In 2016, a bald physics teacher from Prayagraj named Alakh Pandey had a dream that seemed impossible. He didn’t want to build a startup. He didn’t want to raise venture capital. He simply wanted to prove that brilliant education shouldn’t cost ₹1-2 lakhs—it should be affordable for every Indian student.

With just ₹30,000, he started uploading physics lectures on YouTube. No fancy studio. No production team. Just Alakh, a camera, and authentic passion. Fast forward to today: 98.8 million subscribers, a company valued at ₹31,170 crores, and an IPO launching November 11-13, 2025 that’s already captured the nation’s imagination.

This isn’t just another edtech IPO. This is the story of how one man’s mission to democratize education created a multi-billion dollar movement.

| Total Issue Size | Fresh Issue | Offer for Sale (OFS) |

|---|---|---|

| ₹3,480 crore | ₹3,100 crore (89% of total) | ₹380 crore (11% of total) |

| Price Band | Face Value | Lot Size | Minimum Investment |

|---|---|---|---|

| ₹103-109 per share | ₹1 per share | 137 shares | ₹14,111 - ₹14,933 |

| IPO Opens | IPO Closes | Listing Date |

|---|---|---|

| 11/11/2025 | 13/11/2025 | 18/11/2025 |

| Listing Exchange | Post-IPO Market Cap | Grey Market Premium (GMP) |

|---|---|---|

| BSE & NSE | ₹31,370 crore (~$3.5 billion) | ₹4 (3.67% premium) |

How It All Happened: The Nine-Year Rocket Ship

2016: The Beginning

Alakh’s first lectures got minimal views. But he kept uploading. Students were craving affordable, clear explanations of complex physics—and he was delivering it for free.

2019: The Viral Moment

His authentic style—energetic, unpolished, genuinely caring—started resonating. YouTube subscribers exploded. By 2019, he had 2 million followers. Teachers in corporate coaching institutes started worrying. “Who is this bald guy on YouTube stealing our students?”

2020: The Pandemic Blessing

COVID-19 locked down coaching centers. But Physics Wallah was already online. The platform exploded. Students desperate for learning turned to YouTube, and Alakh became their trusted teacher.

2022: The Unicorn

After proving the model worked, Alakh raised ₹100 crores at a ₹1.1 billion valuation. Physics Wallah was now a unicorn—alongside the likes of Byju’s and Unacademy. But Alakh stayed focused on his mission: affordable education.

2024-2025: The Profitability Shift

Here’s where Physics Wallah differs from every other edtech company. While Byju’s was collapsing under its debt burden and Unacademy was burning cash, Physics Wallah did something remarkable: it turned profitable at the operating level (EBITDA positive).

Today: ₹31,170 crore valuation, ₹2,887 crore revenue in FY25, and a loss that’s shrinking by 78% every year.

