The Bank Nifty currently hovers around the 50,500 mark, nearly 5.3% below its all-time high. While large private banks such as HDFC Bank, ICICI Bank, Axis Bank, and Kotak Mahindra Bank generally dominate investor preference, the mid and small-cap banking space has seen exceptional performers recently.

Two names stand out: Federal Bank and Karur Vysya Bank. Both have significantly outperformed the broader banking index, making them top contenders for investors seeking positional stock trading advice in India. Let’s break down the critical factors to determine which of these banks looks more promising right now.

Market Capitalization

- Federal Bank – ₹ 49,883 Cr.

- Karur Vysya Bank – ₹ 17,459 Cr.

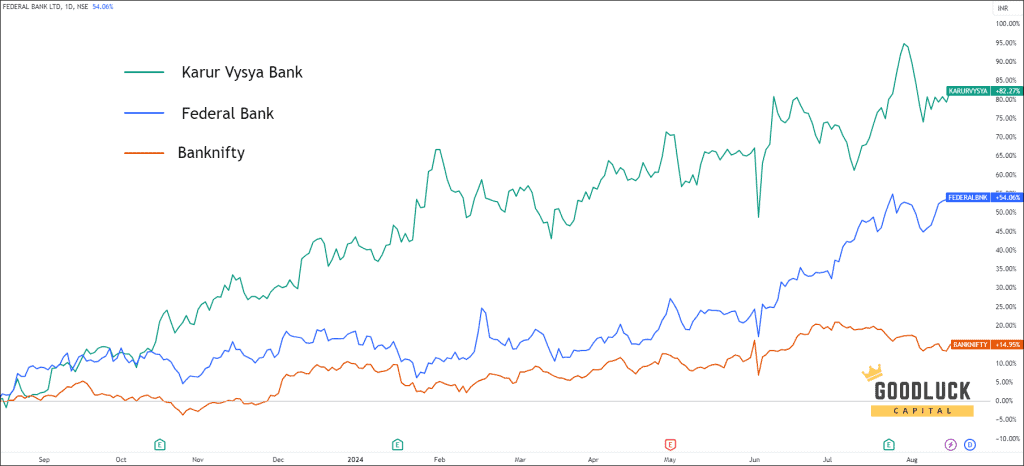

Relative Strength

The chart clearly illustrates that the Bank Nifty has delivered an impressive return on investment of approximately 15% over the past year. However, Federal Bank and Karur Vysya Bank have far surpassed this figure, achieving remarkable returns of around 54% and 82%, respectively. This indicates that these two banks are currently excelling far beyond the overall bank index.

Cost of Liabilities

The liabilities cost for Karur Vysya Bank is at 4.8%, notably lower than Federal Bank’s 5.14%. This indicates that Karur Vysya Bank has a greater ability to secure funds compared to Federal Bank.

CASA Ratio

● The CASA ratio, which measures the proportion of deposits in current and savings accounts to total deposits, is a crucial indicator for banks. A higher CASA ratio signifies a reduced cost of funds, as banks typically do not pay interest on current account deposits, and the interest rates on savings accounts are generally quite low, around 3-4%.

● In this instance, the CASA ratios stand at 30.39% for Karur Vysya Bank and 29.56% for Federal Bank, highlighting Karur Vysya Bank’s superior position over Federal Bank.

Non-performing Asset (NPA) Analysis

- Over the past four years, the net non-performing assets (NPA) for these two banks have seen a remarkable decline.

- In the latest quarter, Karur Vysya Bank reports a net NPA of just 0.4, while Federal Bank follows closely with a net NPA of 0.6.

Total Provisions

● Discussing the NPA without considering the overall provisions presents an incomplete picture. Both banks have experienced a notable decline in this crucial factor.

● For Federal Bank, the total provisioning for FY24 is only 196 crore, a stark reduction from 750 crore in FY23. Similarly, Karur Vysya Bank’s total provisioning for FY24 stands at 728 crore, down from 1,039 crore in FY23.

