Short term swing trade | Buy NSE: COFORGE | 8-9% target | Indian stock trading signal on 13 May 2025

- May 13, 2025

- 8:00 am

- Goodluck Capital

NOTE

-

Closing Price: ₹8292.5 (as of May 13, 2025)

-

StopLoss*: Apply on the daily close. After the first target, reset the StopLoss to your buying price.

-

Duration^: Approximate holding period based on the active trading days (excluding market holidays). Actual holding may vary with the market conditions.

-

Upside Potential#: Based on median of the suggested buy range.

Coforge Limited is an India-based information technology (IT) solution company. It is engaged in in-application development and maintenance, managed services, cloud computing and business process outsourcing. The Company provides computer programming consultancy and related activities. Its geographical segments include the Americas (revenue~48%), Europe, Middle East, and Africa (EMEA~40%), Asia Pacific (APAC~7%), and India (~5%).

Like most other Indian IT services MNCs, Americas (primarily the US) is the largest segment and includes major clients like Sabre and SEI Investments. EMEA, especially Europe’s revenue is driven by BFSI and travel verticals, with clients like British Airways and ING Group. APAC including India is a smaller revenue market but a significant delivery hub.

Coforge has a presence in 23 countries with 30 delivery centers across six countries, indicating a global footprint that supports revenue generation across multiple regions. Key clients in the US and Europe include British Airways, ING Group, SEI Investments, Sabre, and SITA, suggesting significant revenue contributions from these regions. Partnerships with companies like Newgen Software target clients in the US, Europe, and other regions, particularly in the insurance and public sectors. The company’s focus on BFSI (Banking, Financial Services, and Insurance) and travel verticals drives growth in the US and Europe, with a notable rebound in the travel sector.

Coforge provides IT consulting, digital services, and business process management, focusing on sectors like Banking, Financial Services, and Insurance (BFSI), travel, and healthcare. It leverages AI and cloud technologies to drive growth. It’s a Mid-tier IT services provider with a global presence, competing with firms like Infosys, Wipro, and Mphasis.

Coforge offers various services, such as Artificial Intelligence *AI), Digital, Data and Analytics, Digital Process Automation, Salesforce Ecosystem, Cloud and Infrastructure Management Services, Cybersecurity Services, Business Process Solutions, Quality Engineering Services, Systems, Applications & Products in Data Processing (SAP) Services, and Metaverse. Its salesforce ecosystem includes Salesforce and Mulesoft. Its digital process automation includes Appian, Pega, Mendix, and OutSystems. Its cloud and infrastructure management services include Cloud Services, Anyplace Workplace, and others.

Website: https://www.coforge.com/

- Strong Q4 FY25 performance with 43.8% YoY revenue growth in constant currency, driven by the BFSI vertical.

- Significant deal wins, including a $2.1B Total Contract Value (TCV) with the Sabre deal.

- 94% of its workforce is AI-trained, positioning it as a leader in AI-driven solutions.

- Announced stock split (1:2), boosting market liquidity and retail participation.

- Strong Q4 FY25 performance with 43.8% YoY revenue growth in constant currency, driven by the BFSI vertical.

- Significant deal wins, including a $2.1B Total Contract Value (TCV) with the Sabre deal.

- 94% of its workforce is AI-trained, positioning it as a leader in AI-driven solutions.

- Announced stock split (1:2), boosting market liquidity and retail participation.

