Abstract

The Reserve Bank of India’s recent decision to lower the Cash Reserve Ratio (CRR) by 50 basis points to 4% is set to have a big impact on the banking sector. This change will free up about ₹1.16 lakh crore, giving banks more money to lend, especially in areas like real estate and infrastructure. As banks can now earn more from loans, their profits are likely to improve.

The stock market has responded positively, with financial stocks rising. Additionally, this CRR cut might lead to lower interest rates in the future, helping the economy grow even more. Key banking indices are showing strong upward trends, reflecting growing investor confidence.

Continue reading the full article:

Introduction

The recent 50 basis points cut in the Cash Reserve Ratio (CRR) by the Reserve Bank of India (RBI) to 4% will have several key impacts on the banking sector:

- Increased Liquidity: Approximately ₹1.16 lakh crore will be released into the banking system, enhancing banks’ capacity to lend.

- Higher Lending Potential: Banks can extend more loans, supporting economic growth, particularly in sectors like real estate and infrastructure.

- Improved Profitability: Lower CRR can enhance banks’ net interest margins as they can invest more in higher-yielding assets.

- Positive Market Reaction: Financial stocks have shown gains, reflecting investor confidence in increased lending activities.

- Future Rate Cuts: This move may lead to potential interest rate cuts in the near future, further stimulating economic activity.

Technical Analysis

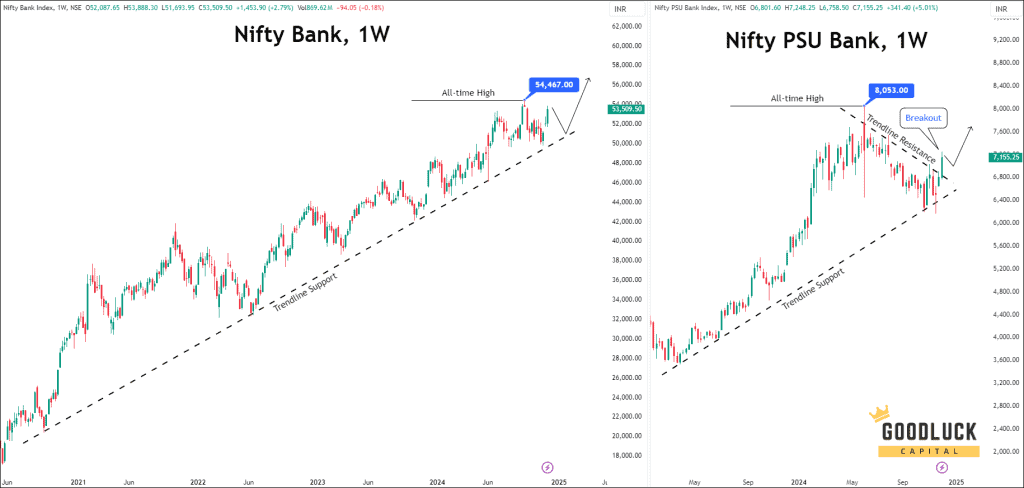

Nifty Bank

- The Nifty Bank index is experiencing a strong upward trend, marked by a series of higher highs and lows.

- After reaching a record peak near the 54,470 level, the index pulled back to the trendline support.

- However, following a recent bounce, it is approaching its prior high and is expected to keep rising.

Nifty PSU Bank

- This index reached an all-time high around the 8,050 level before retreating to the trendline support.

- Following a bounce back, it has successfully broken through its trendline resistance and is now set for further upward movement.

Stocks to Watch

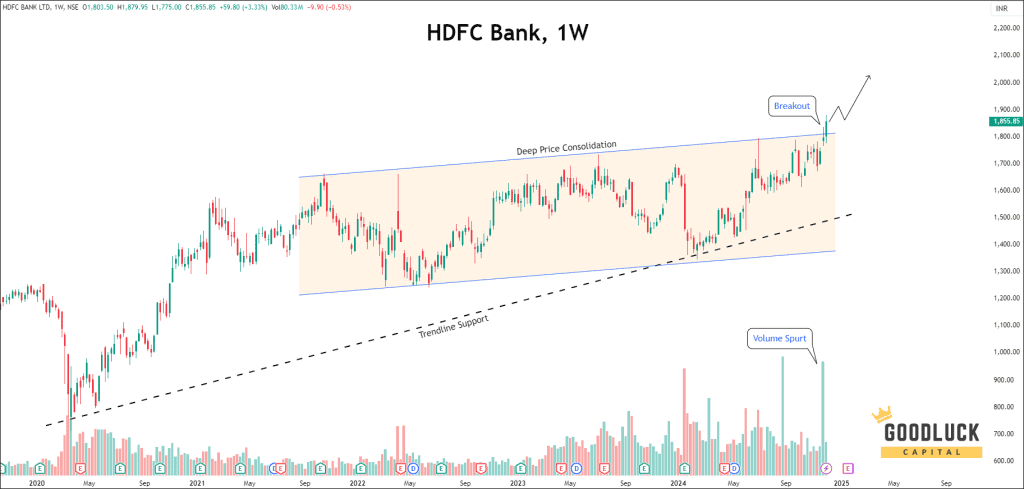

1. HDFC Bank

- The price has broken through its consolidation range and reached a new all-time high, with expectations of further gains.

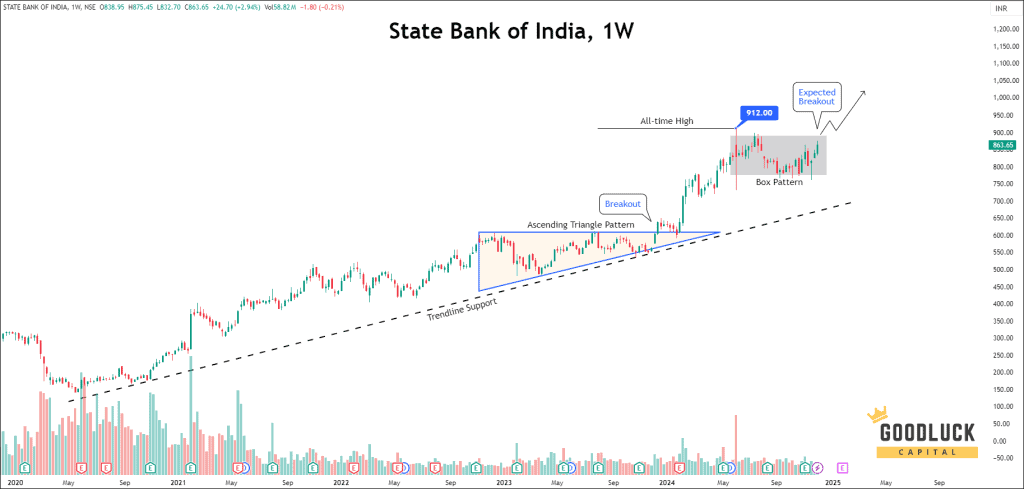

2. State Bank of India

- The stock price has displayed a strong upward trend.

- After reaching a record high of 912, the price has entered a consolidation phase and is now trying to make a breakthrough.

Overall Outlook

The CRR cut is expected to be a catalyst for market momentum. As banks capitalize on increased liquidity, the banking sector will experience growth, economic expansion will accelerate, and market sentiments will become increasingly positive.