India’s most anticipated IPO of the year is finally here. Lenskart Solutions Limited, the eyewear retailer that revolutionized how Indians buy glasses, is going public with a massive ₹7,278 crore offering from October 31 to November 4, 2025. With founder Piyush Bansal’s celebrity status from Shark Tank India and the company’s dominant market position, investor excitement is palpable—the grey market premium (GMP) has surged to ₹60-62, suggesting a potential 15-16% listing gain.

| Total Issue Size | Fresh Issue | Offer for Sale (OFS) |

|---|---|---|

| ₹7,278 crore | ₹2,150 crore (29.5% of total) | ₹5,128 crore (70.5% of total) |

| Price Band | Face Value | Lot Size | Minimum Investment |

|---|---|---|---|

| ₹382-402 per share | ₹2 per share | 37 shares | ₹14,134 - ₹14,874 |

| IPO Opens | IPO Closes | Listing Date |

|---|---|---|

| 31/10/2025 | 04/11/2025 | 10/11/2025 |

| Listing Exchange | Post-IPO Market Cap | Grey Market Premium (GMP) |

|---|---|---|

| BSE & NSE | ₹69,900 crore (~$8 billion) | ₹60-62 (15-16% premium) |

But here’s the critical question everyone should be asking: Are you paying too much for this growth story? At a valuation of nearly ₹70,000 crore ($8 billion), Lenskart is trading at eye-watering multiples of 235-542x P/E depending on how you account for one-time gains. To put this in perspective, that’s more than 3 times the valuation of its US peer Warby Parker, despite similar revenue bases.

In this comprehensive analysis, We’ll cut through the IPO hype and help you understand what you’re really buying—the genuine growth opportunities, the concerning red flags, and most importantly, whether this IPO deserves a place in your portfolio.

The Lenskart Phenomenon: From Startup to Market Leader

Founded in 2008 by Peyush Bansal, Lenskart started as an online eyewear retailer challenging India’s fragmented optical market dominated by local opticians. Today, it’s India’s largest organized eyewear company with 2,806 stores across 13 countries, selling 27.8 million eyewear units annually to 4.4 million customers.

What sets Lenskart apart is its vertically integrated omnichannel model. Unlike traditional retailers who source from multiple suppliers, Lenskart controls the entire value chain—from manufacturing frames and lenses at its massive 645,834 sq ft facility in Bhiwadi, Rajasthan to retailing through company-owned stores and online platforms. The company is doubling down on this advantage with a ₹1,500 crore investment in a Hyderabad facility that will become the world’s largest eyewear manufacturing plant.

The technology integration is impressive too. Virtual 3D try-ons, AI-powered frame recommendations, and home eye check-up services have made Lenskart a tech-enabled retailer rather than just another eyewear shop. Operating under brands like Lenskart, John Jacobs, Vincent Chase, and Lenskart Air, the company offers prescription glasses (80%+ of revenue), sunglasses, contact lenses, and accessories.

But here’s what the IPO prospectus won’t emphasize: 75-80% of Lenskart’s revenue still comes from offline stores. Despite the “tech-driven” narrative, this is fundamentally a retail business with all the associated capital intensity and operating costs that limit the margin expansion you’d expect from a pure technology platform.