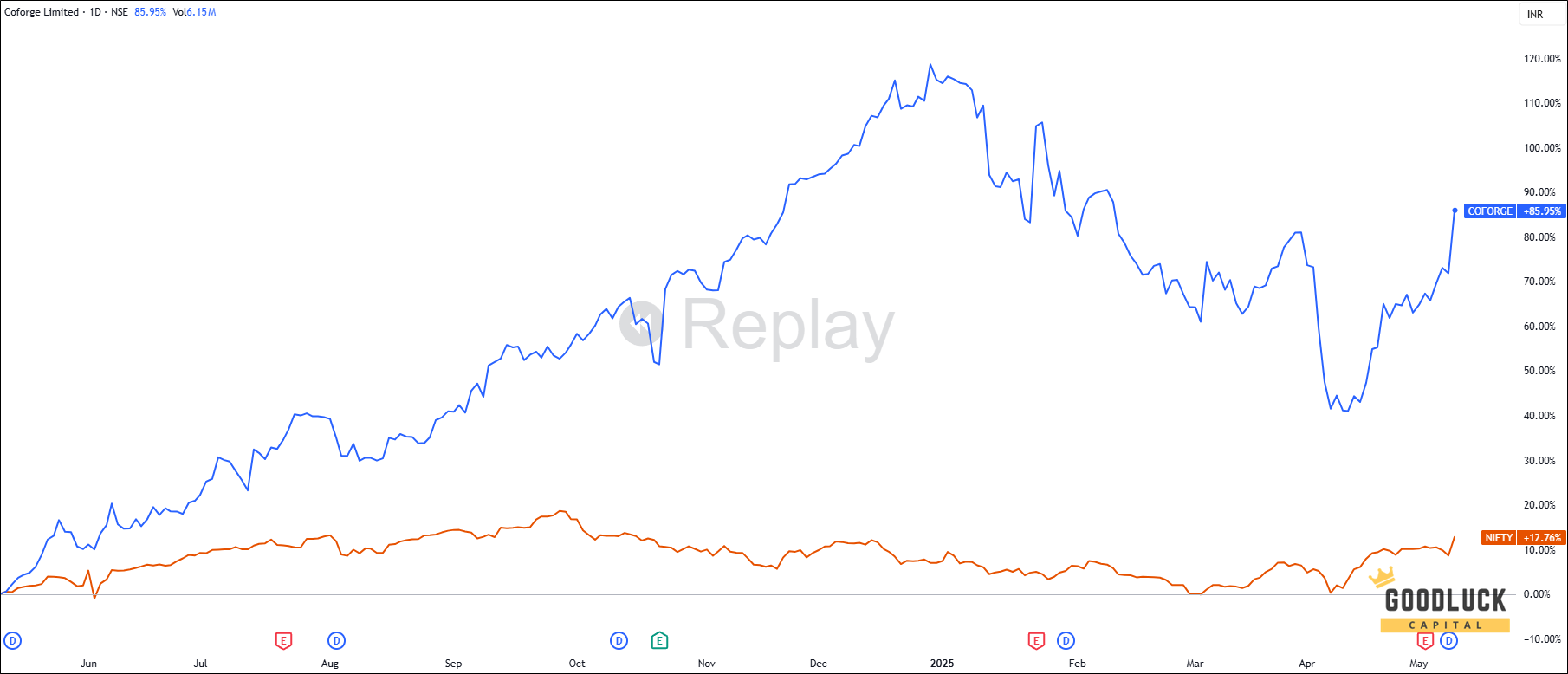

Key Observations

- The stock has successfully broken trendline resistance with strong volume

- This indicates the price is well-positioned for a near-term upside move.

Long-horizon traders benefit from a positional stock trading advisor in India who understands trend behavior and risk control.

Technical Image

Key Observations

- The stock has successfully broken trendline resistance with strong volume

- This indicates the price is well-positioned for a near-term upside move.

Long-horizon traders benefit from a positional stock trading advisor in India who understands trend behavior and risk control.

Technical Image

Coforge Stock Price Forecast

Based on our stock trading advice for short term trading, the Coforge Stock Price target will be INR 8750 - INR 8850 in the next 14-15 trading sessions.

Coforge Stock Price Forecast

Based on our stock trading advice for short term trading, the Coforge Stock Price target will be INR 8750 - INR 8850 in the next 14-15 trading sessions.

MONEY MANAGEMENT AND TRADING RULES

Buy within the recommended price range. You may allow up to 1% flexibility beyond the range if needed.

No need to rush. The recommendation remains valid for up to 7 days, not just at market open.

Use a trailing stop-loss to protect and lock in profits.

Diversify your trading capital across our other recommended stocks to reduce risk.

