Short term swing trade (C): Automobile stock | 6-7% target | Indian stock trading tips on 17 Feb 2026

- February 17, 2026

- 9:00 am

- Goodluck Capital

NOTE

-

Closing Price: ₹444 (as of Feb 16, 2026)

-

StopLoss*: Apply on the daily close. After the first target, reset the StopLoss to your buying price.

-

Duration^: Approximate holding period based on the active trading days (excluding market holidays). Actual holding may vary with the market conditions.

-

Upside Potential#: Based on median of the suggested buy range.

M M Forgings Limited is an Indian company engaged in manufacturing and selling steel forgings. Its products are used across passenger vehicles, commercial vehicles, off-highway, agriculture, oil & gas, and engineering applications.

The company was founded in 1945, renamed from The Madras Motors Ltd to M M Forgings Limited in 1993, and is headquartered in Chennai, India.

Website: https://www.mmforgings.com/

Earnings Call Summary

- Soft quarter: Q2 FY26 revenue was flat to slightly lower YoY, while PAT fell ~48% due to weak demand and higher costs.

- Domestic vs exports: domestic sales were largely stable, but exports declined by ~₹28 crore, driven by a slowdown in the US Class-VIII truck market; Europe provided partial support.

- Margins: EBITDA margin moderated to ~19% in H1 FY26 (operational ~17.5%) from ~21% last year, indicating pressure but still healthy levels.

- Capex & outlook: the company continues with a large ₹1,260-crore expansion. Management expects H2 FY26 revenue of ₹750–800 crore, sees demand near the bottom with recovery from June 2026, and expects initial EV subsidiary sales to contribute ₹20–30 crore annually.

Financial Highlights

| Metric | Q2 FY26 (Sep 2025) | Q1 FY26 (Jun 2025) | Q2 FY25 (Sep 2024) | QoQ Change | YoY Change |

|---|---|---|---|---|---|

| Revenue / Total Income (₹ cr) | 384 | 369 | 405 | +4.1% | -5.2% |

| EBITDA (₹ cr) | 70 | 72 | 84 | -2.8% | -16.7% |

| Profit After Tax (₹ cr) | 16 | 22 | 32 | -27.3% | -50.0% |

| EPS - Basic (₹) | 3.43 | 4.63 | 6.61 | -25.9% | -48.1% |

| EBITDA Margin (%) | 18 | 19.5 | 20.7 | -1.5 pp | -2.7 pp |

| PAT Margin (%) | 4.3 | 5.2 | 7.9 | -0.9 pp | -3.6 pp |

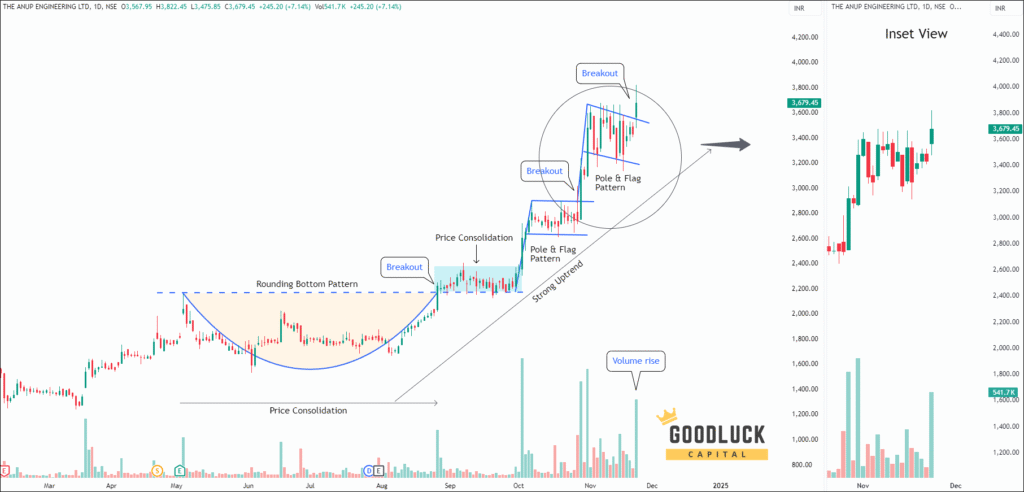

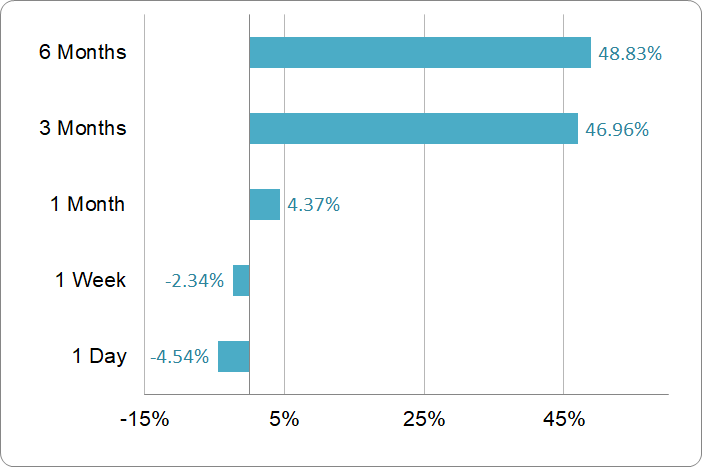

Price Performance

Volume Analysis

Key Observations

- The stock has broken above the trendline resistance after a downtrend and is holding above it.