The Numbers Tell Two Stories: Growth vs. Profitability

The Growth Story is Real

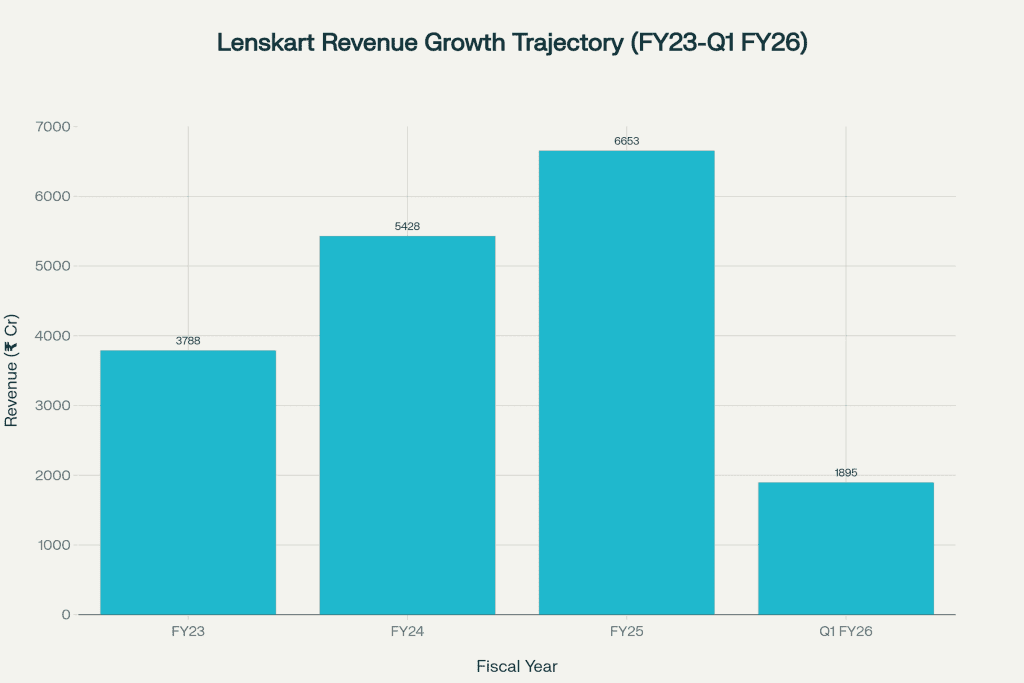

Lenskart’s revenue trajectory is undeniably impressive. From ₹3,788 crore in FY23, revenue jumped to ₹6,653 crore in FY25—a healthy 32.5% CAGR. Even as growth moderates (22.6% in FY25), the company is still expanding faster than most established retailers.

The volume story is equally compelling. Eyewear units sold grew from 15.2 million in FY23 to 27.8 million in FY25 (29% YoY), while the customer base expanded to 4.4 million (25% growth). This isn’t just revenue inflation—real demand is surging.

Geographic diversification adds another positive dimension. International markets now contribute 40% of revenue (₹2,638 crore) with higher margins, thanks to the 2022 acquisition of Japan’s Owndays for approximately $400 million. This expansion spans 13 countries including Singapore, Thailand, Taiwan, Malaysia, and the Middle East.

