◉ Abstract

Saksoft Limited, a Chennai-based IT company, is making strong strides in digital transformation with a global presence across the U.S., Europe, and Asia Pacific. Focused on IT services, the company serves key sectors like telecom, fintech, and logistics. Its revenue and profit are growing steadily, with Q3 FY25 showing an 18% YoY revenue jump and strong margins. Strategic acquisitions in AI, cloud, and Salesforce are boosting its capabilities. With low debt, solid cash flows, and a balanced onsite-offsite model, Saksoft is financially sound.

Technically, the stock is showing bullish signs after a big correction. Trading near fair value but with high growth potential, Saksoft appears to be a smart investment opportunity in the evolving digital and AI-driven world.

◉ Table of Contents

- Introduction: Company Overview of Saksoft Limited

- Revenue Streams

- Financial Performance Highlights

- Client and Employee Metrics

- Saksoft Acquisition History

- Market Outlook

- Company Valuation

- Cash Flow Analysis and Debt Analysis

- Top Shareholders

- Technical Analysis

- Investment Advice Details for Saksoft

- Conclusion

1. Introduction: Company Overview of Saksoft Limited (NSE: SAKSOFT)

Saksoft Limited, headquartered in Chennai and established in 1999, is a global IT company providing digital transformation solutions across the U.S., Europe, Asia Pacific, and other regions. The company specializes in application modernization, cloud migration, mobility, and user experience enhancement. It also offers intelligent automation services, including RPA, data analytics, AI/ML, IoT, and automated testing. Saksoft delivers managed services covering infrastructure support, database and application operations, and endpoint management. In addition, it provides strategic consulting, technology training, and domain-specific IT solutions. Its key client sectors include logistics, fintech, healthcare, retail, telecom, and government.

2. Revenue Mix

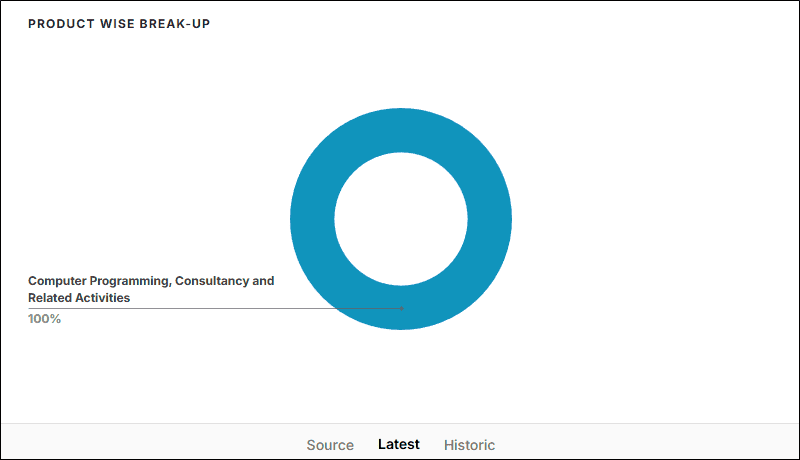

Product-wise Break-up

100% of Saksoft’s revenue comes from:

- Computer Programming, Consultancy, and Related Activities

- This means Saksoft is entirely focused on IT services like software development, consulting, and digital transformation.

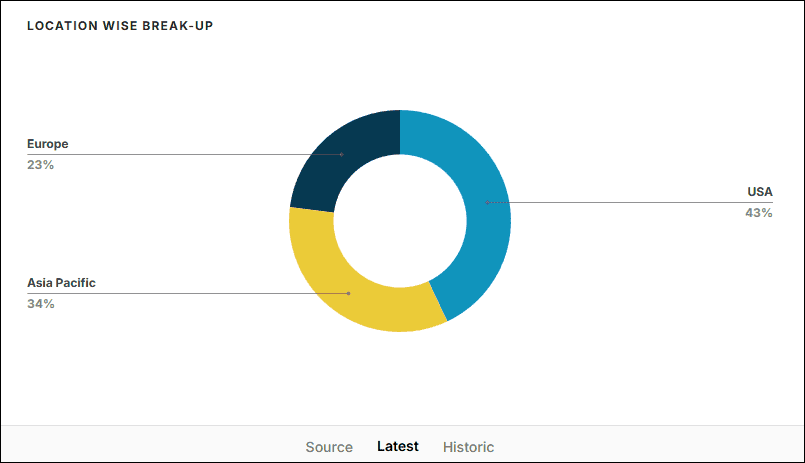

Location-wise Break-up

- USA: 43% of total revenue – Saksoft’s largest market.

