India’s IPO market made headlines throughout 2025, and rightfully so. 373 companies—103 mainboard and 270 SME listings—raised ₹1.95 trillion in capital, creating what media outlets hailed as a historic year for India’s primary market. The numbers were undeniably impressive.

But here’s what the headlines missed: nearly half of these IPOs are now trading below their issue prices, and average listing gains plummeted 70% compared to 2024. This wasn’t just a market correction. It was a wake-up call that exposed a fundamental truth about IPO investing that most retail investors ignore.

Understanding The Gap: Why Record Capital ≠ Record Returns

To understand what happened in 2025, we need to separate the noise from reality.

The Impressive Numbers:

- 373 total IPO offerings across both segments ✓

- ₹1.95 trillion in capital raised (10% higher than 2024) ✓

- 69 out of 103 mainboard IPOs listed above issue price (66%) ✓

The Uncomfortable Truth:

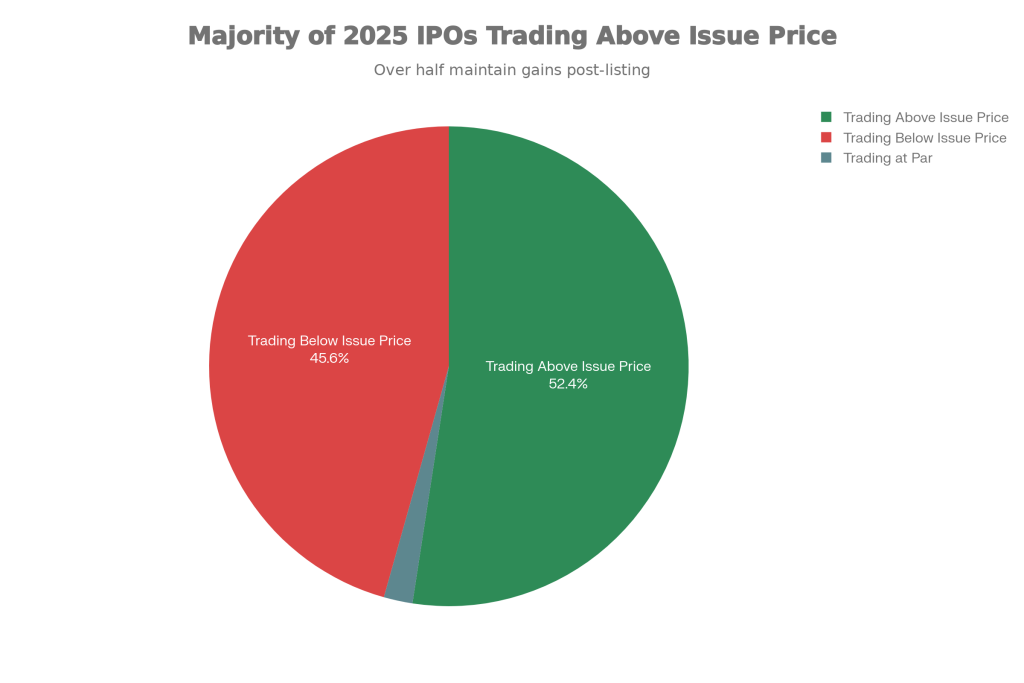

- Only 54 of those 103 remained above issue price by year-end (52%)

- 47 mainboard IPOs fell below issue price (46%)

- Average listing gains collapsed from 30.25% (2024) to 9.1% (2025) – a 70% decline

- 36 IPOs opened in red on listing day itself (a rare phenomenon in bull markets)

The paradox is stark: More IPOs launched with stronger subscription numbers, yet fewer investors actually profited. This tells us something critical: Size of participation doesn’t equal quality of returns.

The Four Reasons Why Your IPO Profits Evaporated

1. Companies Priced Aggressively, Leaving No Margin for Error

When an IPO prices at a 40x Price-to-Earnings (P/E) multiple, it’s essentially saying: “This company will grow perfectly, with no surprises, for years.”