But the Profitability Picture Raises Red Flags

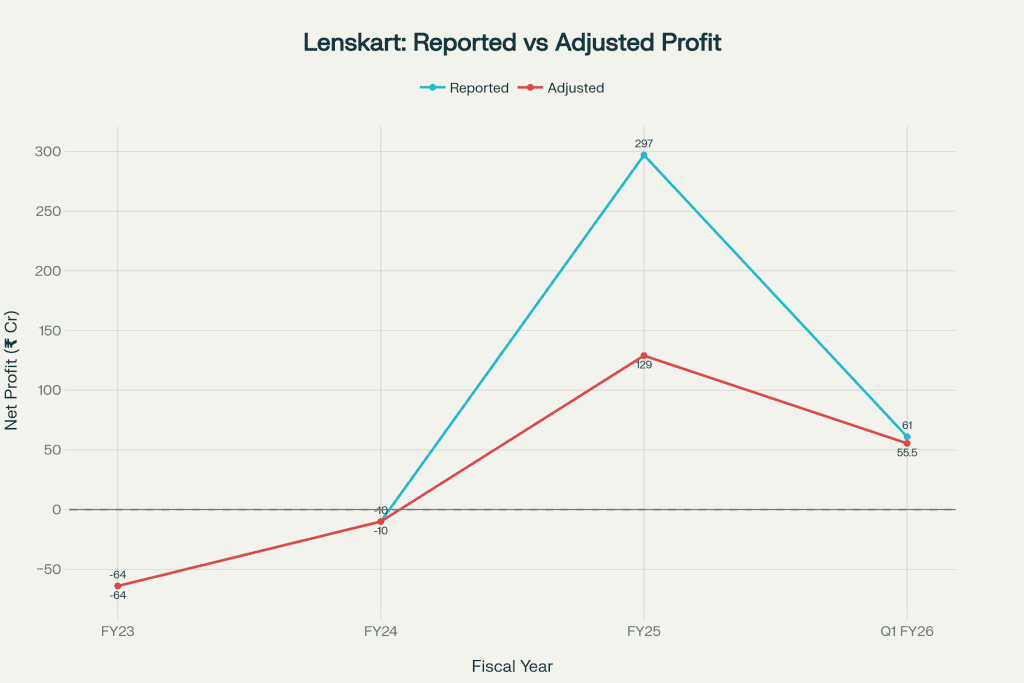

Here’s where the story gets complicated. Lenskart proudly proclaims it turned profitable in FY25 with ₹297 crore net profit after years of losses. Sounds great, right? Not so fast.

Dig into the fine print and you’ll discover that ₹168 crore of that profit is a one-time accounting gain (Fair Value Through Profit & Loss) related to the Owndays acquisition—essentially, when expected future payments for the deal declined, the difference appeared as profit on paper. Strip out this non-cash gain, and adjusted FY25 profit is just ₹129 crore, giving a razor-thin 1.9% net margin on ₹6,653 crore revenue.

Even Q1 FY26 benefited from a similar ₹5.5 crore gain. More concerning? Commission expenses mysteriously dropped from 11% to 2% of revenue in Q1 FY26—a classic pre-IPO earnings management tactic to make profitability look better than it actually is.

Where Do the Profits Disappear?

Lenskart enjoys 70% product margins—excellent by retail standards. But here’s how that 70% gross margin shrinks to just 1.9% adjusted net margin:

- Manpower Costs: 20% of revenue goes to salaries for staff across 2,100+ physical stores.

- Commission & Incentives: 11% (suspiciously dropped to 2% in Q1 FY26).

- Rent & Store Operations: 8% for lease costs and utilities.

- Marketing: 7% for customer acquisition.

- Depreciation & Finance: 8% reflecting heavy capital investments.

This cost structure reveals the fundamental challenge: operating 90% company-owned stores is capital-intensive and constrains margin expansion. Unlike asset-light tech platforms that scale margins as they grow, Lenskart’s store-heavy model creates fixed costs that limit operating leverage.

The Market Opportunity: Structural Tailwinds Are Real

Lenskart is riding strong, long-term growth trends that could fuel its expansion for many years—despite short-term profitability concerns.

