 14-15 days

- Ultra Swing Trading Advice

Features

- 10—12 swing trade advice / month

- expected upside 6%—8% per trade

- short term trade holding 1-2 weeks

- minimum capital required ₹2.5 lakh

Select Subscription

Months

01

Price

₹ 6666

Months

03

20% OFF

₹ 20000

Price

₹ 15900

Months

06

35% OFF

₹ 40000

Price

₹ 25900

Months

12

Price

₹ 39900

Months are referred as calendar months

- e.g. 12 January — 12 April (3 Months)

- 20 June — 20 December (6 Months)

Looking for more information?

Our FAQ section covers everything you need to know about Swing Trade Subscription

Ultra Swing Trading Benefits

- ideal for short term positional traders

- receive trading advice via Whatsapp

- precise Entry, Target and StopLoss

- preferred largecap & midcap stocks

- revised targets & stoploss if required

- alert message for target or stoploss hit

-

Buy Piramal Pharma

nse: pplpharma

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 190 - 194

- : 204 - 207

- : below 180

- : 7% - 8%

- : 12-14 days

-

Buy Le Travenues Technology

nse: ixigo

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 215 - 220

- : 240 - 240

- : below 195

- : 10% - 13%

- : 14-15 days

-

Buy Privi Speciality Chemicals

nse: priviscl

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 1845 - 1875

- : 1975 - 2000

- : below 1770

- : 6% - 8%

- : 12-14 days

-

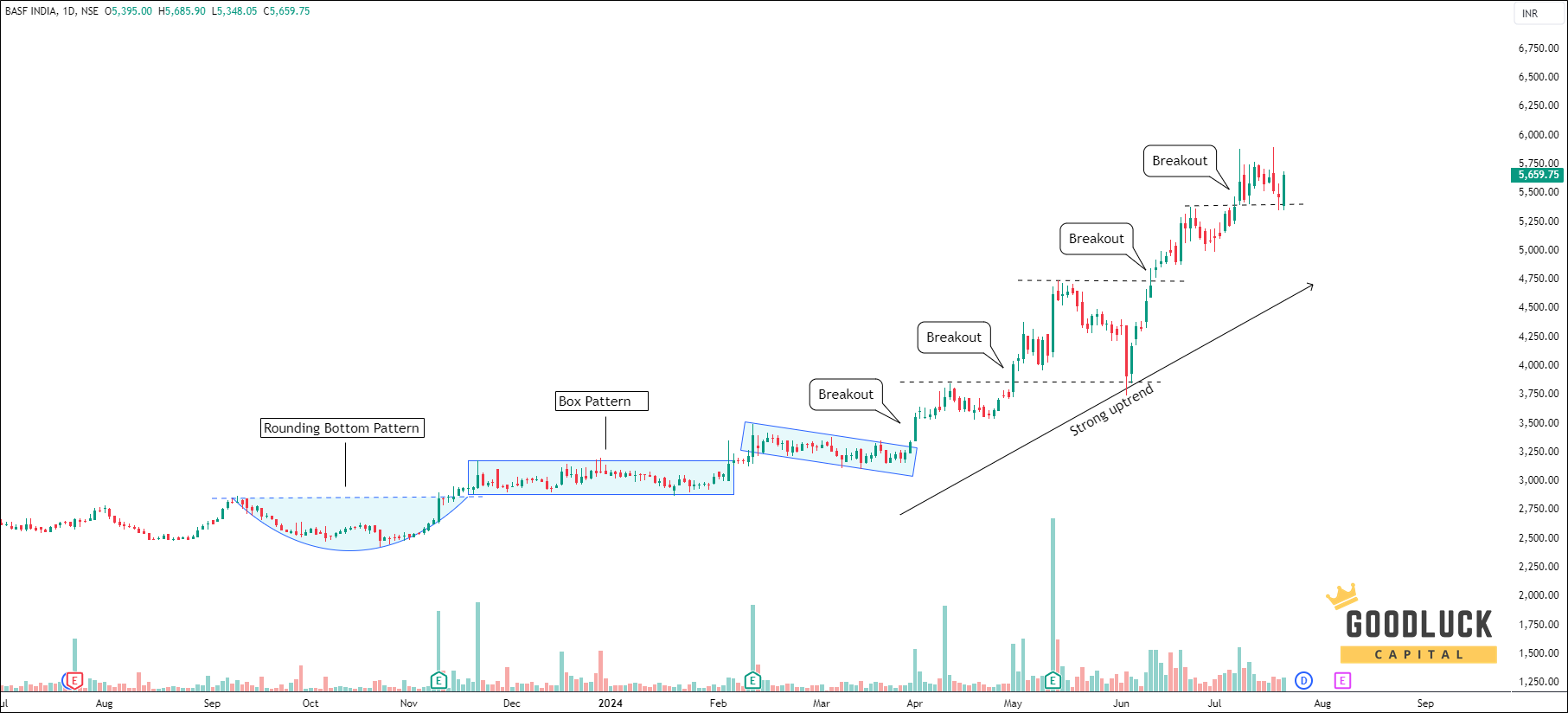

Buy BASF India

nse: basf

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 5450 - 5600

- : 6050 - 6200

- : below 5200

- : 10% - 12%

- : 12-14 days

-

Buy S H Kelkar

nse: shk

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 285 - 300

- : 330 - 340

- : below 270

- : 13% - 16%

- : 14-15 days

Ultra Swing Trading Benefits

- ideal for short term positional traders

- receive trading advice via Whatsapp

- precise Entry, Target and StopLoss

- preferred largecap & midcap stocks

- revised targets & stoploss if required

- alert message for target or stoploss hit

-

Buy Piramal Pharma

nse: pplpharma