The Numbers That Tell a Story

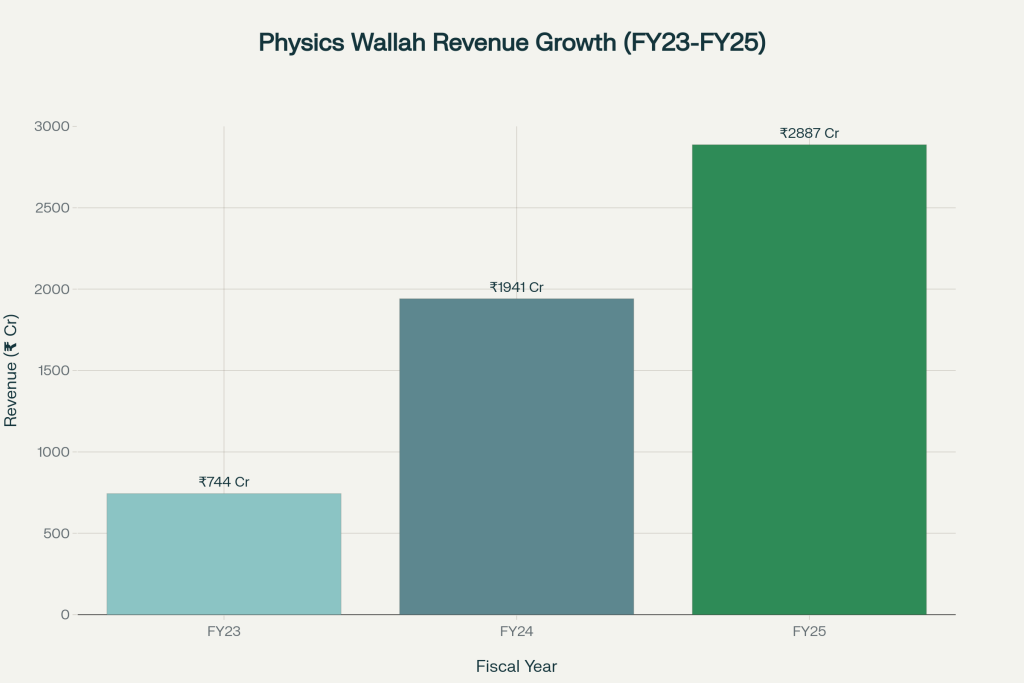

Revenue Growth

Imagine a company growing from ₹744 crores (FY23) to ₹1,941 crores (FY24) to ₹2,887 crores (FY25). That’s not just growth—that’s **97% CAGR, nearly 4x in just two years.

To put this in perspective: Most companies dream of 20-30% growth. Physics Wallah is growing nearly 100% year-over-year. This is the growth rate of companies that truly capture market opportunities.

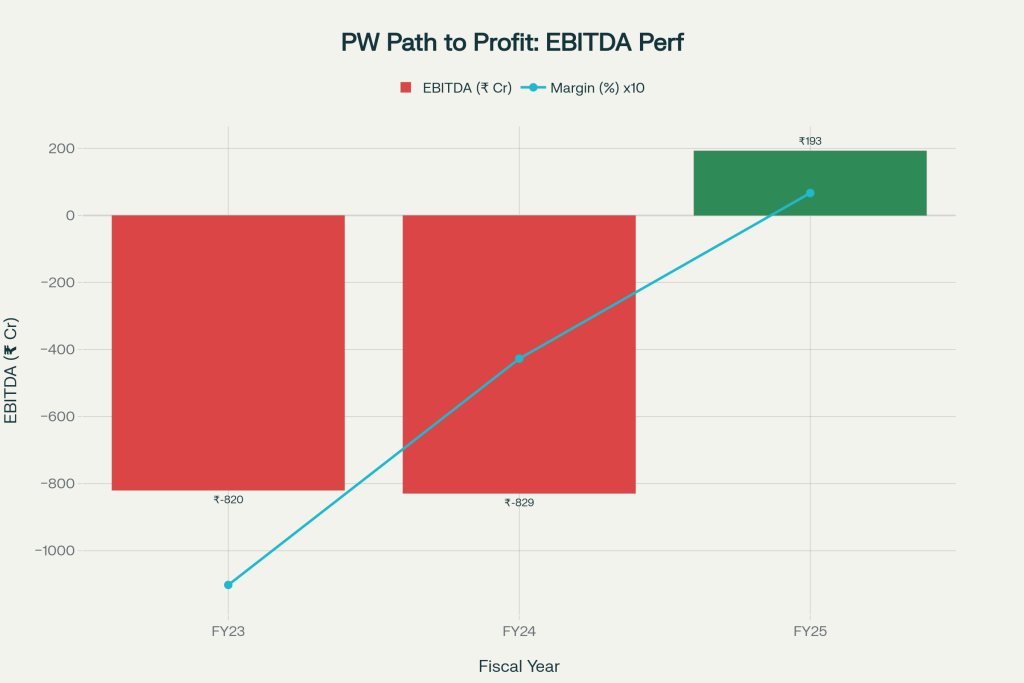

The Profitability Puzzle

Here’s the fascinating part. Physics Wallah is still loss-making at the net profit level (₹243 crore loss in FY25). But look at the trajectory:

FY24: Net loss of ₹1,131 crores

FY25: Net loss of ₹243 crores

Reduction: 78.5% improvement in one year

More importantly, at the EBITDA level (earnings before interest, taxes, depreciation, and amortization—the truest measure of operational profitability), Physics Wallah is positive at ₹193 crores with a 6.7% margin. It went from losing ₹829 crores in FY24 to making ₹193 crores in FY25.

What does this mean? The core business is profitable. The losses are from aggressive expansion—opening 198 offline centers, launching new courses, scaling operations. As the company matures, these losses will evaporate.

The User Explosion (The Moat)

- Total Users: 1.76 million (FY23) → 4.46 million (FY25)

- Growth Rate: 59% CAGR

- YouTube Subscribers: 98.8 million

- Daily Active Users: 2 million spending 80+ minutes daily

Think about what 98.8 million YouTube subscribers mean. That’s free advertising every single day. Every time Alakh uploads a video, millions of students watch. And many convert to paid customers. This is a competitive moat that money can’t buy.

