Introduction: Stock Market Trading and Investing Scams on Social Media Platforms

In recent years, India has witnessed a surge in investment scams propagated through social media platforms such as Instagram, Facebook, YouTube, Telegram, and WhatsApp. Fraudsters or Scammers exploit the trust and reach of these platforms to lure unsuspecting investors with promises of high returns. The Securities and Exchange Board of India (SEBI) has been actively issuing warnings and taking action against such fraudulent activities. Understanding the tactics employed by these scammers and adhering to SEBI’s safety guidelines is paramount for protecting your hard-earned money.

Decoding Scammers Playbook: How fraudsters exploit social media for scamming individuals?

Scammers are becoming increasingly sophisticated in their methods. They utilize various tactics on platforms like WhatsApp, Telegram, YouTube, Facebook, and Instagram to deceive investors. Here’s a breakdown of the common tactics they use on social media:

1. Fake Testimonials and Manipulated Screenshots

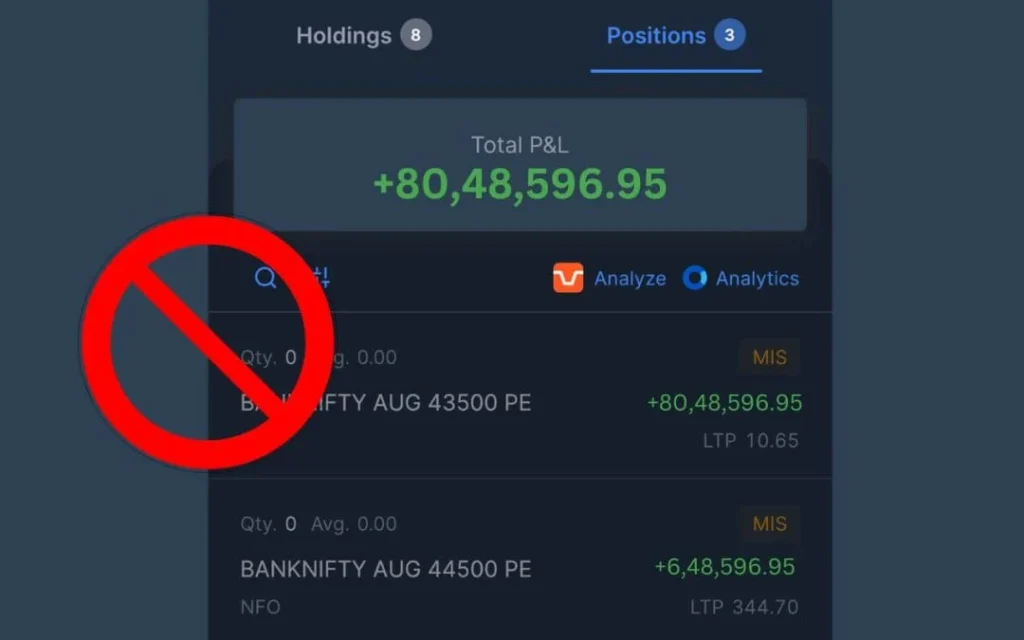

What They Do: Scammers post fake screenshots showing big profits, fake withdrawals. They also share made-up reviews from “happy investors” to make things look real.

These scammers create an illusion of success by posting fake screenshots showcasing substantial profits and fake withdrawal confirmations. Moreover, to make things look real, or credible, they share made-up testimonials and reviews from fictitious “happy investors”.

Real Case – Noida ₹3.15 Crore Scam:

A real example is the case of a Noida woman who fell prey to a WhatsApp group scam. The group members shared fabricated profit screenshots, reviews and testimonials about a fraudulent trading app. Initially, she was even allowed to withdraw a small sum of ₹40,000, a classic tactic to gain her trust. Encouraged by this initial “success,” she invested a staggering ₹3.15 crore before the entire group abruptly vanished, leaving her with devastating losses.