India’s Growing Vision Crisis: A Huge Opportunity

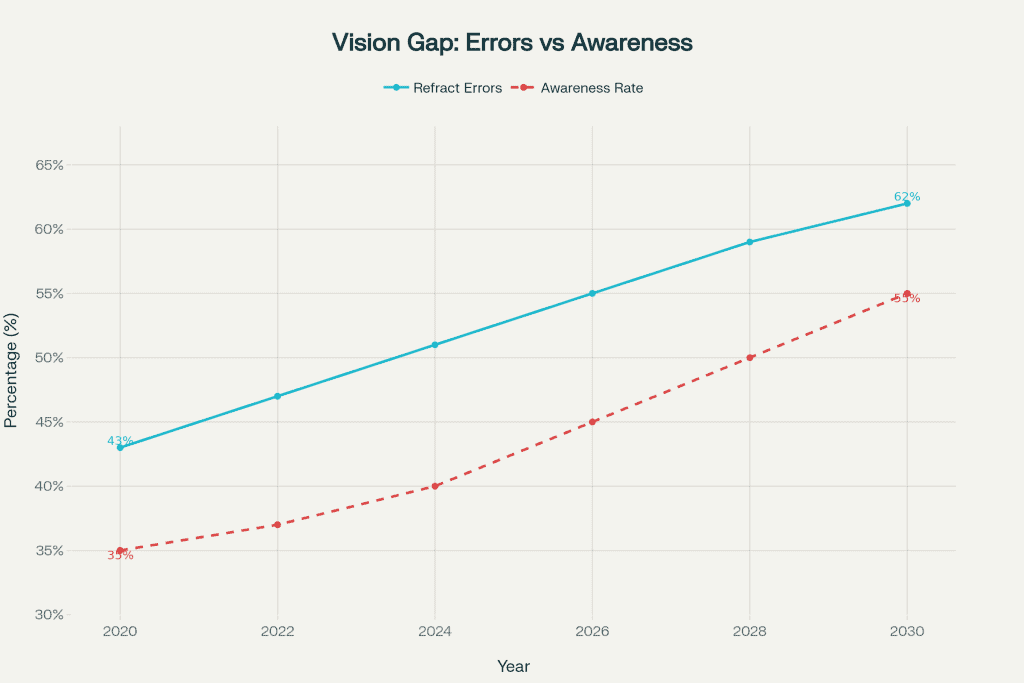

India is facing a vision correction epidemic. The share of people with refractive errors (nearsightedness, farsightedness, astigmatism) is expected to jump from 43% in 2020 to 62% by 2030 — meaning 6 out of 10 Indians will need glasses soon.

What’s driving this surge?

- Screen addiction: Heavy device use is worsening myopia in kids and youth.

- Less outdoor time: Less sunlight exposure affects eye health.

- Urban pollution: Poor air quality damages eyes.

- Aging population: More age-related vision problems.

The hidden opportunity: Only 35–40% of affected people currently use glasses — leaving 60–65% still unserved. As awareness, affordability, and access improve, this represents a massive untapped market.

India’s Eyewear Market Set for Strong Growth

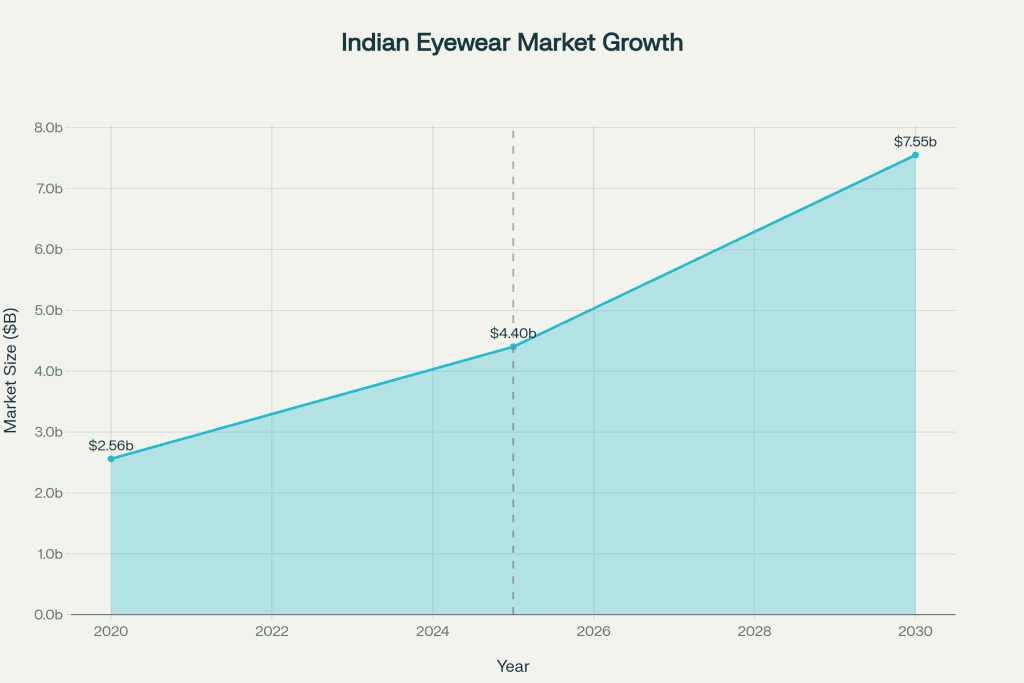

Multiple research firms project explosive growth for India’s eyewear industry:

- Current market size (2025): $4.4 billion.