The Business Model: Why It’s Different

Physics Wallah makes money in three ways, creating a powerful three-legged stool:

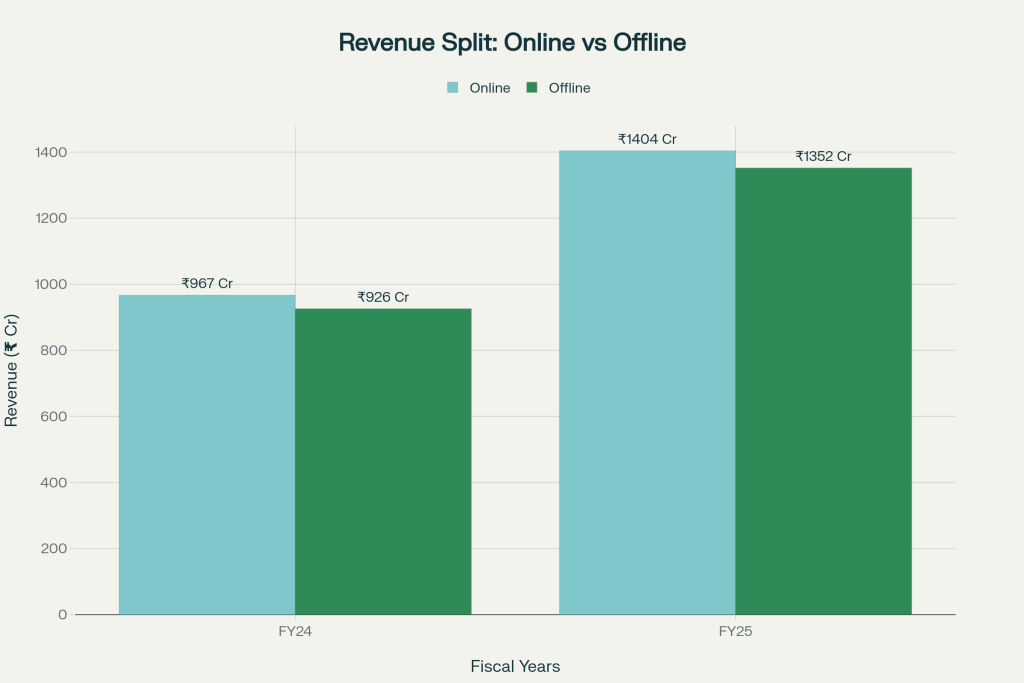

Online Revenue (49% = ₹1,404 Crores)

Students subscribe to the Physics Wallah app for courses on JEE, NEET, UPSC, Banking, CA, and 8 other categories. Average price: ₹3,682 per student per year. Compare this to competitors charging ₹50,000-1,00,000. Physics Wallah’s pricing is affordable by design, not accident.

Offline Revenue (49% = ₹1,352 Crores)

Physics Wallah operates 198 physical coaching centers across 109 Indian cities. Students attend traditional classrooms with live teachers. Price: ₹40,405 per student—still a fraction of what traditional coaching charges. These centers are spreading rapidly—from just 28 in FY23 to 198 in FY25 (a 165% CAGR).

Hybrid Centers (The Innovation)

The best of both worlds: Students attend physical centers but learn through broadcasted lectures with live doubt-clearing. This reduces teacher dependency and scales learning efficiently.

Why This Model Wins?

When Byju’s went all-in on online, it burned cash and eventually collapsed. When traditional coaching stuck to offline-only, they missed the digital wave. Physics Wallah did both simultaneously—creating a balanced, resilient, low-risk model.

If online learning faces headwinds, offline revenue cushions the company. If offline expansion slows, online growth carries it. This is why Physics Wallah survived while competitors didn’t.

The IPO: Why ₹3,480 Crores Now?

Physics Wallah is raising ₹3,480 crores through this IPO. But here’s the twist—and it’s a BIG one.

Fresh Issue vs Offer for Sale

- Fresh Issue: ₹3,100 crores (89%) — Money goes to Physics Wallah to grow the business

- Offer for Sale: ₹380 crores (11%) — Money goes to founders (Alakh & Prateek) who are selling some shares

Comparison with Lenskart (just listed):

- Lenskart: 70% OFS (founders cashing out big)

- Physics Wallah: 11% OFS (founders staying invested)

Physics Wallah founders aren’t running away with the money. They’re staying to build. Alakh Pandey retains 72% stake post-IPO. This signals confidence and commitment.

