Short term swing trade | Buy NSE: HDFCAMC | 4-5% target | Indian stock trading idea on 19 Aug 2025

- August 19, 2025

- 8:00 am

- Goodluck Capital

NOTE

-

Closing Price: ₹5,717 (as of Aug 19, 2025)

-

StopLoss*: Apply on the daily close. After the first target, reset the StopLoss to your buying price.

-

Duration^: Approximate holding period based on the active trading days (excluding market holidays). Actual holding may vary with the market conditions.

-

Upside Potential#: Based on median of the suggested buy range.

HDFC Asset Management Company Limited, founded in 1999 and based in Mumbai, is a leading investment management firm in India. It manages equity, debt, balanced, and real estate portfolios, offering a wide range of mutual funds to investors. The company uses fundamental analysis for its investment approach and operates as a subsidiary of HDFC Bank Limited.

Website: http://www.hdfcfund.com/

Key Observations

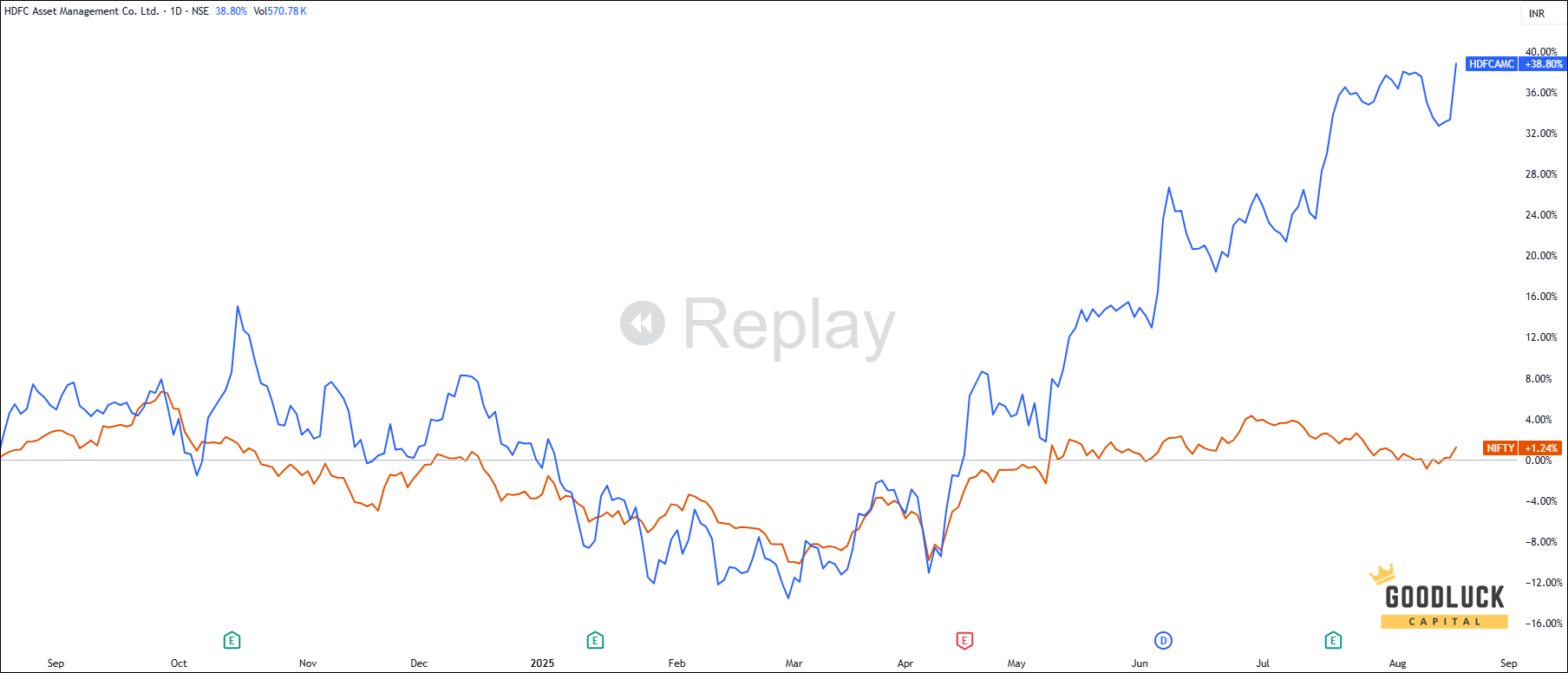

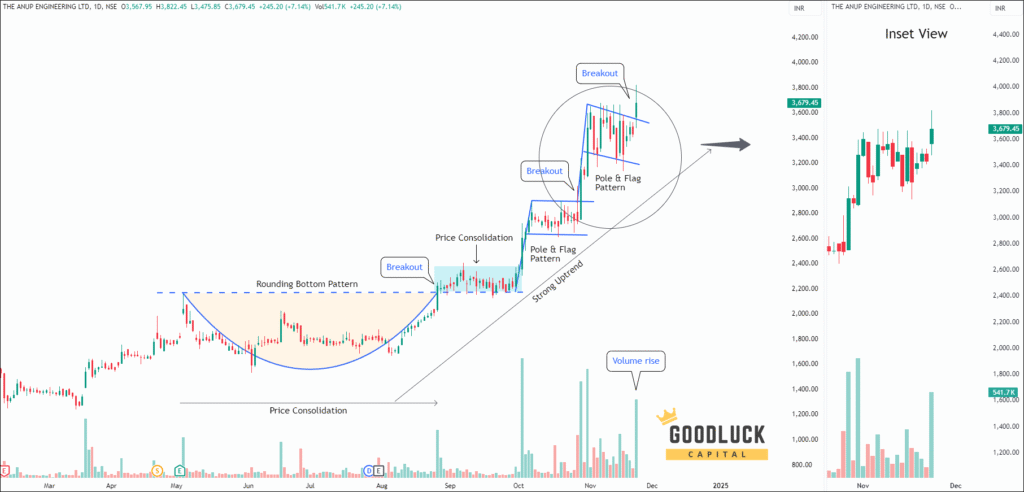

- After a prolonged consolidation, the stock has formed a rounding bottom pattern.

- Following a strong breakout, it has sustained bullish momentum and is now trading at an all-time high.

Long-horizon traders benefit from a positional stock trading advisor in India who understands trend behavior and risk control.

Technical Image - Daily Timeframe

Key Observations

- After a prolonged consolidation, the stock has formed a rounding bottom pattern.

- Following a strong breakout, it has sustained bullish momentum and is now trading at an all-time high.

Long-horizon traders benefit from a positional stock trading advisor in India who understands trend behavior and risk control.

Technical Image - Daily Timeframe

HDFC Asset Management Stock Price Forecast

Based on our swing trading picks, the HDFC Asset Management Stock Price target will be INR 5900 - INR 6000 in the next 14-15 trading sessions.

HDFC Asset Management Stock Price Forecast

Based on our swing trading picks, the HDFC Asset Management Stock Price target will be INR 5900 - INR 6000 in the next 14-15 trading sessions.

MONEY MANAGEMENT AND TRADING RULES

Buy within the recommended price range. You may allow up to 1% flexibility beyond the range if needed.

No need to rush. The recommendation remains valid for up to 7 days, not just at market open.

Use a trailing stop-loss to protect and lock in profits.

Diversify your trading capital across our other recommended stocks to reduce risk.

Invest responsibly. Trade only with funds you can afford to lose and hedge positions where appropriate.

Analyst Summary