Learn full story here – Noida Woman Duped Of Rs 3.15 Crore In Investment Scam

2. Posing as Expert or Experienced Stock Trading Advisors (Impersonation Scam)

What They Do: Scammers pretend to be from top investment firms (like JP Morgan) or claim to be SEBI-Registered Advisors. Furthermore, they often create fake company identity cards to appear credible and gain trust. Their deceptive tactics include:

- Showing fabricated or stolen SEBI registration certificates

- Using the names of genuine, reputable companies or SEBI-registered entities

- Initially offering accurate free stock advice to gain trust.

- Later convincing the victims to transfer money using the name of genuine SEBI-registered firms, making the scam harder to detect.

Real Case – Bengaluru ₹1.3 Crore Scam:

A Bengaluru-based realtor tragically lost ₹1.3 crore after being duped by an individual posing as a JP Morgan executive. The scammer used fabricated documents and presented a bogus global investment plan to deceive the victim.

Learn full story here – Bengaluru realtor falls for Rs 1.30 crore ‘JP Morgan’ investment scam

Unregistered Advisors Giving Stock Tips

What They Do: Individuals who lack the necessary authorization and approvals from SEBI illegally provide stock tips and manage investment portfolios, generally operating through social media channels. This practice is a direct violation of SEBI’s regulatory norms.

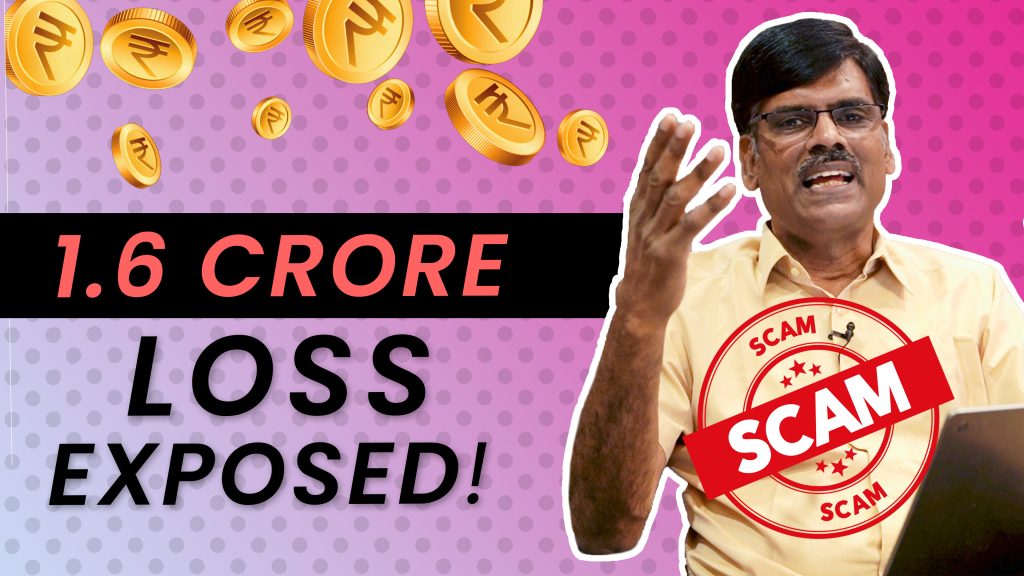

Real Case – PR Sundar Case:

A prominent example is the case of popular options trader PR Sundar and his firm. SEBI found them guilty of offering unregistered investment advice. As a consequence, they were penalized with a ₹6 crore fine and barred from trading in the securities market for 1 year.

Learn full story here – Options Trader PR Sundar Settles Investment Advisory Case, Won’t Deal In Securities For A Year

4. Fake VIP WhatsApp and Telegram Groups

What They Do: Scammers create a false sense of exclusivity by adding individuals to supposed “insider” WhatsApp or Telegram groups. These groups often promise privileged access to Initial Public Offerings (IPOs) or secret trading or investment tips, creating a fear of missing out (FOMO) among potential victims. However, these promises are all fake.

