Abstract

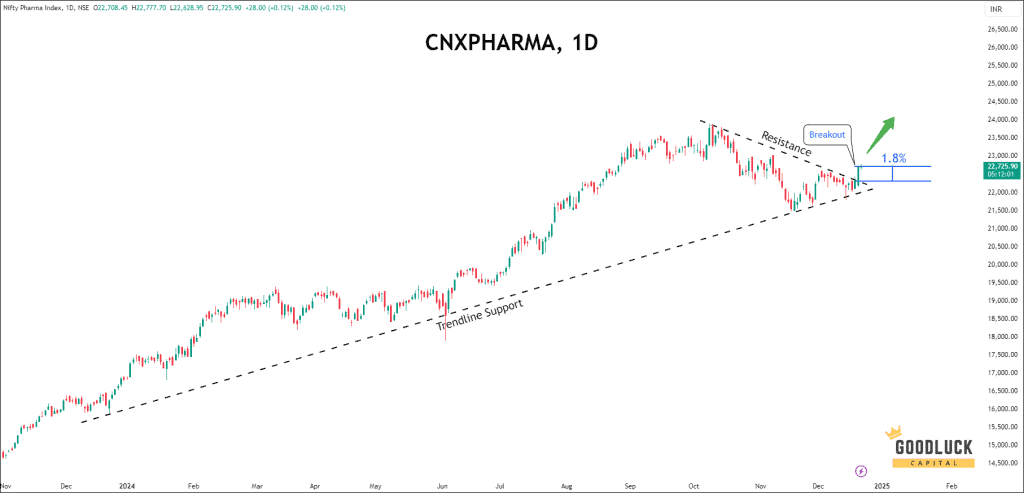

On December 19, 2024, the Indian pharmaceutical sector showed strong performance, with the Nifty Pharma index rising over 1.8%. This made it the only sector to gain while the overall market was down. The increase in trading volume suggests that more foreign investors are putting money into this sector. Investors are drawn to pharmaceuticals because they are considered safer during uncertain economic times.

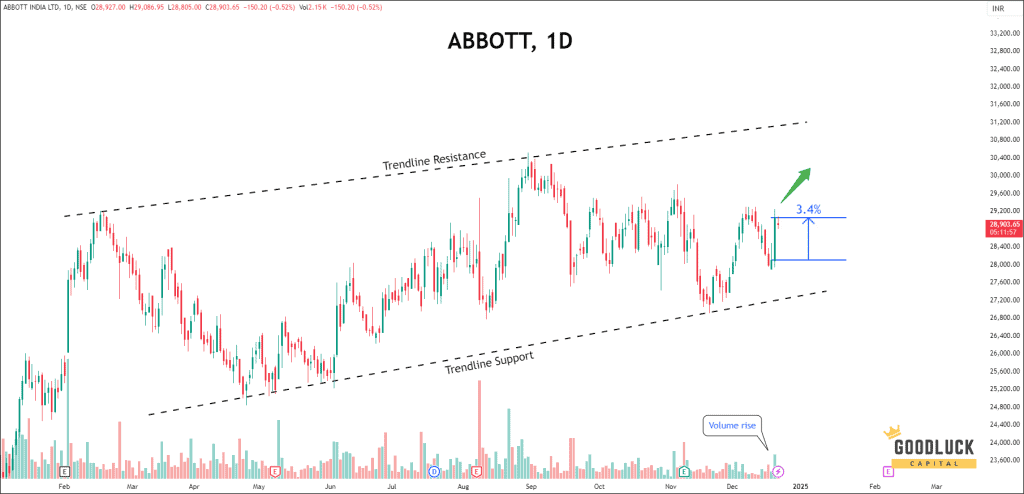

There are also positive expectations for growth, with the Indian pharmaceutical market expected to reach $130 billion by 2030. Key stocks like Ipca Laboratories (up 5.4%), Dr. Reddy’s Laboratories (up 4.3%), and Abbott India (up 3.4%) performed well, indicating a bright future for this important industry.

Introduction

On December 19, 2024, the pharmaceutical sector in India experienced a notable uptrend, with the Nifty Pharma index rising over 1.8%, making it the only sector to gain in an otherwise weak market.

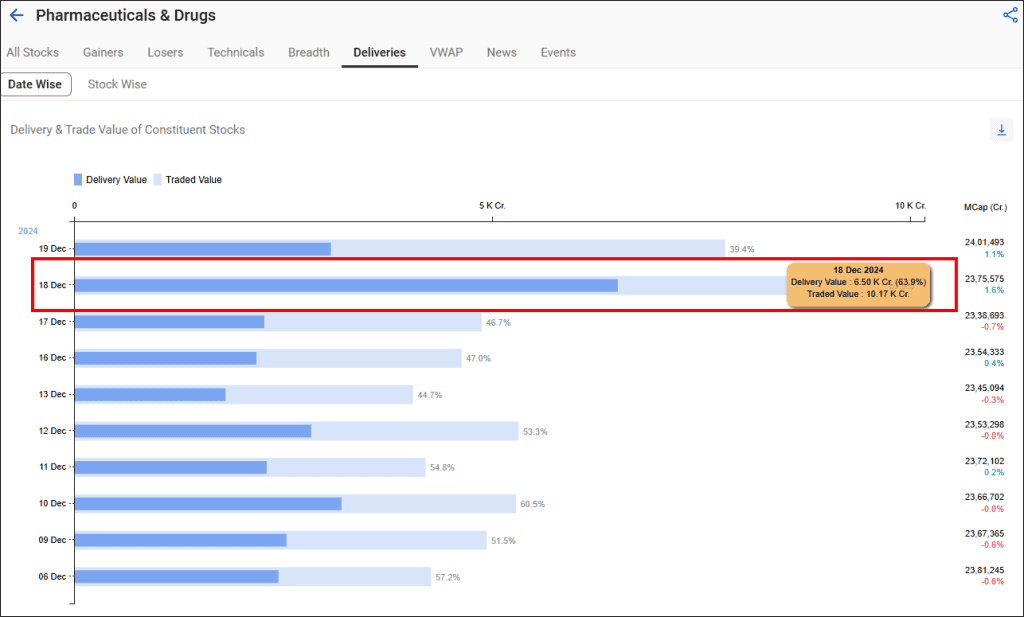

The significant surge in delivery volume indicates a substantial influx of foreign capital into the sector.