The research analysis is prepared by Arijit Banerjee, CMT, CFTe. He is a veteran trader and an active investor having in-depth knowledge in financial market research, advanced technical analysis, market cycle, algorithmic trading and portfolio management. Arijit is a Chartered Market Technician (CMT) accredited by CMT Association USA, the leading global authority of Technical Analysis and has been honoured by Certified Financial Technician (CFTe) from the International Federation of Technical Analysts, USA. SEBI, the regulatory body of Indian financial market also recognizes him as a Research Analyst (INH300006582).

Your Return Could be Much Better

- Swing Trading Advice

- 10—12 swing trade advice / month

- expected upside 6%—8% per trade

- short term trade holding 1-2 weeks

- minimum capital required ₹2.5 lakh

- receive trade advice before 9:00 am

- trade ideas by blackbox system, relied on statistics, technical, fundamental, macroeconomics and sentiment

- Stocks only — no intraday or F&O

Months

01

Price

₹ 6666

Months

03

20% OFF

₹ 20000

Price

₹ 15900

Months

06

35% OFF

₹ 40000

Price

₹ 25900

Months

12

50% OFF

₹ 80000

Price

₹ 39900

Months are referred as calendar months

- e.g. 12 January — 12 April (3 Months)

- 20 June — 20 December (6 Months)

Looking for more information?

Looking for more information?

Swing Trade Advice Benefits

- ideal for short term positional traders

- receive trading advice via Whatsapp

- precise Entry, Target and StopLoss

- preferred largecap & midcap stocks

- revised targets & stoploss if required

- alert message for target or stoploss hit

Swing Trade Advice Samples

-

Buy Piramal Pharma

nse: pplpharma

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 190 - 194

- : 204 - 207

- : below 180

- : 7% - 8%

- : 12-14 days

-

Buy Le Travenues Technology

nse: ixigo

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 215 - 220

- : 240 - 240

- : below 195

- : 10% - 13%

- : 14-15 days

-

Buy Privi Speciality Chemicals

nse: priviscl

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 1845 - 1875

- : 1975 - 2000

- : below 1770

- : 6% - 8%

- : 12-14 days

-

Buy BASF India

nse: basf

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 5450 - 5600

- : 6050 - 6200

- : below 5200

- : 10% - 12%

- : 12-14 days

-

Buy S H Kelkar

nse: shk

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 285 - 300

- : 330 - 340

- : below 270

- : 13% - 16%

- : 14-15 days

More Trading & Investment Advice

- Premium

- February 24, 2026

- Free

- February 24, 2026

- Premium (unlocked)

- February 17, 2026

- Premium (unlocked)

- February 10, 2026