- Asia Pacific: 34% – Strong presence in India and other APAC regions.

- Europe: 23% – Significant, but smaller compared to USA and APAC.

This shows Saksoft has a globally diversified revenue base, with a major focus on the US.

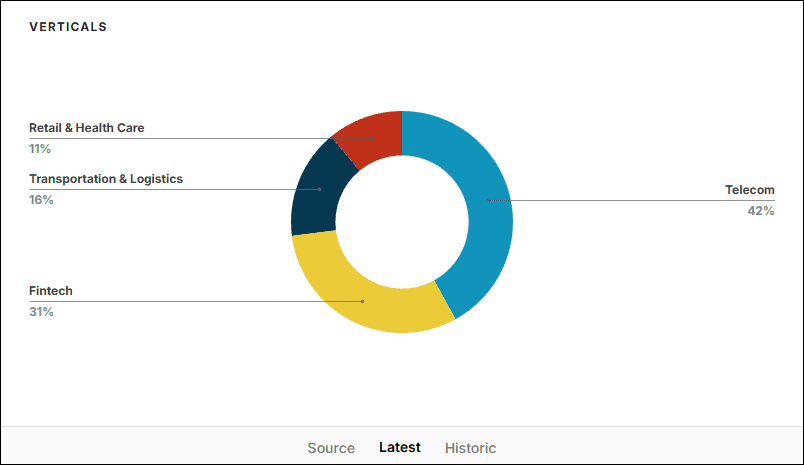

Verticals (Industry Focus)

- Telecom: 42% – Saksoft company’s largest industry vertical.

- Fintech: 31% – Second largest, showing strength in digital finance.

- Transportation & Logistics: 16%

- Retail & Healthcare: 11%

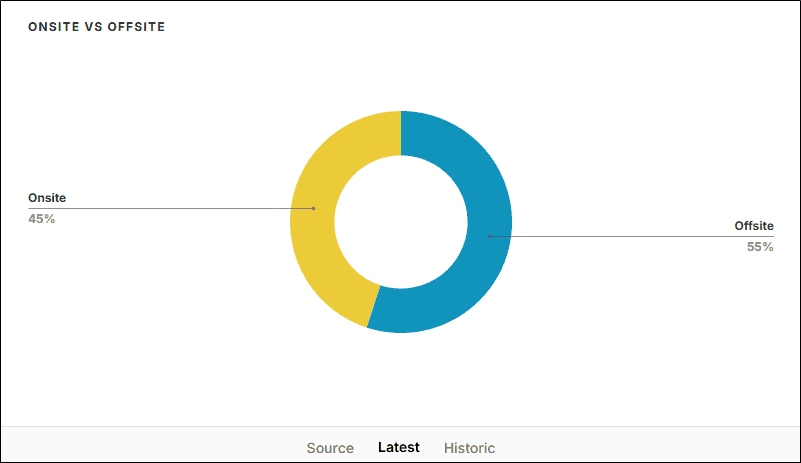

Onsite vs Offsite Delivery

- Offsite (Remote/India-based): 55%

- Onsite (Client location/abroad): 45%

This indicates a balanced delivery model, with a slight preference for remote/ offshore execution, which is typically more cost-effective.

3. Financial Performance Highlights

Q3 FY25 Results of Saksoft Ltd

- Revenue grew 18% year-on-year (YoY), reaching INR 227 crores.

- EBITDA stood at INR 38 crores, with strong margins of 16.78%.

- Net profit surged 20% YoY to INR 27 crores, exceeding industry benchmarks.

- Profit After Tax (PAT) margins remained robust at 11.91%.

9-Month FY25 Performance (Ending Dec 31, 2024)

- Operating revenues reached INR 643 crores, reflecting 14% YoY growth.

- EBITDA grew 6% YoY to INR 110 crores, with margins at 17.08%.

4. Client and Employee Metrics

Client Growth:

- Expanded high-value client base, with clients spending over USD 1 million increasing from 17 to 18.

Workforce Strength:

- Total employee count reached 2,513 at quarter-end.

- Technical workforce stood at 2,275, reinforcing core capabilities.

- Global technical hiring grew by 437 employees, supporting strong revenue visibility.

Operational Efficiency:

- Utilization rates improved by 1% for the 9-month period ending December 31, 2024, despite seasonal furlough impacts.