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 190 - 194

- : 204 - 207

- : below 180

- : 7% - 8%

- : 12-14 days

-

Buy Le Travenues Technology

nse: ixigo

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 215 - 220

- : 240 - 240

- : below 195

- : 10% - 13%

- : 14-15 days

-

Buy Privi Speciality Chemicals

nse: priviscl

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 1845 - 1875

- : 1975 - 2000

- : below 1770

- : 6% - 8%

- : 12-14 days

-

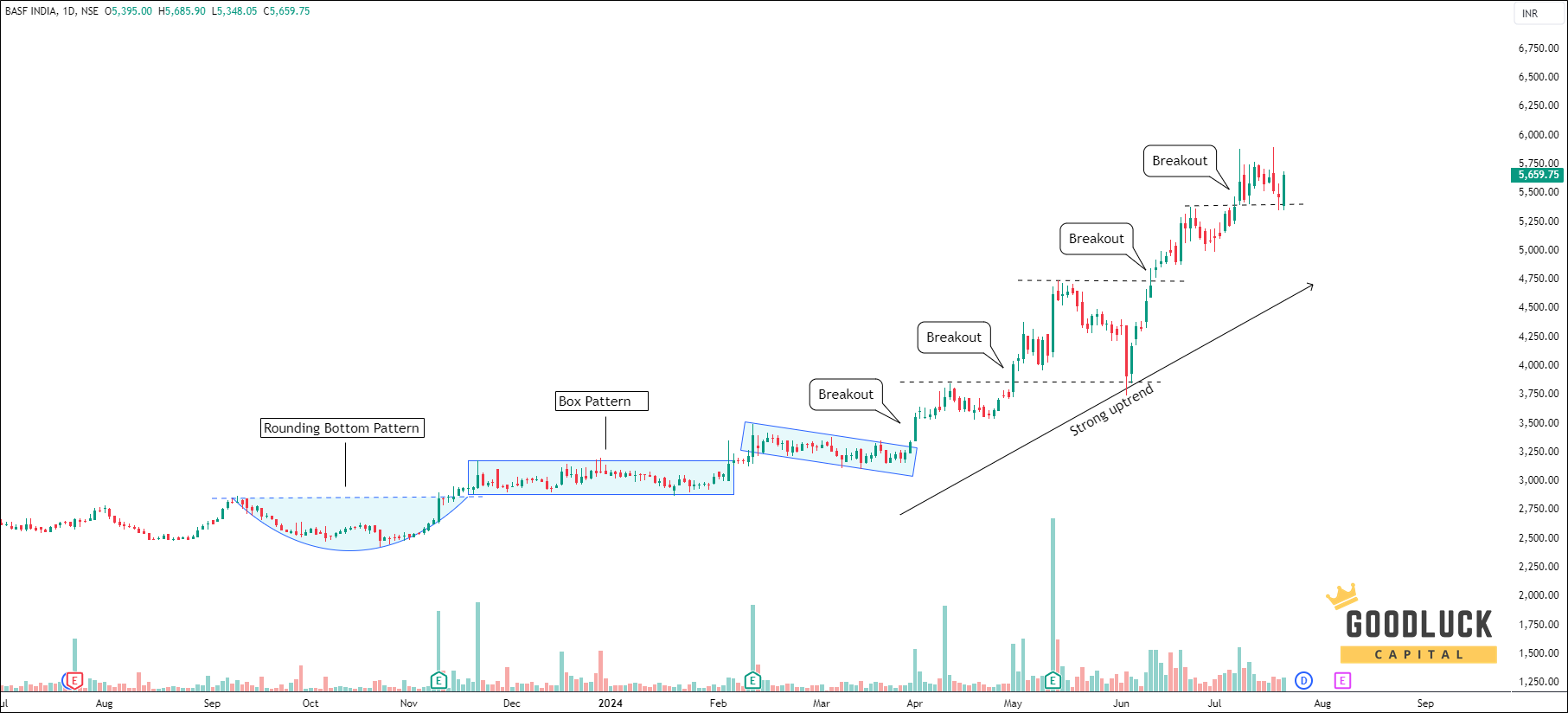

Buy BASF India

nse: basf

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 5450 - 5600

- : 6050 - 6200

- : below 5200

- : 10% - 12%

- : 12-14 days

-

Buy S H Kelkar

nse: shk

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 285 - 300

- : 330 - 340

- : below 270

- : 13% - 16%

- : 14-15 days

More Trading & Investment Advice

Looking for more information?

Our FAQ section covers everything you need to know about Swing Trade Subscription

Ultra Swing Trading Benefits

- ideal for short term positional traders

- receive trading advice via Whatsapp

- precise Entry, Target and StopLoss

- preferred largecap & midcap stocks

- revised targets & stoploss if required

- alert message for target or stoploss hit

-

Buy Piramal Pharma

nse: pplpharma

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 190 - 194

- : 204 - 207

- : below 180

- : 7% - 8%

- : 12-14 days

-

Buy Le Travenues Technology

nse: ixigo

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 215 - 220

- : 240 - 240

- : below 195

- : 10% - 13%

- : 14-15 days

-

Buy Privi Speciality Chemicals

nse: priviscl

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 1845 - 1875

- : 1975 - 2000

- : below 1770

- : 6% - 8%

- : 12-14 days

-

Buy BASF India

nse: basf

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 5450 - 5600

- : 6050 - 6200

- : below 5200

- : 10% - 12%

- : 12-14 days

-

Buy S H Kelkar

nse: shk

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 285 - 300

- : 330 - 340

- : below 270

- : 13% - 16%

- : 14-15 days