Real Case – Hyderabad ₹5.9 Crore IPO Scam:

A Hyderabad-based businessman fell victim to one such Telegram group that falsely claimed affiliation with Goldman Sachs. Enticed by the promise of exclusive IPO access, he lost a staggering ₹5.9 crore through multiple fraudulent transactions.

Learn full story here – Hyderabad man loses Rs 5.9 crore after falling for fake IPO scam

5. Deepfake Videos & AI Generated Voiced Promotions

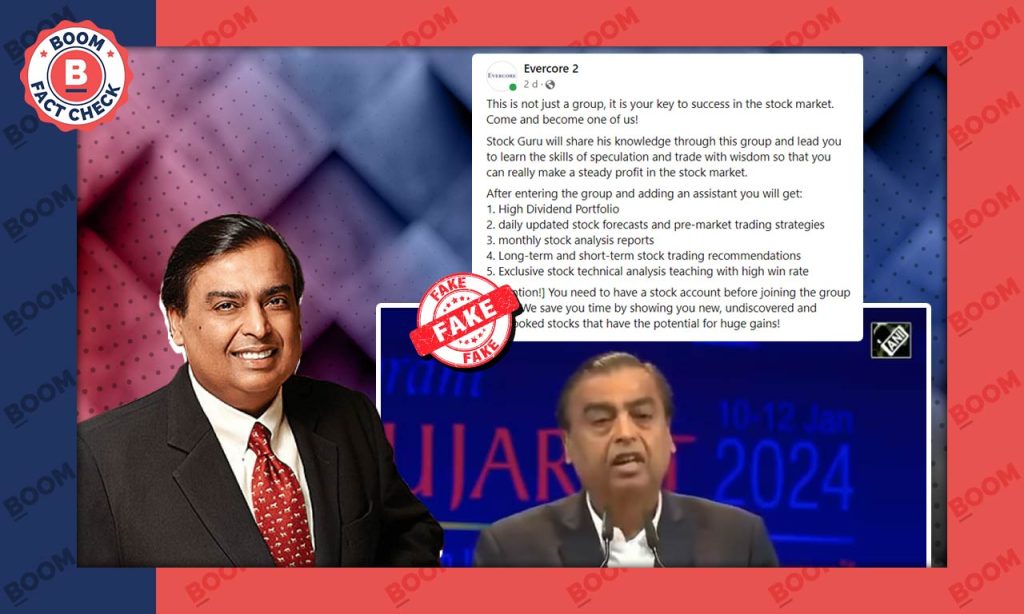

What They Do: Using advanced Artificial Intelligence (AI), scammers create Deepfake videos and AI-generated voice overs of prominent personalities like Mukesh Ambani. These fake media content portray these personalities “endorsing” scam investment apps or cryptocurrency platforms, lending a false sense of legitimacy.

Real Case – Mukesh Ambani Deepfake:

In 2024, a deceptive deepfake video featuring “Mukesh Ambani” went viral on Facebook. In the video, the AI-generated version of Ambani appeared to be promoting a fraudulent investment application. Thousands of unsuspecting individuals clicked on the links and subsequently lost their money. Both SEBI and Reliance Industries swiftly confirmed that the video was a complete fake.

Learn full story here – Fake video of Mukesh Ambani endorsing stock market forum circulates

6. Paid Influencer Promotions of Scam Projects

What They Do: Some social media influencers are paid to promote dubious cryptocurrency tokens or Ponzi schemes. In some instances, these influencers may be unaware that they are promoting fraudulent activities. However, their endorsements can significantly encourage their followers to invest in such fraud schemes.

Real Case – GainBitcoin Scam:

Back in 2018, many influencers promoted GainBitcoin, a fake crypto mining company. Thousands of individuals invested in the scheme and suffered significant financial losses. The founder, Amit Bhardwaj, was eventually arrested in connection with the scam.

