Short term swing trade (C): FMCG stock | 6-8% target | Indian stock trading advice on 2 Dec 2025

- December 2, 2025

- 9:00 am

- Goodluck Capital

NOTE

-

Closing Price: ₹349 (as of Dec 1, 2025)

-

StopLoss*: Apply on the daily close. After the first target, reset the StopLoss to your buying price.

-

Duration^: Approximate holding period based on the active trading days (excluding market holidays). Actual holding may vary with the market conditions.

-

Upside Potential#: Based on median of the suggested buy range.

Cupid Limited designs, manufactures, markets, and exports male and female condoms in India. The company offers water based lubricant jellies; in vitro diagnostic kits, including rapid diagnostic, viral transport medium, typhoid antibody, syphilis antibody, HIV 1 and 2 kit antibody, dengue IgG/IgM, malaria Pf-Pv and Pf-PAN antigen, hepatitis B (HbsAg) antigen, hepatitis C (HCV) antibody, pregnancy detection testing kit, LH ovulation testing kit, and dengue NS1 testing kit; and personal care products including deodorants, perfumes, toilet sanitizers, menstrual cups, petroleum jelly, hair and body oils, and hair removal sprays. It also exports its products to countries in Africa, Europe, Asia-Pacific, North America, Middle East, and South America. The company was formerly known as Cupid Condom Limited and changed its name to Cupid Limited in January 2006. The company was incorporated in 1993 and is based in Nashik, India.

Website: https://www.cupidlimited.com/

Earnings Call Summary

- Record-Breaking Quarter: Cupid Limited posted its best-ever results with total income up 91% to ₹90.23 crore and net profit soaring 140% to ₹24.12 crore YoY.

- Massive Profit Surge: EBITDA jumped 176% to ₹28.41 crore, with margins expanding by 900 bps to 34%, reflecting strong operational efficiency.

- Broad-Based Revenue Growth: Operating income grew 103% to ₹84.45 crore, supported by solid performance in India FMCG, B2B Exports, and the IVD segment.

- Capacity Expansion in Progress: The company is increasing its production capacity to meet rising demand while preserving healthy margins.

- Strong FY26 Guidance: Management expects FY26 revenue of ₹335 crore and net profit above ₹100 crore, signaling continued strong growth ahead.

