Market crashes are not only financial events — they are emotional storms driven by fear, panic, and confusion. When the Sensex collapsed by 1,408 points on January 21, 2008 (“Black Monday”), millions of Indian investors watched their portfolios fall sharply. Many reacted emotionally and sold at the worst possible time. Yet the investors who understood market psychology, stayed patient, and trusted long-term fundamentals ended up making extraordinary gains when the market bounced back.

Market psychology determines who panics and who profits. To invest wisely during crashes, you must first understand the emotions behind them.

Why Markets Crash: The Psychological Foundation

At the center of every crash lies a battle between fear and greed. Greed pushes investors to buy aggressively during bull runs, while fear triggers panic selling during downturns. Human behavior studies show that we feel the pain of losses twice as strongly as the joy of gains — a psychological principle called loss aversion. This is why panic spreads so quickly when markets fall.

Tools like the Fear & Greed Index help track these emotions. Readings below 20 mean extreme fear, often signaling opportunity. During the COVID-19 market crash of March 2020, when the Sensex fell from 42,000 to 25,600 in weeks, the index hit record lows — reflecting widespread panic and emotional selling.

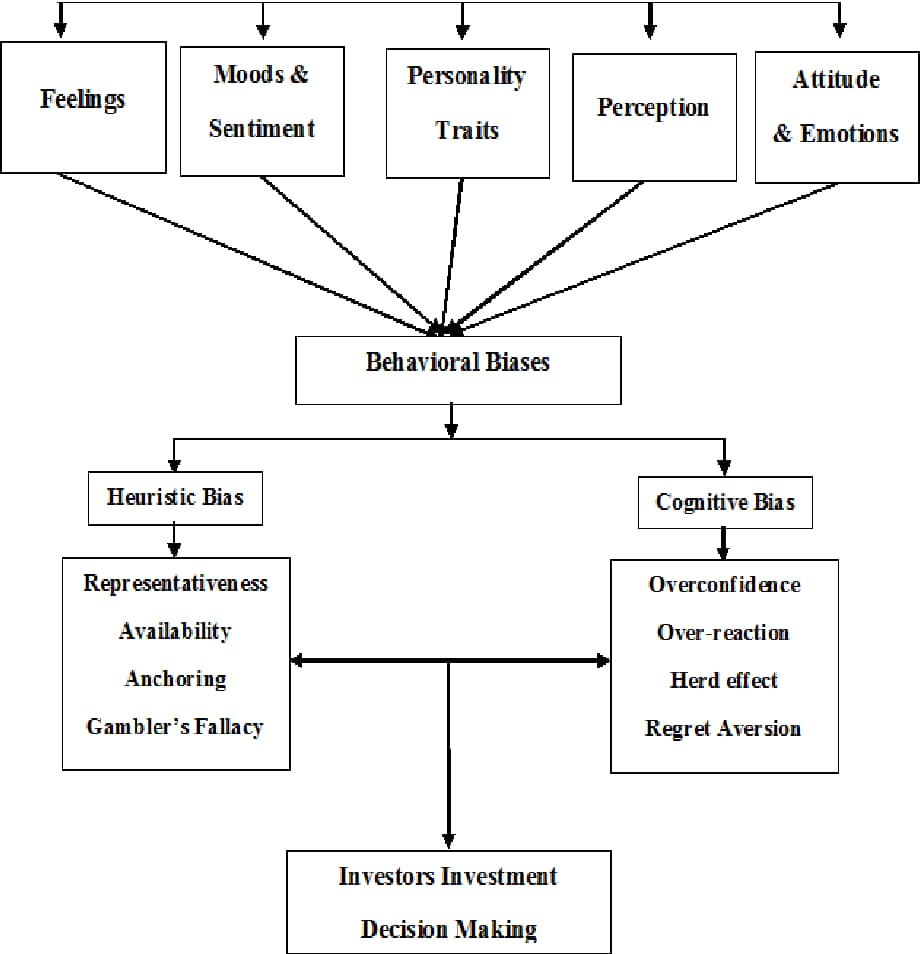

Psychological Biases That Intensify Crashes

Several mental biases lead investors to make irrational decisions during market declines.

Herd mentality makes people follow the crowd. If everyone sells, they feel the urge to sell too. During strong rallies, this same behavior drives people to buy overpriced stocks simply because “everyone else is making money.”

Recency bias makes recent events feel permanent. After big crashes, investors assume markets will keep falling. After big rallies, they assume markets will never fall again.

Loss aversion triggers emotional selling. The fear of losing money becomes so overwhelming that investors exit at exactly the wrong moment. This was evident in 2008, when global fear led to trillions in wealth being wiped out.

Anchoring causes investors to fixate on old price levels — like the price they bought at — which prevents rational decision-making.

Confirmation bias makes investors seek only the information that supports their fear, and ignore facts that contradict it. During crashes, this leads to a constant cycle of negative news consumption, reinforcing panic.