The moment Q1 earnings arrive and growth is merely “good” instead of “exceptional,” valuations compress sharply. A 40x P/E becomes a 15x P/E in weeks. Your 50% listing gain? Erased in 30 days.

Historical data shows that companies priced aggressively at the upper end of valuation ranges experience the sharpest post-listing reversals. The stocks that sustained gains (Meesho, Stallion, ICICI Prudential AMC) came to market with reasonable valuations relative to their growth prospects.

2. Institutional Investors (Smart Money) Exited on Listing Day

Here’s how institutional investing in IPOs actually works:

Anchor investors—large institutional funds—receive IPO shares at issue price before retail investors even apply. They hold these shares for just hours after listing. When the stock jumps 50-70% on opening, they immediately sell.

This creates a brilliant setup for institutions and a terrible one for retail investors:

Institutions: Buy at ₹100, sell at ₹150 on listing day → +50% profit, locked in

Retail investors: Buy the shares institutions are selling at ₹150 → later watch them fall to ₹110 → -26% loss

This dynamic repeated itself across 2025. Heavy retail subscription meant institutions had eager buyers for their exit. Most retail investors didn’t stand a chance.

This is exactly why many seasoned investors prefer structured decision-making frameworks or guidance from a SEBI registered stock advisory, rather than relying on listing-day hype or social media narratives.

3. Market Saturation: Too Many IPOs, Too Little Capital

The sheer volume of IPO launches in 2025 created a selection problem. With 373 offerings competing for the same pool of investor capital, quality selectivity disappeared.

Instead of evaluating each IPO on fundamentals, retail investors applied indiscriminately, chasing FOMO (fear of missing out). This diluted demand across the entire market. Companies that might have generated strong listing gains in a less crowded environment instead opened flat or negative.

The data proves this: Retail subscription multiples fell from 33.71x (2024) to 26.99x (2025)—a 20% decline. Fewer retail investors applying to each IPO meant weaker listing performance across the board.

4. Secondary Market Weakness Dragged Down New Listings

Newly listed stocks are inherently risky—they lack operational track records, have untested management, and operate in unproven business models. When broader markets are strong, investors overlook this risk. When markets are weak, premium valuations compress first.

The BSE Sensex delivered just 6.5% returns in 2025—below historical averages. This modest secondary market performance meant newly listed IPOs faced disproportionate selling pressure. What could have sustained as a ₹100 valuation in a bull market got marked down to ₹80 in a flat market.

The Sector That Actually Won: Finance and Tech

While infrastructure and industrial companies collapsed, certain sectors delivered consistent gains.

Companies with capital-light, recurring revenue models sustained gains:

- ICICI Prudential AMC (asset management): Scales without proportional cost increases ✓

- Meesho (e-commerce marketplace): High margins, compound unit economics ✓

- Groww (financial platform): Software scaling, recurring user engagement ✓

Why? Because these businesses have compounding mechanics built in. As India’s wealth grows, asset management fees and platform transaction volumes expand exponentially.

Conversely, infrastructure and commoditized industrial businesses collapsed:

- Highway Infrastructure: 72% listing gain → 19% loss from IPO price

- Gem Aromatics: 48% decline from issue price

- Ola Electric: 53% drop despite massive brand recognition

The lesson: Business model matters infinitely more than hype or brand recognition.

The Grey Market Premium Trap: Why GMP Is Unreliable

Every IPO investor has heard about the “grey market premium” (GMP)—the unofficial price at which IPO shares trade before listing. High GMP supposedly predicts strong listing gains.

It doesn’t. Not anymore.

LG Electronics had a healthy GMP but listed 48-50% higher than expected. Groww had a tiny ₹3 GMP but delivered a 12% listing pop that extended to 31% by close. Meanwhile, Tata Capital’s GMP promised 6-7% gains, but the stock opened with just 1.2%.

The reason? GMP reflects speculation and leverage-driven bids from high-net-worth traders, not genuine institutional demand. An inflated GMP is often a warning sign—it means speculators are pricing in euphoria that listing-day reality won’t support.