5. Saksoft Acquisition History

- Augmento Labs (June 2024) – Acquired for up to ₹100 crore to boost digital engineering services like AI-enabled analytics and cloud solutions.

- CEPTES Software (Announced Sept 2024) – A ₹62 crore deal to strengthen Salesforce expertise across Sales Cloud, AI, and Data Cloud offerings.

- ZeTechno (Completed Jan 2025) – Acquired for ₹2.59 crore to expand ServiceNow and IT service management capabilities.

6. Market Outlook

- Management remains optimistic for Q4 FY25 and FY26.

- Strong order book expected to drive growth in the coming year.

- U.S. discretionary IT spending likely to rise, while European market expected to remain cautious.

7. Company Valuation

P/E Ratio

- Currently at 22.5, slightly above its 1-year median of 19.4, but below the industry average of 32, indicating undervaluation.

Intrinsic Value

- Trading at ₹173, which is about 1.1x its intrinsic value of ₹153, suggesting the stock is fairly valued.

PEG Ratio

- At 1.05, implying the stock is undervalued relative to its growth potential.

8. Cash Flow Analysis and Debt Analysis

Cash Flow Analysis

- Operating Cash Flow rose sharply from ₹84 crore in FY23 to ₹124 crore, indicating strong financial health.

- CFO/PAT ratio stands at 0.83, aligned with its five-year average, showing efficient profit-to-cash conversion.

Debt Analysis

- Debt-to-equity ratio is just 0.09, suggesting the company is virtually debt-free.

9. Top Shareholders

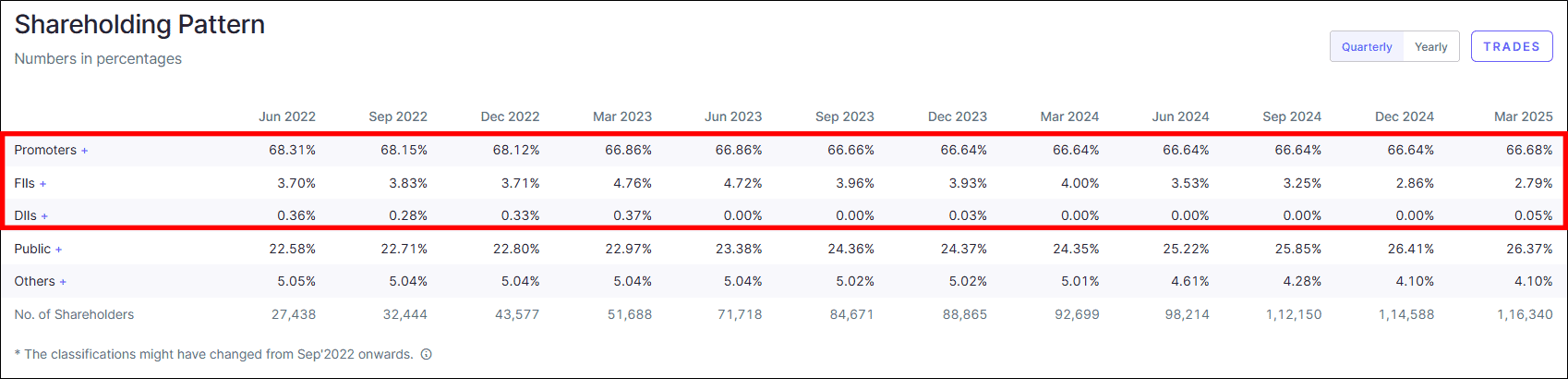

- Promoters hold 66.68%, slightly up from 66.64% in December 2024, reflecting strong promoter confidence.

- Foreign Institutional Investors (FIIs) have reduced their stake to 2.79% as of March 2025, down from 4% in March 2023, which is a concern.

- Domestic Institutional Investors (DIIs) hold a minimal stake of 0.05%.