- Projected size (2030): $7.6 billion.

- Growth rate: 11.4% CAGR.

Prescription glasses (Lenskart’s main business, ~80% of revenue) will grow even faster — expected at a 14-15% CAGR.

Sunglasses, contact lenses, and accessories will also expand steadily.

Market Structure: The Consolidation Opportunity

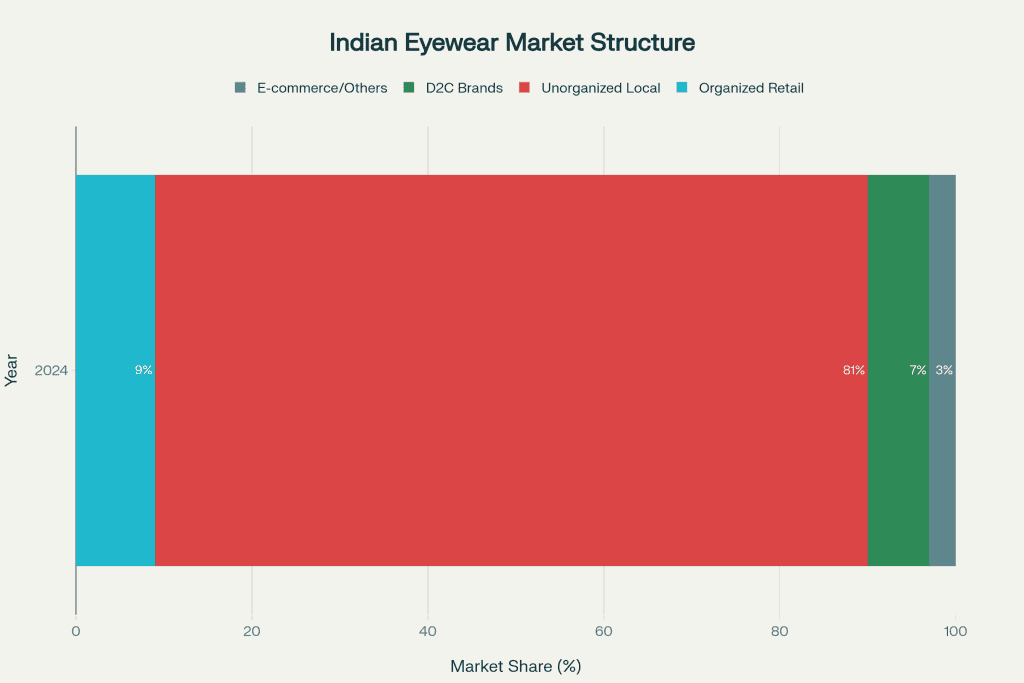

Here’s Lenskart’s biggest advantage: 81% of India’s eyewear market remains unorganized—controlled by thousands of small local opticians with inconsistent quality and pricing.

By 2030, the market transforms:

- D2C brands (Lenskart, Coolwinks): 7% → 14% market share (doubling)

- Organized retail (Titan Eye Plus, GKB): 9% → 18%

- Unorganized local opticians: 81% → 65% (losing 16 points)

As the market consolidates, Lenskart, with its 2,800+ stores and strong brand presence, is perfectly positioned to lead this shift.

The Vision Correction Gap: Driving Demand

By 2030, about 62% of Indians will need vision correction, but only 55% will actually get it — leaving millions still underserved.

As awareness and affordability improve, more people will seek eyewear solutions — ensuring steady, long-term demand for Lenskart’s products.