Learn full story here – GainBitcoin scam: CBI conducts searches at 60 locations across India

7. Fake Trading Gurus Offering False Promises and Illegal Investment Advisory Services

What They Do: Self-proclaimed trading “gurus” use social media platforms like Instagram and YouTube to sell their courses and guarantee profits. Many of these so-called trading “gurus” also illegally manage investors’ funds without the mandatory SEBI registration.

Real Case – Asmita Patel Scam:

Asmita Patel falsely claimed to offer automated trading strategies and collected over ₹53 crore from investors. SEBI’s investigation revealed that she was running unregistered investment advisory and portfolio management services. Consequently, SEBI froze her accounts and imposed a ban on her participation in the securities market. Learn full story here – SEBI Cracks Whip on Finfluencer Asmita Patel, Impounds Rs53.67 Crore Unlawful Gain Earned from Illegal Investment Advisory Business

3. SEBI’s Warnings and Essential Guidelines for Traders and Investors

SEBI has been proactive in issuing multiple advisories to alert traders and investors about the escalating threat of social media-driven investment fraud and scams. Here are their crucial recommendations to safeguard your investments:

1. The Golden Rule: Verify SEBI Registration

Always, without exception, verify whether an investment advisor or firm is duly registered with SEBI before acting on their advice or using their services.

How to Verify: You can easily check the registration status on SEBI’s official website

2. The Red Flag: Don’t Fall for Guaranteed Returns

SEBI has consistently warned that no legitimate entity can guarantee profits in the stock market. Any scheme that promises fixed or guaranteed returns should be treated with extreme suspicion as it is highly likely to be fraudulent.

3. Beware of Unregistered Advisors

Providing stock investment and stock trading advice or managing investment portfolios without the necessary SEBI registration is illegal. Investors should avoid taking stock tips or any services from influencers, Telegram groups, or individuals who are not listed as Registered Investment Advisers (RIAs) or Portfolio Management Services (PMS) providers on SEBI’s website.

4. Avoid Relying on Social Media Promotions

Scammers often use deceptive tactics such as fake screenshots, deepfake videos, and fabricated testimonials to mislead investors on social media platforms. Always conduct thorough independent verification before making any investment decisions based on such promotions.

5. Ignore Unsolicited Investment Offers

If you receive unsolicited investment offers or promises of guaranteed returns via platforms like WhatsApp, Telegram, or Instagram, it is highly probable that it is a scam or a fraud. Do not engage with such unsolicited communications.

6. Report Fraud Immediately

If you encounter any suspicious investment activities, fake advisory accounts, or potential scams, it is crucial to report them immediately to SEBI.

How to Report:

📧 Email SEBI: scores@sebi.gov.in

📝 File a complaint on SEBI’s SCORES portal: https://scores.sebi.gov.in/

By staying informed, being vigilant, and adhering to SEBI’s guidelines, investors can significantly reduce their risk of falling victim to these pervasive social media investment scams in India.

4. Conclusion

In conclusion, the rise of social media investment scams in India presents a serious threat to traders and investors. Scammers use increasingly sophisticated tactics, including fake testimonials, reviews, impersonation, and deepfakes, to deceive and defraud.

It is crucial for investors to exercise caution, verify the legitimacy and credibility of advisors and investment opportunities, and be wary of unsolicited offers or guaranteed returns. SEBI’s warnings and guidelines provide essential safeguards, emphasizing the importance of verifying registration, avoiding unregistered advisors, and reporting suspicious activity. By staying informed and vigilant, investors can protect themselves from these scams and make sound financial decisions.

If you’re interested in stock market trading or investing but lack the time or expertise to identify opportunities, consider our expert-led plans:

Short-Term Trading Plan – For Short Term Traders (Swing Traders) with the objective of creating passive income.

Long-Term Investment Plan – For Long Term Investors with the objective of wealth multiplication.

We offer clear stock recommendations for both short-term and long-term investment strategies, enabling you to make well-informed trading decisions without the burden of conducting your own extensive research. You can also join our Telegram Channel and WhatsApp Channel for regular stock market analysis, insights and advice.