Key Takeaways

- The phasing down of HFCs in the U.S. is driving significant changes in the refrigerant market.

- Indian specialty chemicals companies, particularly those involved in refrigerant production, are poised to benefit from this market shift.

- The demand-supply imbalance in the refrigerant gas segment is expected to persist, creating favourable conditions for industry growth.

Introduction

On January 9, 2025, the Indian specialty chemicals sector witnessed a significant surge, driven by a sharp increase in refrigerant gas prices. This surge was primarily attributed to the phasing down of hydrofluorocarbons (HFCs) in the United States, as mandated by the U.S. Environmental Protection Agency (EPA).

Market Dynamics

- Phasing down HFCs: The EPA aims to reduce hydrofluorocarbon (HFC) emissions by 85% over the next 15 years. This will impact the production and pricing of refrigerants.

- Refrigerant price increases: As HFC production declines, prices for existing refrigerants like R-410A and R-22 may rise. This could lead to higher costs for consumers and businesses.

- New refrigerant alternatives: The industry is shifting towards alternative refrigerants with lower global warming potential (GWP), such as R-32, R-454B, and R-1234yf. These alternatives may become more widely adopted and affordable.

Impact on Indian Companies

The surge in refrigerant gas prices significantly benefited leading Indian players:

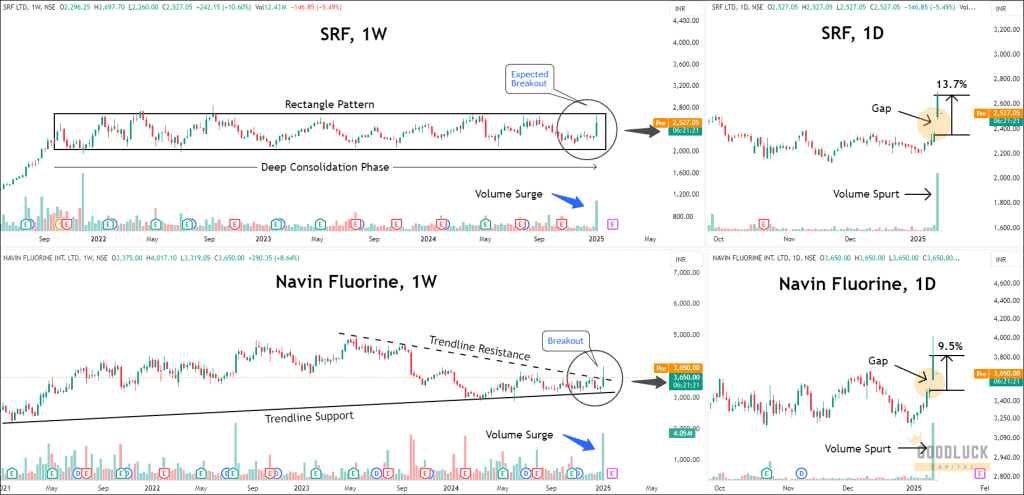

- SRF and Navin Fluorine: These companies were prominent beneficiaries, witnessing a remarkable 14% increase in their stock prices.

- Financial Gains: Analysts estimate that every $1/kg increase in R32 prices could boost SRF’s EBITDA by ₹260 crore and Navin Fluorine’s by ₹77 crore.

- Capacity Expansion: With SRF’s production capacity for R32 at approximately 29,000 to 30,000 tons and plans for Navin Fluorine to double its capacity from 4,500 tons to 9,000 tons by February 2025, both companies are well-positioned to capitalize on this market shift.

Wider Market Impact

Indo Count Industries Limited (NSE: ICIL), established in 1988, is a leading Indian home textile manufacturer. The company offers a diverse range of products, including bed sheets, fashion bedding, utility bedding, and institutional bedding. With showrooms in the UK and US, Indo Count sells its products under 17 distinct brands through multi-brand outlets, large format stores, and e-commerce platforms. Headquartered in Mumbai, India, the company exports its products globally.

Future Outlook

As the U.S. transitions to more environmentally friendly refrigerants, the dynamics of supply and pricing for these alternatives are likely to continue evolving. This evolving landscape presents significant opportunities for Indian specialty chemicals companies that are well-positioned to capitalize on the growing demand for these new-generation refrigerants. For active investors, such structural shifts not only highlight long-term potential but also create space for a short term trading opportunity in specialty chemical stocks that may benefit directly from the global refrigerant transition.