The Valuation Conundrum: Premium or Excessive?

Now we arrive at the heart of the investment decision: Is Lenskart’s ₹70,000 crore valuation justified?

The Numbers Are Stretched by Any Measure

At the IPO price of ₹402, here’s what you’re paying:

| Metric | FY25 | FY26E | Industry Comparison |

|---|---|---|---|

| P/E Ratio (Reported) | 235x | 202x | High |

| P/E Ratio (Adjusted) | 542x | - | Extremely Stretched |

| Price/Sales | 10.5x | 8.1x | Warby Parker: 3.1x |

| EV/EBITDA | 71.7x | 53.9x | Warby Parker: 77.9x |

| Price/Book | 10.89x | - | High |

Even on forward FY26 estimates, Lenskart trades at 202x P/E and 8.1x Price/Sales—multiples that assume near-perfect execution for years to come.

How Does Lenskart Compare to Peers?

The peer comparison reveals why some analysts are nervous:

Lenskart vs. Warby Parker (US eyewear peer):

- Market Cap: Lenskart $8.0 Bn vs. Warby Parker $2.6 Bn

- Revenue: Both ~$795 million (nearly identical)

- Profitability: Lenskart ₹129 Cr adjusted profit vs. Warby Parker’s losses

- Valuation: Lenskart P/S 10.5x vs. Warby Parker P/S 3.1x

Lenskart is valued at 3.4x Warby Parker’s Price/Sales multiple despite similar revenue. Yes, Lenskart is growing faster (23% vs. 14%) and is actually profitable, but is that worth 3.4x the valuation?

Here’s the cautionary tale: Warby Parker is down 59% from its IPO highs ($59.5 to current $21). The US market clearly doesn’t value eyewear retail at rich multiples, even for a tech-enabled brand.

What Could Justify This Valuation?

To be fair, many argue that P/E ratios are inappropriate for evaluating high-growth, recently profitable companies. If Lenskart can deliver on the following, the valuation might make sense:

Bull Case Requirements:

- Sustain 25-30% revenue CAGR for 5 years: Achievable given market growth and consolidation opportunity.

- Expand EBITDA margin to 20%+, net margin to 8-10%: Requires significant operating leverage; Q1 FY26’s 19.5% EBITDA margin is encouraging but may be IPO-engineered.

- Capture increasing market share: D2C segment growing from 12% to 20% by 2030; Lenskart is the leader.

- Scale international to 50% of revenue: Currently 40% with higher margins; plenty of runway.

- Expand into adjacent categories: Not currently in plans, but could diversify beyond eyewear.

Bear Case Concerns:

- Valuation prices in perfection: 235-542x P/E leaves zero room for execution missteps.

- Offline dependency limits scalability: 80% revenue from stores vs. tech platform narrative.

- Single category risk: No diversification unlike multi-category Nykaa.

- Promoter selling: ₹5,128 crore OFS (70% of IPO) suggests insiders cashing out at peak.

- Accounting concerns: ₹168 Cr one-time gain inflating profits + suspicious commission expense drop.

Should You Apply?

After analyzing the business, financials, market opportunity, and valuation, here’s our take for different investor types:

Consider Applying (with Caution) If You Are:

Long-Term Growth Investors (3-5+ years)

- Rationale: India’s eyewear market is genuinely attractive with structural tailwinds. Lenskart’s market leadership, vertical integration, and execution track record position it to capitalize on this growth.

- Caution: Valuations are expensive; expect significant volatility. This is not a “safe” investment.

- Approach: Apply for 1-2 lots only as a high-risk, small portfolio allocation (<5%).

- Key assumption: You believe management can expand margins to 8-10% net as scale increases.

Listing Gains Traders

- Rationale: GMP of ₹60-62 (15-16% premium) suggests positive listing sentiment.

- Risk: Many high-valuation IPOs (Paytm, Zomato initially) saw sharp post-listing corrections despite positive GMPs.