Several factors contributed to this positive movement:

- Defensive Nature of the Sector: Amidst economic uncertainties, investors often turn to defensive sectors like pharma, which offer relatively lower risk compared to cyclical sectors.

- Positive Market Sentiment: The overall sentiment for the pharma sector was buoyed by expectations of strong growth in the Indian pharmaceutical market, projected to reach $130 billion by 2030 and $450 billion by 2047.

- Resilient to US Tariffs: India is a major supplier of generic drugs to the US, which could help shield this sector from tariffs due to its critical role in healthcare and the ongoing demand for affordable medications.

Specific Stock Performances

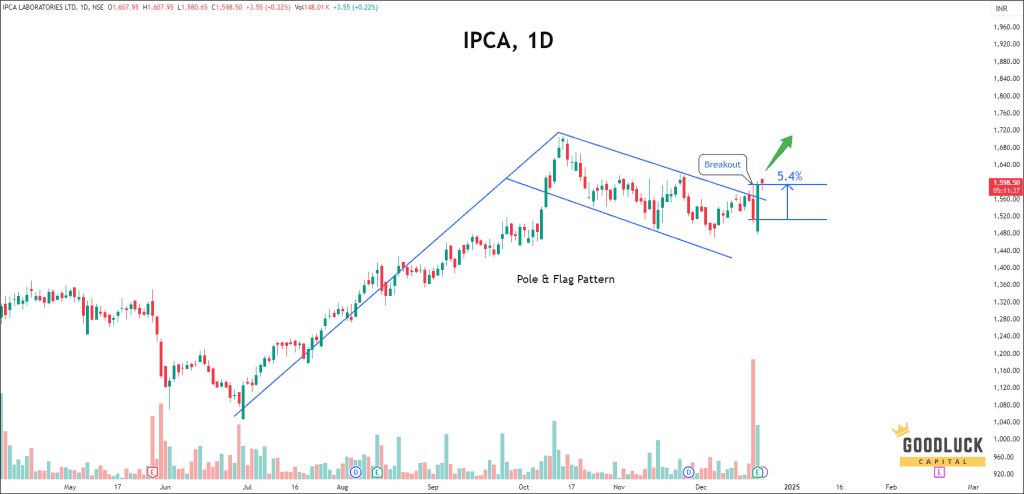

1. Ipca Laboratories: Up 5.4%

- The stock has formed a Bullish Pole & Flag pattern, and following a breakout, it is set to continue its upward movement.

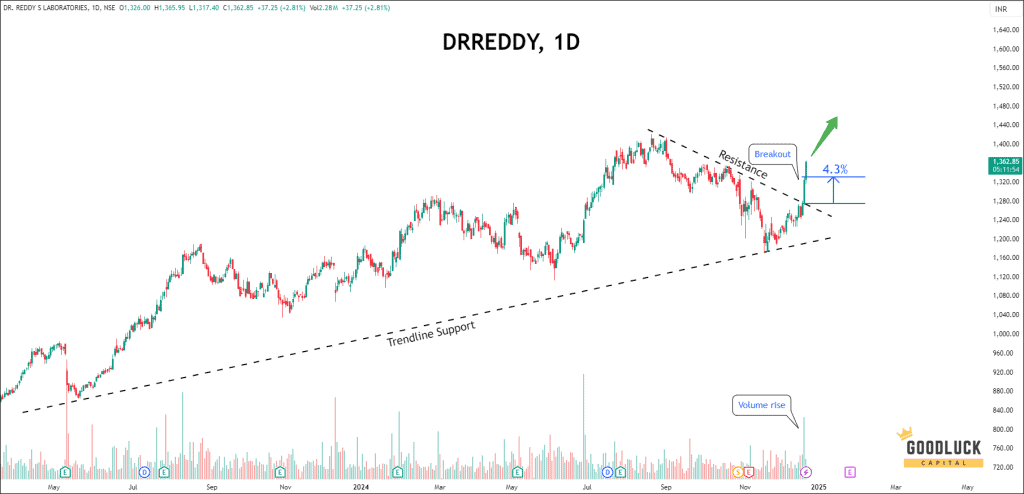

2. Dr. Reddy’s Laboratories: Up 4.3%

- The price has broken out of a falling trendline, signalling strong bullish momentum.

- This breakout, supported by a significant rise in trading volume, indicates growing investor interest.

3. Abbott India: Up 3.4%

- The stock is currently in a consolidation phase within a parallel channel.

- After rebounding from the lower boundary, the price is now on an upward trend.

Conclusion

The Pharma sector’s strong performance is driven by key players’ impressive gains, contrasting with the broader market’s decline. This divergence makes the sector an attractive investment opportunity. With a promising outlook and strong fundamentals, the Pharma sector is well-positioned for continued growth. For active traders, applying well-tested swing trading strategies for Indian stocks within the pharma space could help capture short- to medium-term opportunities while aligning with the sector’s long-term strength.