Financial Highlights

| Metric | Q2 FY26 | Q1 FY26 | Q2 FY25 | QoQ Growth (%) | YoY Growth (%) |

|---|---|---|---|---|---|

| Total Income (₹ Cr) | 90 | 65 | 47 | 39.40% | 90.80% |

| Operating Income (₹ Cr) | 84 | 60 | 42 | 41.40% | 103.00% |

| EBITDA (₹ Cr) | 28 | 17 | 10 | 72.00% | 176.00% |

| EBITDA Margin (%) | 34% | 28% | 25% | +6.0 pp | +9.0 pp |

| Net Profit (₹ Cr) | 24 | 15 | 10 | 60.80% | 140.30% |

| Net Profit Margin (%) | 29% | 25% | 24% | +4.0 pp | +5.0 pp |

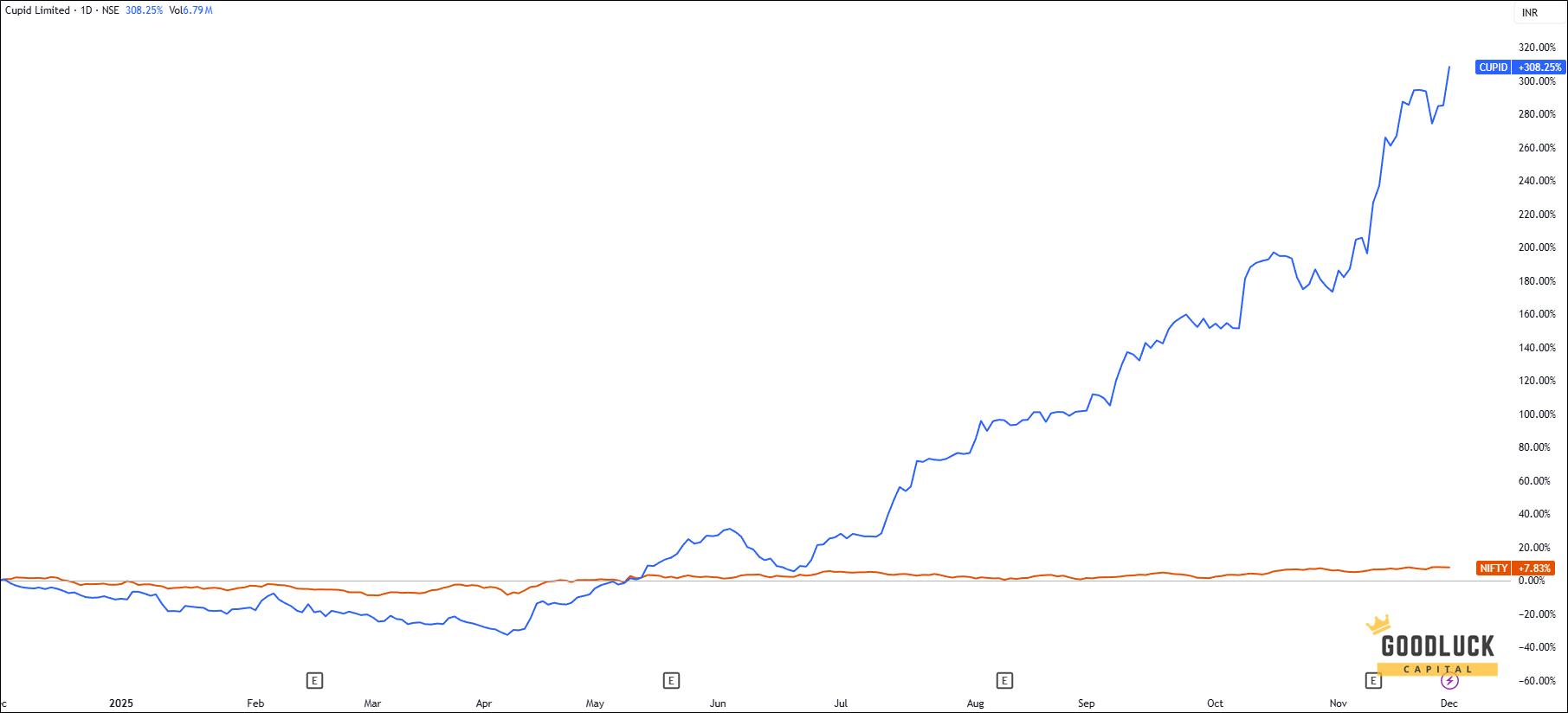

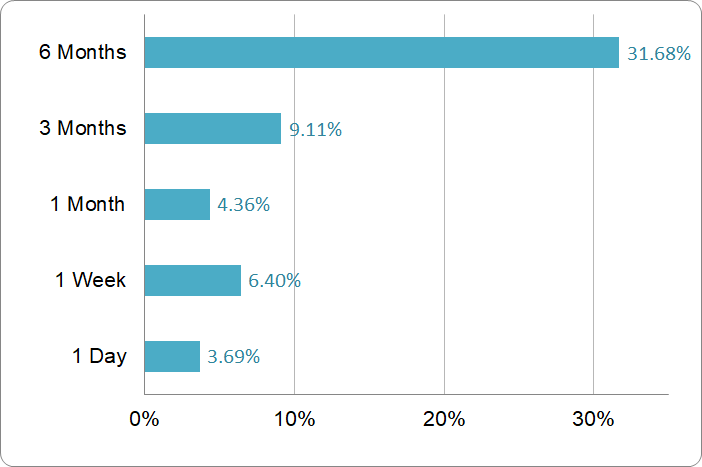

Price Performance

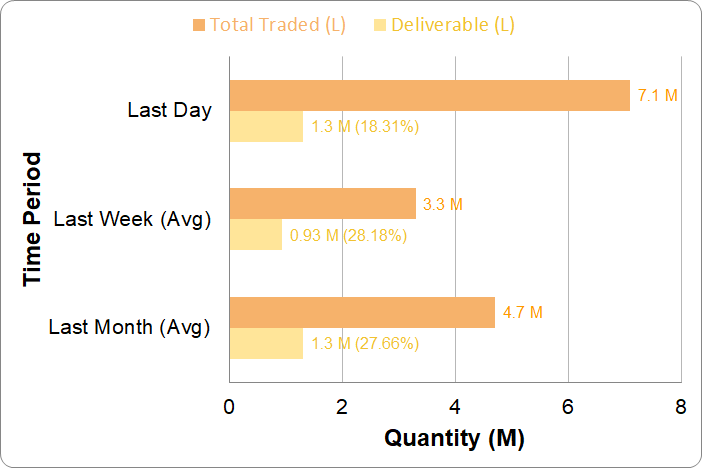

Volume Analysis

Key Observations

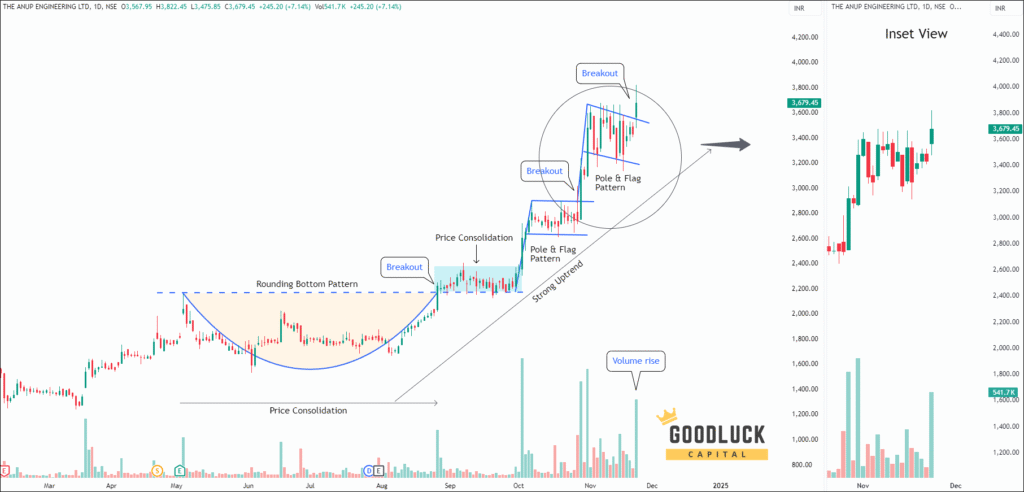

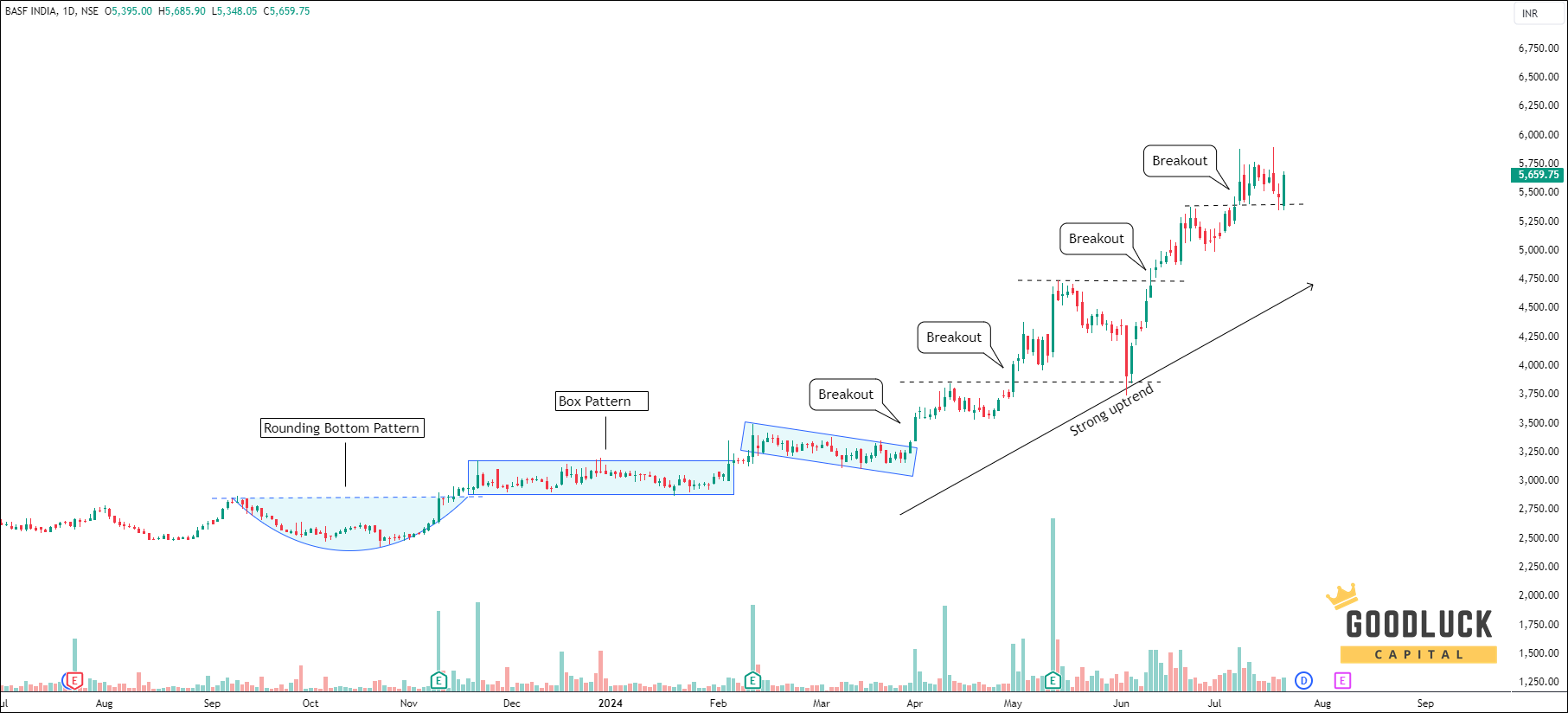

- After a long consolidation phase, the stock formed a rounding bottom pattern.