- Strategy: Apply for listing gains but book profits quickly on listing day; don’t hold if prices start dropping.

Avoid or Wait If You Are:

Value Investors

- Rationale: Trading at 235-542x P/E with 1.9% net margins violates all value investing principles.

- Alternative: Wait for 40-50% correction, which still may not make it “cheap” by value standards.

- Better approach: Let market determine fair value over 6-12 months post-listing.

Conservative Investors

- Rationale: Valuation risk too high for conservative portfolios; potential for 30-50% downside volatility.

- Alternative: Wait for 2-3 quarters of consistent performance demonstrating sustainable profitability without accounting tricks.

- Better option: Evaluate after Q2-Q3 FY26 results to validate margin trajectory.

Risk-Averse Investors

- Rationale: If you’re uncomfortable with 235-542x P/E valuations or investing significant savings, this isn’t for you.

- Remember: Warby Parker’s poor post-IPO performance shows eyewear retail doesn’t command premium multiples everywhere.

The “Wait and Watch” Strategy: Often the Wisest Approach

For most investors, patience may be the better strategy:

Let the IPO list and observe for 2-3 months: Initial euphoria often fades as investors digest actual business performance.

Wait for Q2-Q3 FY26 results: Validate if profitability is sustainable or if Q1 was IPO-engineered.

Monitor key metrics:

- Commission expense normalization (should return to ~11%, not stay at 2%).

- Margin trajectory (can EBITDA sustain 19.5%?).

- Store expansion pace vs. same-store sales growth.

- International revenue contribution.

Buy on corrections at more reasonable valuations: Target entry at 8-10x P/S or 100-150x P/E rather than current 235-542x.

Remember: IPOs are not always the best entry point for long-term investors. With Lenskart priced at premium valuations, it’s wiser to wait for post-listing price stability before taking a position. For personalized entry and exit strategies, consult a SEBI-registered financial advisor.

“An IPO is like a negotiated transaction — the seller decides when to come public, and it’s seldom a time that’s advantageous for buyers.” – Warren Buffet

Final Thoughts: Growth is Real, But Are You Overpaying?

Lenskart’s IPO presents a classic growth vs. valuation dilemma. There’s no denying the company operates in a structurally attractive market with genuine growth drivers:

What’s Working:

- Rising refractive errors driving long-term demand (43% to 62% population by 2030).

- Large addressable market doubling to $12-20 Bn by 2030.

- 85-90% unorganized market ripe for consolidation.

- Market leadership with 2,806 stores and strong brand recall.

- Vertical integration providing cost and quality advantages.

- Geographic diversification (40% international revenue with higher margins).

What’s Concerning:

- Valuation stretched at 235-542x P/E, 10.5x P/S vs. peers.

- Thin profitability (1.9% adjusted net margin) despite scale.

- ₹168 Cr one-time accounting gain inflating FY25 profits.

- Heavy offline dependence (80% revenue from stores) limits tech scalability.

- High operating costs (manpower 20%, rent 8%, marketing 7%) constraining margins.

- Promoter selling ₹5,128 Cr (70% of IPO) signals profit-booking.

- Single-category focus (eyewear only) vs. diversified peers like Nykaa.

Conclusion

The eyewear market opportunity is real, but you’re being asked to pay a significant premium for it. For most investors, waiting for post-listing price discovery and 2-3 quarters of validated performance is the prudent approach.

If you do apply, treat it as a high-risk, small allocation bet on India’s eyewear market growth story, not a core portfolio holding. Be prepared for volatility and have clear exit strategies.

Listing day is rarely the best entry point for long-term value creation. Sometimes, the wisest investment decision is knowing when to wait.

And if you’re someone who wants to trade or invest in the stock market, but don’t have enough time, and skills to conduct your own research, then check out our Short Term Trading Advice in India.

You can also join our Telegram Channel and WhatsApp Channel for regular stock market analysis, insights and advice.