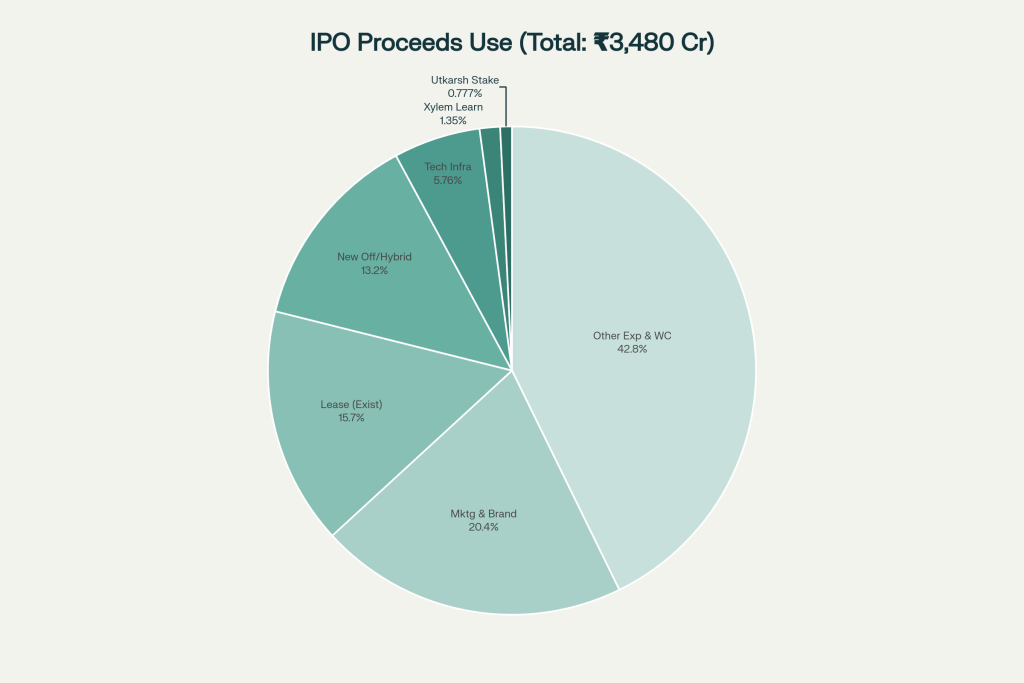

Where’s the ₹3,100 Crores Going?

- Marketing & Growth: ₹710 crores — Acquiring new students aggressively

- Center Expansion: ₹461 crores — Opening 50+ new physical centers over the next 2-3 years

- Lease Payments: ₹548 crores — Long-term rental agreements for existing centers

- Technology Infrastructure: ₹200 crores — Better app, AI-powered learning, better servers

- South India Push (Xylem Learning): ₹471 crores — Expanding acquired subsidiary

- Other Operational Needs: ₹1,110 crores — Working capital, staff, content creation

The Market Opportunity: Why Now?

India’s edtech market isn’t small. It’s explosive.

- Current Market Size

- As of 2024: $7.5 billion

- By 2030: $29 billion

Growth Rate: 28.7% CAGR (one of India’s fastest-growing sectors)

Why This Growth?

- Demographics: 954 million internet users, with rural internet penetration growing rapidly

- Economics: Middle-class parents see education as the key to upward mobility

- Affordability: Physics Wallah charges ₹18,000 for UPSC prep vs competitors’ ₹1-2 lakhs. When your competitor offers something at 1/10th the price with better teaching, customers switch.

- Post-COVID Normalization: Hybrid learning is here to stay. It’s not temporary—it’s the future.

- Exam Culture: India has over 2.5 crore students taking competitive exams annually (JEE, NEET, UPSC, Banking, SSC, CA, etc.). Only 10% use coaching today. Massive untapped market.

Physics Wallah serves 45 lakh students across 13 exam categories. That’s less than 2% of the addressable market. The runway for growth is enormous.

The Competition: How Physics Wallah Stands Out

Byju’s: The Cautionary Tale

Once valued at $22 billion, Byju’s is now in insolvency. What went wrong? Over-expansion, high burn rate, aggressive fundraising based on vanity metrics, poor governance. They forgot the basics.

Physics Wallah’s Lesson: Focus on unit economics (cost to acquire a student vs revenue per student), not just growth at any cost.

Unacademy: The Comeback Story

After burning thousands of crores, Unacademy is finally cutting costs and improving. They’re profitable on individual batches but still loss-making overall. They’re reviving but haven’t proven they can sustain.