What History Teaches Us About Crashes

| Year | Event | Sensex Fall (%) | Peak to Low | Key Lesson |

|---|---|---|---|---|

| 1992 | Harshad Mehta Scam | ~55% | 4,500 → 2,000 | Fraud exposed → panic |

| 2000-01 | Dot-com & Ketan Parekh | ~56% | 6,000 → 2,600 | Greed bubble burst |

| 2008-09 | Global Financial Crisis | 61.5% | 21,206 → 8,160 | Contagion & panic |

| 2015 | China Slowdown | Single-day fall | 1,624 points | Geopolitical fears |

| March 2020 | COVID-19 Pandemic | 38% (in weeks) | 42,000 → 25,600 | Extreme uncertainty |

Every major crash in India has eventually reversed and created new highs. Whether it was the dot-com collapse, the 2008 global financial crisis, or the 2020 COVID crash, the pattern is the same: markets fall sharply, emotions take over, and then — eventually — strong recoveries follow.

Crashes are temporary. Recoveries are long-lasting.

This simple truth separates successful investors from emotional ones.

How Investor Behavior Changes During Crashes

Behavioral science explains why investors make poor decisions during uncertainty. According to Prospect Theory, the pain of losing money pushes people into irrational actions. First they hold losing positions hoping they recover, and then the fear becomes too strong, leading to panic selling.

During extreme fear, all stocks start moving together because everyone sells in a hurry — a phenomenon called herd-driven correlation. Even fundamentally strong companies get dragged down by emotion-driven selling.

Crashes also affect mental health. Studies show that large market falls are linked with higher stress, anxiety, and even hospital visits for mental disorders. Emotional stress becomes a major part of the investor experience during downturns.

How to Invest During Market Crashes

The key to surviving — and benefiting from — market crashes is not superior knowledge, but emotional discipline.

One powerful approach is the contrarian mindset. Warren Buffett famously suggests buying when others are fearful. During the 2008 crisis, while panic dominated the markets, he invested heavily in Goldman Sachs and later made billions in profit. Similarly, investors who bought strong Indian companies during the 2020 crash saw many of their holdings double within months. This is also why many experts offering short term stock trading advice in India warn against emotional selling, as it often leads to missed recovery opportunities.

Contrarian investing works best when focused on companies with strong balance sheets, durable competitive advantages, and long-term growth potential.

Another proven strategy is continuing SIPs during downturns. SIPs use rupee cost averaging to automatically buy more units when prices fall, reducing the average cost. Even during major crashes, SIP investors often come out ahead because they accumulate units at lower prices.

Investors should also prioritize quality businesses. High-quality companies fall less during crashes and recover faster. These are businesses with strong cash flows, low debt, powerful brands, and reliable management.

Diversification plays a critical role too. Spreading money across stocks, gold, debt, and real estate helps protect your portfolio. For example, while stocks crashed in 2020, gold surged — balancing losses for diversified investors.

Having a strong emergency fund is essential. Without savings set aside, investors may be forced to sell stocks at a loss to meet urgent needs. Keeping 6–9 months of expenses in liquid instruments ensures you can stay invested through downturns.

Finally, portfolio rebalancing during volatility helps maintain your target allocation and lets you buy high-quality stocks at attractive prices. This is an approach often recommended in swing trading stock recommendations, where timing and discipline matter more than predictions.

Common Mistakes to Avoid During Crashes

Most investors lose money not because of the market, but because of their own decisions. Panic selling, trying to time the market, following the herd, and constantly checking portfolios often lead to emotional mistakes.

Research shows that even missing the market’s best recovery days can dramatically reduce long-term returns. This is why staying invested is more important than trying to get in and out at the perfect time.

Mental Health Matters During Market Crashes

Crashes can be emotionally draining. Limiting portfolio checks, practicing mindfulness, and taking breaks from financial news can help reduce stress. Many successful investors, including Ray Dalio, use meditation to improve decision-making and stay emotionally balanced.

If stress becomes overwhelming, seeking professional help is not only okay — it’s wise.

A Behavioral Pattern That Never Changes

Whether it’s the dot-com crash, the 2008 financial crisis, or the 2020 COVID crash, the same pattern appears every time:

Extreme fear creates opportunity, and extreme greed creates danger.

This pattern has repeated across decades and will repeat again.

A Practical Guide for the Next Crash

When the next crash comes:

- Stay calm and avoid emotional decisions

- Continue your SIPs

- Stick to quality companies

- Rebalance your portfolio

- Avoid market noise

- Focus on your long-term goals

- Treat the crash as an opportunity, not a disaster

These steps help ensure you benefit from the recovery that follows.

Conclusion: Turning Crashes Into Wealth-Building Opportunities

Market crashes feel frightening, but they also create life-changing opportunities. The Indian stock market has recovered from every crash and gone on to reach new highs. Investors who stayed invested — or bought more during downturns — built significant long-term wealth.

Your biggest advantage as an investor is not predicting the future. It’s staying emotionally disciplined.

When others panic, remember that you are not just buying stocks — you are buying strong businesses at discounted prices. And that’s how real fortunes are built.

Want to invest in the stock market? Check out our Expert share market tips for smart, research-backed investment guidance.

You can also join our Telegram Channel and WhatsApp Channel for regular stock market analysis, insights and advice.