Invest responsibly. Trade only with funds you can afford to lose and hedge positions where appropriate.

Analyst Summary

The research analysis is prepared by Arijit Banerjee, CMT, CFTe. He is a veteran trader and an active investor having in-depth knowledge in financial market research, advanced technical analysis, market cycle, algorithmic trading and portfolio management. Arijit is a Chartered Market Technician (CMT) accredited by CMT Association USA, the leading global authority of Technical Analysis and has been honoured by Certified Financial Technician (CFTe) from the International Federation of Technical Analysts, USA. SEBI, the regulatory body of Indian financial market also recognizes him as a Research Analyst (INH300006582).

Your Return Could be Much Better

- Swing Trading Advice

- 10—12 swing trade advice / month

- expected upside 6%—8% per trade

- short term trade holding 1-2 weeks

- minimum capital required ₹2.5 lakh

- receive trade advice before 9:00 am

- trade ideas by blackbox system, relied on statistics, technical, fundamental, macroeconomics and sentiment

- Stocks only — no intraday or F&O

Months

01

Price

₹ 6666

Months

03

20% OFF

₹ 20000

Price

₹ 15900

Months

06

35% OFF

₹ 40000

Price

₹ 25900

Months

12

50% OFF

₹ 80000

Price

₹ 39900

Months are referred as calendar months

- e.g. 12 January — 12 April (3 Months)

- 20 June — 20 December (6 Months)

Looking for more information?

Looking for more information?