Physics Wallah’s Advantage: Already EBITDA positive while still growing 40%+.

| Factor | Physics Wallah | Byju's | Unacademy |

|---|---|---|---|

| Revenue Growth | 97% CAGR | Declining | 30-40% |

| EBITDA Status | Positive (₹193 Cr) | Negative (insolvency) | Negative |

| Founder Commitment | 72% stake retained | Founder exited | Mixed |

| Unit Economics | Improving | Poor | Improving |

| Pricing | Affordable | Premium (lost appeal) | Mid-premium |

| Model | Hybrid (50:50) | Online only (risky) | Hybrid |

Why You Should Care (Or Why You Shouldn’t)

5 Reasons to Be Excited

- Authentic Story: This isn’t some venture capital cash grab. Alakh genuinely cares about affordable education.

- Real Growth: 97% CAGR with EBITDA profitability. These aren’t vanity numbers.

- Massive Market: From $7.5B to $29B by 2030. Physics Wallah is riding a wave.

- Founder Staying: Alakh retains 72% and is putting ₹3,100 crores into growth, not into his personal bank account.

- Balanced Model: 50:50 online-offline split provides resilience that pure online players lack.

5 Reasons to Be Cautious

- Still Unprofitable: Net loss of ₹243 crores in FY25. Yes, it’s improving, but profits aren’t here yet.

- Expensive to Run: Teachers cost 48.5% of revenue. This is the nature of the business—quality teachers are expensive.

- Valuation is Premium: At ₹109/share, you’re paying 10.8x Price-to-Sales. That’s rich. If growth slows, the stock could fall 30-50%.

- Founder Dependent: If Alakh Pandey leaves or faces scandal, the entire brand could crumble.

- Competition is Fierce: Unacademy is reviving. Byju’s (or what’s left of it) might resurrect. New AI-driven competitors could emerge overnight.

The Investment Question: Should You Apply?

For Long-Term Investors (3-5 Years)

YES, absolutely apply.

If you believe in India’s education sector and can stomach 1-2 years of losses before profitability, this is a compelling bet. The story is real. The numbers are improving. The founder is committed. The market is huge.

Strategy: Apply for 1-2 lots (₹14,933-29,866). Hold for 3+ years. Expect 2-3x returns if execution succeeds.

For Short-Term Traders (3-6 Months)

CAUTIOUS approach.

Yes, there might be 5-10% listing gains from curiosity buying and the “first edtech IPO” novelty. But don’t expect a 50% pop. The valuation is already premium, and the market is lukewarm on loss-making IPOs post-Byju’s.

For short-term traders, listing gains may be limited to 5–10%. Those interested in tactical plays often depend on a swing trading advisory service in India for precise entry and exit levels, especially during volatile IPO seasons.

Strategy: Apply for 1 lot. If listing gains exceed 10%, book 30-40% profits. Hold 60% for long term.

For Conservative Investors

AVOID or wait for lower valuation.

If you need immediate profits, dividends, or company stability, Physics Wallah isn’t for you. You’d be better off with established, profitable companies.

The Reality Check: What Could Go Wrong?

Scenario 1: Losses Persist

If the company can’t achieve net profitability by FY27, investor confidence will evaporate. Currently, it’s taken 2 years to go from ₹1,131 Cr loss to ₹243 Cr loss. If that improvement stalls, valuations could collapse.

Scenario 2: Competition Intensifies

If Unacademy (backed by better VC money) becomes more aggressive, or if Byju’s somehow revives, Physics Wallah could lose market share. The edtech space can shift quickly.

Scenario 3: Regulatory Changes

The government might regulate coaching centers more strictly, impacting the offline business. Or they might impose restrictions on online education. Regulatory risk is real.

Scenario 4: Alakh’s Brand Damage

If Alakh faces a scandal or decides to quit, the stock could plunge 30-50% overnight. The company is still heavily dependent on his personal brand.

Scenario 5: Valuation Compression

At 10.8x Price-to-Sales (vs traditional companies at 2-3x), if the market changes sentiment about high-growth unprofitable companies, Physics Wallah shares could fall despite solid fundamentals.

The Bottom Line

If we had to rate the Physics Wallah IPO, it would be 7.5/10 — a Qualified Buy ✅

Not a “quick flip” or “guaranteed gains” play — this is a long-term growth story built on conviction, mission, and momentum.

Alakh Pandey’s vision made quality education affordable for millions — 45 lakh students who now pay 5–10x less.

If you believe in that mission and can stay invested for 3+ years, Physics Wallah deserves a place in your portfolio.

But if you’re chasing instant listing gains, this isn’t your trade.

Because great investments aren’t just about profits —

they’re about belief, purpose, and strong numbers.

And Physics Wallah checks all three. 🚀

Good luck, and invest wisely!

Want to invest in the stock market? Check out our Expert share market tips for smart, research-backed investment guidance.

You can also join our Telegram Channel and WhatsApp Channel for regular stock market analysis, insights and advice.