The Size Paradox: Smaller Isn’t Always Better

Smaller IPOs (below ₹200 crore) delivered 37% average listing gains, while mega-IPOs (above ₹5,000 crore) averaged 29%.

Sounds like smaller IPOs are the winner, right? Wrong.

The 10 worst-performing IPOs uniformly came from the sub-₹1,000 crore segment. Why? Lower liquidity means sharper reversals when anchor investors exit. Small initial pops trap retail investors who hold expecting continued gains.

Valencia India, Glottis, Gem Aromatics, and dozens of similar small-cap IPOs cratered 50-80% from issue prices. The stocks that outperformed had either mid-sized launches (₹1,000-2,000 crore) or mega-launches from tier-1 companies with genuine institutional backing.

What Professional Investors Do That Retail Investors Miss

The investors who actually profited from 2025 IPOs followed a specific framework:

Before Applying:

- Review the fundamentals, not the hype. Check revenue growth, profit margins, debt levels, and return on capital.

- Compare valuations. If the IPO is priced at 40x P/E and peers trade at 20x, understand why. There better be a compelling reason.

- Evaluate the management team. Has the promoter built and scaled other successful businesses? Are they incentivized to create shareholder value?

- Understand the use of IPO proceeds. Are funds going toward expansion (good) or debt repayment (neutral/bad)?

On Listing Day:

- Exit 50-70% of your allotment immediately if there’s a strong listing gain. Lock in profits. Don’t hold hoping for more.

- Reassess the remaining 50% based on post-listing fundamentals. Only hold if the business story genuinely excites you.

This approach mirrors how disciplined short term trade recommendations are structured—prioritizing capital protection and probability over emotion and excitement.

Post-Listing:

- Monitor Q1/Q2 results carefully. Earnings misses trigger sharp reversals. If the company guides lower, exit immediately.

The 2026 Outlook: Consolidation, Not Exuberance

For 2026, the IPO pipeline is expected to moderate to 100-120 mainboard listings raising ₹3.5-4 lakh crore—down from 2025’s ₹1.75-1.95 trillion.

This consolidation phase offers an opportunity. With fewer offerings competing for capital, selectivity will improve. But only investors who’ve learned the 2025 lessons will capitalize.

Your Action Plan: How To Approach IPOs Intelligently

1. Stop Treating IPO Allotments As Lottery Tickets

An IPO allocation is a business decision, not a guaranteed money machine. Approach it with the same rigor you’d use to evaluate any stock purchase.

2. Ignore The Hype. Focus On Fundamentals

- What is the company’s actual competitive advantage?

- Can it maintain profitability at the IPO valuation?

- Is management aligned with shareholder interests?

3. Don’t Rely On Grey Market Premiums

GMP is speculation in an unregulated market. It’s not a reliable predictor of listing performance. Real price discovery happens on the exchange, not in the grey market.

4. Have An Exit Plan Before You Enter

Decide your profit-taking point before listing day. When it arrives, execute without emotion. Lock in gains. Don’t hold hoping for more.

5. Choose Selectivity Over Participation

Applying for every IPO and hoping some deliver is a flawed strategy. Apply to 2-3 IPOs per year that genuinely excite you, not 20 IPOs you barely understand.

The Bottom Line

India’s 2025 IPO market delivered an unintended education in market dynamics. Record capital mobilization masked a deteriorating quality of returns. Massive subscriptions didn’t translate to wealth creation. Celebrity IPOs disappointed just as often as nobody-knew-about-them IPOs soared.

The investors who prospered recognized this disconnect early. They exited listing-day euphoria ruthlessly. They reassessed based on Q1 fundamentals. They applied discipline instead of FOMO.

Everyone else became cautionary tales.

The good news? 2026 offers a fresh start. The market will be more selective. Valuations will be more reasonable. Capital will be more discerning. Investors who’ve internalized the 2025 lessons will be positioned to genuinely build wealth through IPOs.

Those who repeat the same mistakes will repeat the same results.