10. Technical Analysis

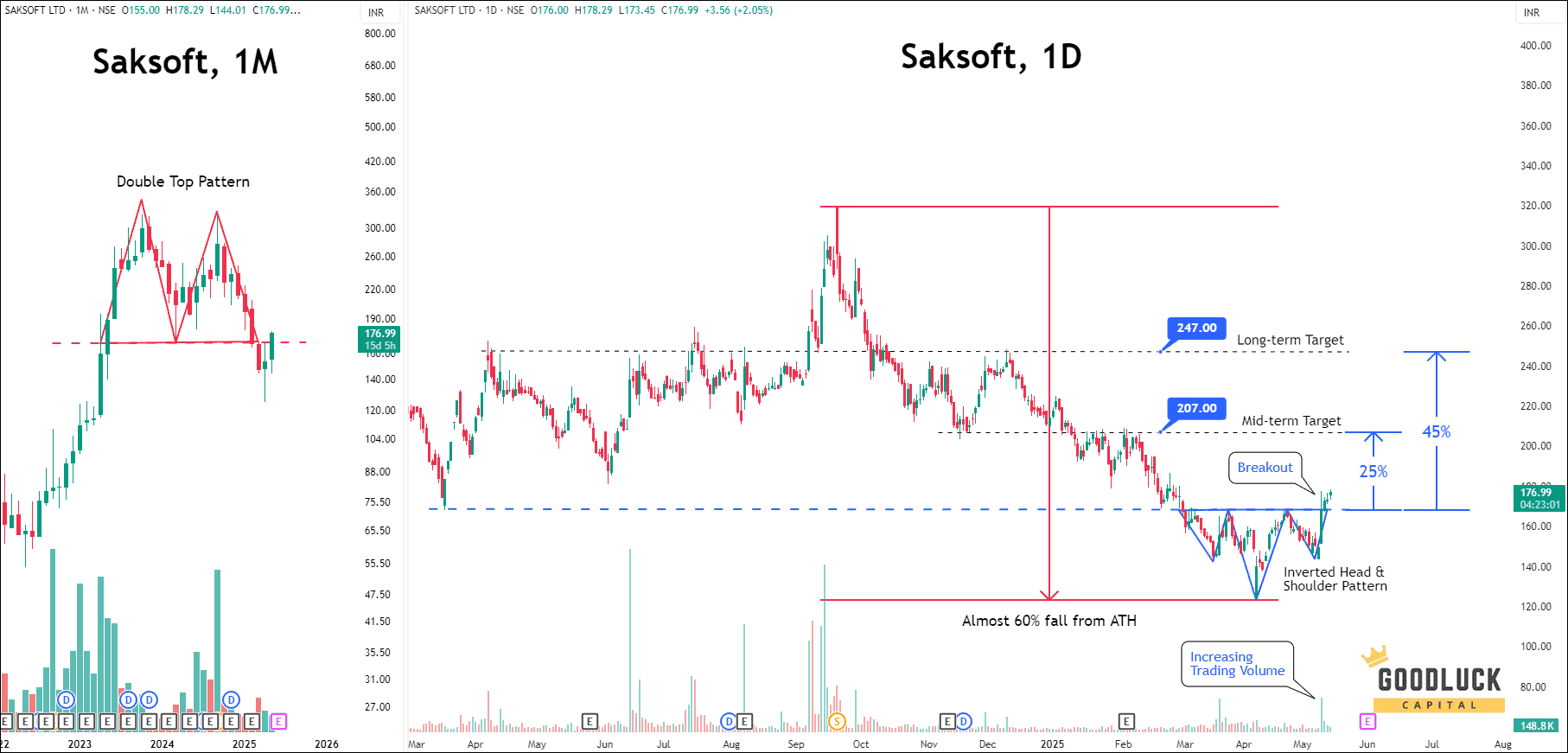

- After dropping about 60% from it’s all-time high, the stock is showing signs of a turnaround by forming an Inverted Head & Shoulders pattern.

- A recent breakout suggests it’s ready to move higher and begin a new upward trend.

11. Investment Advice Details for Saksoft

| CP# | 176 |

| Idea | BUY |

| Buy Range | 170 – 172 |

| Target | 247 – 250 |

| Duration | 12 – 14 Months |

| Upside Potential^ | 45 – 50% |

| CP# | Idea | Buy Range | Target | Duration | Upside Potential^ |

| 176 | BUY | 170 – 172 | 247 – 250 | 12 – 14 Months | 45 – 50% |

12. Conclusion

Saksoft stands out as a smart investment bet, fueled by robust financial growth, a healthy cash flow, and a virtually debt-free structure. With a rapidly expanding global footprint, a growing roster of high-value clients, and strategic acquisitions in AI and cloud services, it’s perfectly poised to ride the wave of the digital and AI revolution. Trading at an attractive valuation, Saksoft offers investors a unique blend of stability and innovation—making it a compelling choice for those looking to capitalize on tomorrow’s technology today.