- Following a strong breakout in July 2025, it surged sharply to reach an all-time high.

For investors searching stock recommendations for short term, momentum-driven setups often deliver quick and clean trades.

Technical Image - Daily Timeframe

Oscillators

| Indicator | Value | Zone |

|---|---|---|

| RSI-14 | 76.03 | Overbought |

| CCI-14 | 86.51 | Neutral |

| MFI | 93.14 | Overbought |

| ROC | 21.21 | Positive |

| Stochastic %K | 87.33 | Neutral |

| William %R | -2.79 | Overbought |

Exponential Moving Averages (EMAs)

| EMA | Value | Stock Position |

|---|---|---|

| 5 EMA | 346.25 | Above |

| 10 EMA | 342.15 | Above |

| 20 EMA | 338.33 | Above |

| 50 EMA | 331.54 | Above |

| 100 EMA | 317.18 | Above |

| 200 EMA | 292.22 | Above |

Cupid Stock Price Forecast

Based on our short term swing trading idea, the Cupid Stock Price target will be INR 365 - INR 370 in the next 10-12 trading sessions.

MONEY MANAGEMENT AND TRADING RULES

Buy within the recommended price range. You may allow up to 1% flexibility beyond the range if needed.

No need to rush. The recommendation remains valid for up to 7 days, not just at market open.

Use a trailing stop-loss to protect and lock in profits.

Diversify your trading capital across our other recommended stocks to reduce risk.

Invest responsibly. Trade only with funds you can afford to lose and hedge positions where appropriate.

Analyst Summary

The research analysis is prepared by Arijit Banerjee, CMT, CFTe. He is a veteran trader and an active investor having in-depth knowledge in financial market research, advanced technical analysis, market cycle, algorithmic trading and portfolio management. Arijit is a Chartered Market Technician (CMT) accredited by CMT Association USA, the leading global authority of Technical Analysis and has been honoured by Certified Financial Technician (CFTe) from the International Federation of Technical Analysts, USA. SEBI, the regulatory body of Indian financial market also recognizes him as a Research Analyst (INH300006582).

Your Return Could be Much Better

- Swing Trading Advice

- 10—12 swing trade advice / month

- expected upside 6%—8% per trade

- short term trade holding 1-2 weeks

- minimum capital required ₹2.5 lakh

- receive trade advice before 9:00 am

- trade ideas by blackbox system, relied on statistics, technical, fundamental, macroeconomics and sentiment

- Stocks only — no intraday or F&O

Months

01

Price

₹ 6666

Months

03

20% OFF

₹ 20000

Price

₹ 15900

Months

06

35% OFF

₹ 40000

Price

₹ 25900

Months

12

50% OFF

₹ 80000

Price

₹ 39900

Months are referred as calendar months

- e.g. 12 January — 12 April (3 Months)

- 20 June — 20 December (6 Months)

Looking for more information?

Looking for more information?

Swing Trade Advice Benefits

- ideal for short term positional traders

- receive trading advice via Whatsapp

- precise Entry, Target and StopLoss

- preferred largecap & midcap stocks

- revised targets & stoploss if required

- alert message for target or stoploss hit

Swing Trade Advice Samples

-

Buy Piramal Pharma

nse: pplpharma

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 190 - 194

- : 204 - 207

- : below 180

- : 7% - 8%

- : 12-14 days

-

Buy Le Travenues Technology

nse: ixigo

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 215 - 220

- : 240 - 240

- : below 195

- : 10% - 13%

- : 14-15 days

-

Buy Privi Speciality Chemicals

nse: priviscl

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 1845 - 1875

- : 1975 - 2000

- : below 1770

- : 6% - 8%

- : 12-14 days

-

Buy BASF India

nse: basf

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 5450 - 5600

- : 6050 - 6200

- : below 5200

- : 10% - 12%

- : 12-14 days

-

Buy S H Kelkar

nse: shk

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 285 - 300

- : 330 - 340

- : below 270

- : 13% - 16%

- : 14-15 days

More Trading & Investment Advice

- Premium

- February 24, 2026

- Free

- February 24, 2026

- Premium (unlocked)

- February 17, 2026

- Premium (unlocked)

- February 10, 2026