Swing Trade Advice Benefits

- ideal for short term positional traders

- receive trading advice via Whatsapp

- precise Entry, Target and StopLoss

- preferred largecap & midcap stocks

- revised targets & stoploss if required

- alert message for target or stoploss hit

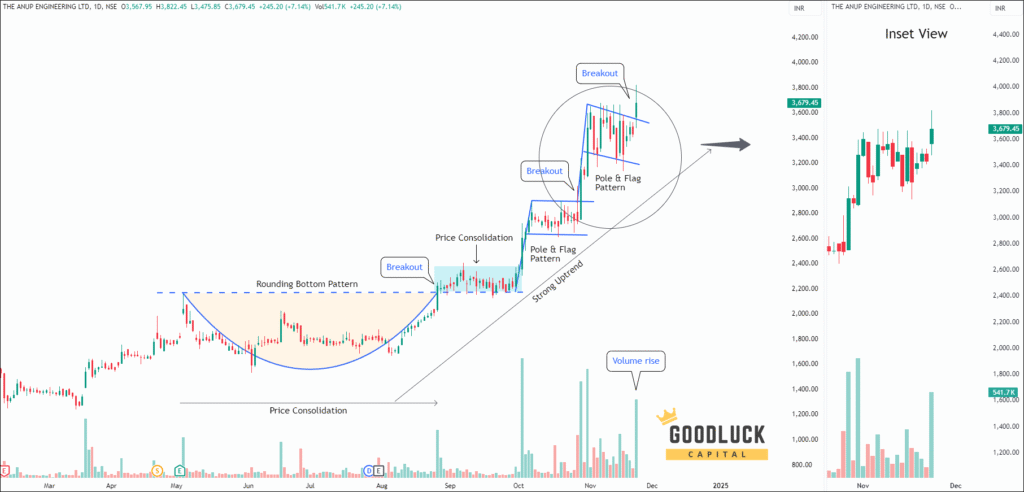

Swing Trade Advice Samples

-

Buy Piramal Pharma

nse: pplpharma

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 190 - 194

- : 204 - 207

- : below 180

- : 7% - 8%

- : 12-14 days

-

Buy Le Travenues Technology

nse: ixigo

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 215 - 220

- : 240 - 240

- : below 195

- : 10% - 13%

- : 14-15 days

-

Buy Privi Speciality Chemicals

nse: priviscl

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 1845 - 1875

- : 1975 - 2000

- : below 1770

- : 6% - 8%

- : 12-14 days

-

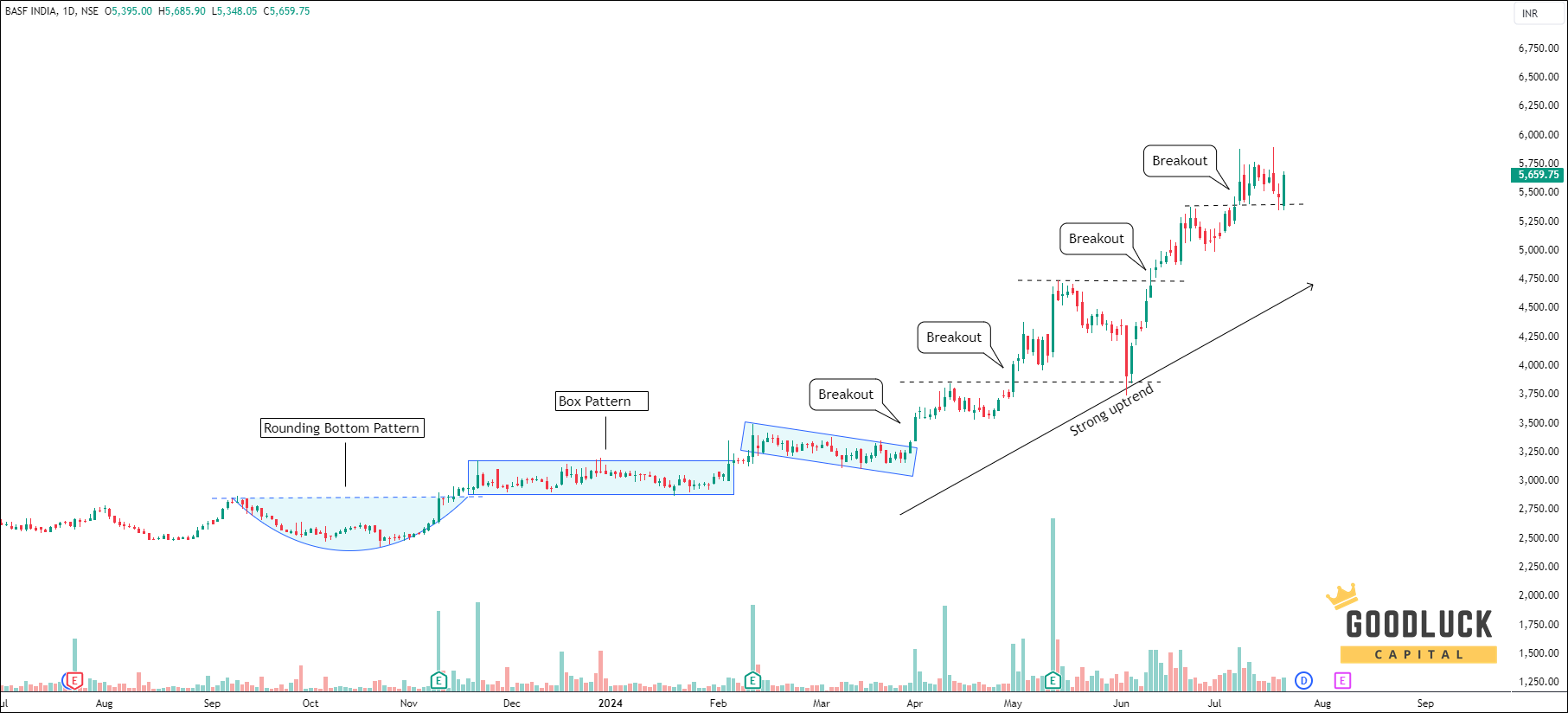

Buy BASF India

nse: basf

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 5450 - 5600

- : 6050 - 6200

- : below 5200

- : 10% - 12%

- : 12-14 days

-

Buy S H Kelkar

nse: shk

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 285 - 300

- : 330 - 340

- : below 270

- : 13% - 16%

- : 14-15 days

More Trading & Investment Advice

- Premium

- February 24, 2026

- Free

- February 24, 2026

- Premium (unlocked)

- February 17, 2026

- Premium (unlocked)

- February 10, 2026