- If bullish momentum persists, the price is likely to move higher from current levels.

Technical Image - Daily Timeframe

Oscillators

| Indicator | Value | Zone |

|---|---|---|

| RSI-14 | 55.26 | Neutral |

| CCI-14 | 44.39 | Neutral |

| MFI | 68.52 | Neutral |

| ROC | 8.47 | Positive |

| Stochastic %K | 82.84 | OverBought |

| William %R | -35.87 | Neutral |

Exponential Moving Averages (EMAs)

17022026 - MMFL - EMAs

| EMA | Value | Stock Position |

|---|---|---|

| 5 EMA | 457 | Below |

| 10 EMA | 449 | Below |

| 20 EMA | 435 | Above |

| 50 EMA | 403 | Above |

| 100 EMA | 379 | Above |

| 200 EMA | 380 | Above |

M M Forgings Stock Price Forecast

Based on our stock trading signals, the M M Forgings price target will be INR 455 - INR 460 in the next 12-14 trading sessions.

MONEY MANAGEMENT AND TRADING RULES

Buy within the recommended price range. You may allow up to 1% flexibility beyond the range if needed.

No need to rush. The recommendation remains valid for up to 7 days, not just at market open.

Use a trailing stop-loss to protect and lock in profits.

Diversify your trading capital across our other recommended stocks to reduce risk.

Invest responsibly. Trade only with funds you can afford to lose and hedge positions where appropriate.

Analyst Summary

The research analysis is prepared by Arijit Banerjee, CMT, CFTe. He is a veteran trader and an active investor having in-depth knowledge in financial market research, advanced technical analysis, market cycle, algorithmic trading and portfolio management. Arijit is a Chartered Market Technician (CMT) accredited by CMT Association USA, the leading global authority of Technical Analysis and has been honoured by Certified Financial Technician (CFTe) from the International Federation of Technical Analysts, USA. SEBI, the regulatory body of Indian financial market also recognizes him as a Research Analyst (INH300006582).

Your Return Could be Much Better

- Swing Trading Advice

- 10—12 swing trade advice / month

- expected upside 6%—8% per trade

- short term trade holding 1-2 weeks

- minimum capital required ₹2.5 lakh

- receive trade advice before 9:00 am

- trade ideas by blackbox system, relied on statistics, technical, fundamental, macroeconomics and sentiment

- Stocks only — no intraday or F&O

Months

01

Price

₹ 6666

Months

03

20% OFF

₹ 20000

Price

₹ 15900

Months

06

35% OFF

₹ 40000

Price

₹ 25900

Months

12

50% OFF

₹ 80000

Price

₹ 39900

Months are referred as calendar months

- e.g. 12 January — 12 April (3 Months)

- 20 June — 20 December (6 Months)

Looking for more information?

Looking for more information?

Swing Trade Advice Benefits

- ideal for short term positional traders

- receive trading advice via Whatsapp

- precise Entry, Target and StopLoss

- preferred largecap & midcap stocks

- revised targets & stoploss if required

- alert message for target or stoploss hit

Swing Trade Advice Samples

-

Buy Piramal Pharma

nse: pplpharma

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 190 - 194

- : 204 - 207

- : below 180

- : 7% - 8%

- : 12-14 days

-

Buy Le Travenues Technology

nse: ixigo

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 215 - 220

- : 240 - 240

- : below 195

- : 10% - 13%

- : 14-15 days

-

Buy Privi Speciality Chemicals

nse: priviscl

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 1845 - 1875

- : 1975 - 2000

- : below 1770

- : 6% - 8%

- : 12-14 days

-

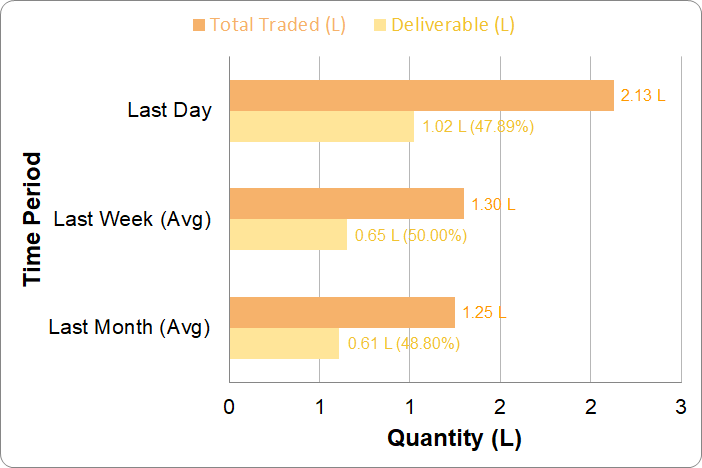

Buy BASF India

nse: basf

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 5450 - 5600

- : 6050 - 6200

- : below 5200

- : 10% - 12%

- : 12-14 days

-

Buy S H Kelkar

nse: shk

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 285 - 300

- : 330 - 340

- : below 270

- : 13% - 16%

- : 14-15 days

More Trading & Investment Advice

- Premium (unlocked)

- February 17, 2026

- Premium (unlocked)

- February 10, 2026

- Premium (unlocked)

- February 10, 2026

- Premium (unlocked)

- February 4, 2026