Net Interest Margins (NIM)

● Karur Vysya Bank boasts a superior net interest margin (NIM) of 3.75, significantly outpacing the Federal Bank’s NIM of 2.87.

● A NIM below 3 is generally viewed as unfavorable for banks. highlighting the strength of Karur Vysya Bank in this key metric.

Advances Growth (%) Analysis

An increase in advances growth signifies a bank’s ability to efficiently provide loans. The 20.4% rise in advances for Federal Bank surpasses the 16.68% growth seen at Karur Vysya Bank, showcasing a more robust lending capability.

Valuation

- Federal Bank’s current price-to-earnings (PE) ratio is 12.4, which exceeds its 1-year median PE of 9.0. Compared to the industry average PE of 11.83, this suggests that the stock is not excessively overvalued.

- On the other hand, Karur Vysya Bank has a current PE of 10.2, which is marginally above its 1-year median PE of 9.8. Given the industry PE of 11.83, this indicates that Karur Vysya Bank is significantly undervalued.

- When analyzing the PE ratios, it becomes clear that Karur Vysya Bank holds a more advantageous position.

Intrinsic Value

- The Federal Bank is currently trading at ₹204, while its intrinsic value stands at ₹228, indicating that the stock is undeniably undervalued at this time.

- On the other hand, Karur Vysya Bank’s market price is ₹217, but with an intrinsic value of only ₹146, it clearly shows that the stock is currently overvalued.

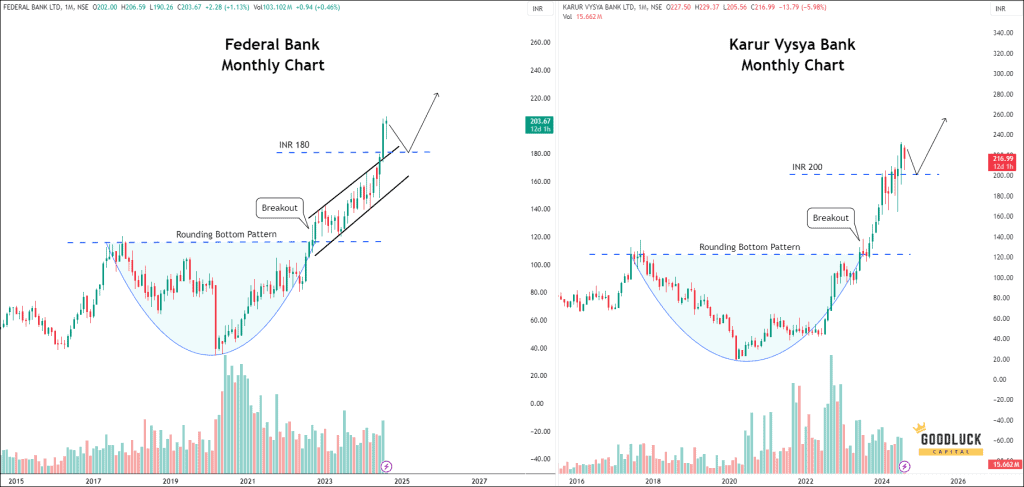

Technical Aspects

From a technical standpoint, both stocks exhibit a similar pattern and appear to be currently overextended. Any pullbacks could provide a valuable opportunity to take positions.

Conclusion

After evaluating all parameters:

- Karur Vysya Bank scores higher on NIM, CASA, cost of liabilities, and valuations relative to peers.

- Federal Bank scores better in intrinsic value and loan book growth.

Overall, Karur Vysya Bank holds a slight edge, but Federal Bank remains fundamentally strong and well-positioned to outperform the broader banking sector as the economy expands.

For investors who rely on structured and compliant guidance, consulting a SEBI registered stock advisory can help in timing entries, managing risk, and building a solid banking-sector portfolio.