Geopolitical tensions often create ups and downs in financial markets, and the long-standing conflict between India and Pakistan is no different. The recent rise in tensions, caused by the Pahalgam terrorist attack and the diplomatic actions that followed, has brought fresh uncertainty to both countries’ stock markets. Since both nations have strong military power — including nuclear weapons — any increase in conflict naturally makes investors nervous. However, history teaches us an important lesson: while short-term market swings are common during such times, major market crashes are very rare.

In this report, we look at how real the risk of a market crash is by studying past events, the current mood of the markets, and the overall political situation.

Current Market Situation: India and Pakistan

Indian Stock Market

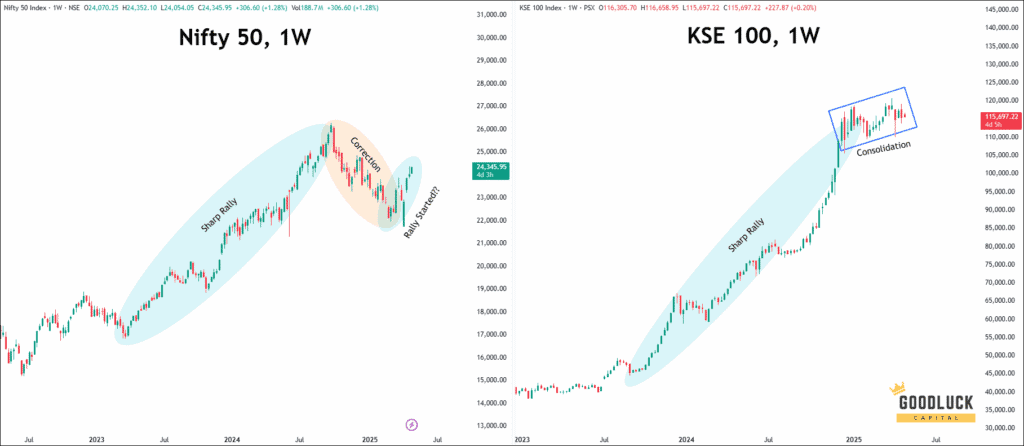

Currently, Indian markets are trading about 7–8% below their recent all-time highs, primarily due to a mix of global uncertainties and domestic factors.

Following the Pahalgam incident, the BSE Sensex fell 0.74% (589 points) and the Nifty dropped 0.86% (207 points). Notably, the India VIX — a gauge of market fear — spiked over 17%, signaling heightened short-term anxiety among investors.

Pakistani Stock Market

After a robust rally earlier this year, the Pakistani stock market has entered a consolidation phase.

Post-attack, the KSE-100 index witnessed a sharp 2.12% decline (approximately 2,486 points) over April 24–25, reflecting investor nervousness amid growing geopolitical risks.

What Happened to Indian Stock Markets Historically During Indo-Pak Tensions?

- Kargil War (1999) – No major market dip; volatility was contained.

- Parliament Attack (2001) – Minor dips (~5–6%), quickly recovered.

- Mumbai Attacks (2008) – No crash linked to attacks; global financial crisis was the dominant market driver.

- Surgical Strikes (Uri attack – 2016) – Brief volatility, no significant correction.

- Balakot Air Strike (2019) – Brief volatility, no significant correction.

Key Points to Remember

- Big crashes (>20%)?

- Very rare — almost never happened just because of India-Pakistan tensions.

- Small dips (5–10%)?

- Quite common, but markets usually bounce back fast.

- Recovery Time?

- Markets generally recover within 1–3 months, sometimes even sooner.

Why Markets Don’t Crash Hard During India-Pakistan Tensions

- Nuclear Weapons: Both countries know that a full war would be disastrous, so major wars are avoided.

- Focus on Economy: Global investors care more about India’s economic growth, not short-term border issues.

- Stronger Economy: Since the 2000s, India’s economy is more stable and less affected by small conflicts.

- Quick Responses: The Indian government now acts quickly and carefully, without letting situations spiral.

Final Conclusion

When tensions rise, markets may get shaky — but they don’t collapse.

Based on past events and current market strength, a full market crash due to India-Pakistan tensions is very unlikely.

For investors, it’s important to stay calm. History shows that short-term fear often leads to long-term opportunities for smart investors who don’t panic.

And if you’re someone who wants to trade or invest in the stock market, but don’t have enough time, and skills to conduct your own research, then check out our Short Term Trading Advice in India.

You can also join our Telegram Channel and WhatsApp Channel for regular stock market analysis, insights and advice.

Happy Trading!