Indian auto stocks rallied on January 2, 2025, driven by robust December sales figures, sending the Nifty Auto index to a six-month high.

Key Players

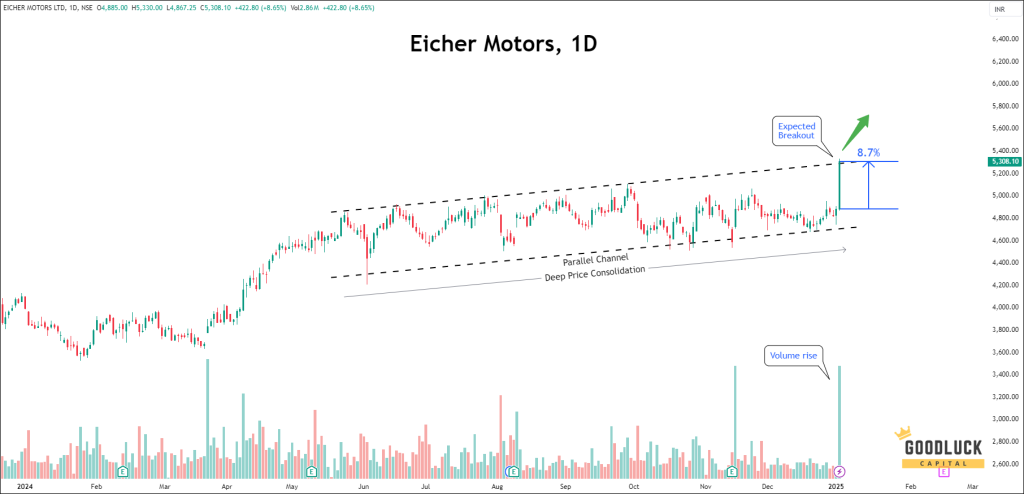

1. Eicher Motors

- Surged 7%, with December sales up 25% YoY to 79,466 units, and exports rising 90% YoY.

2. Ashok Leyland

- Rose 5%, with December sales exceeding estimates, up 5% YoY, and Medium and Heavy Commercial Vehicles sales up 8% YoY.

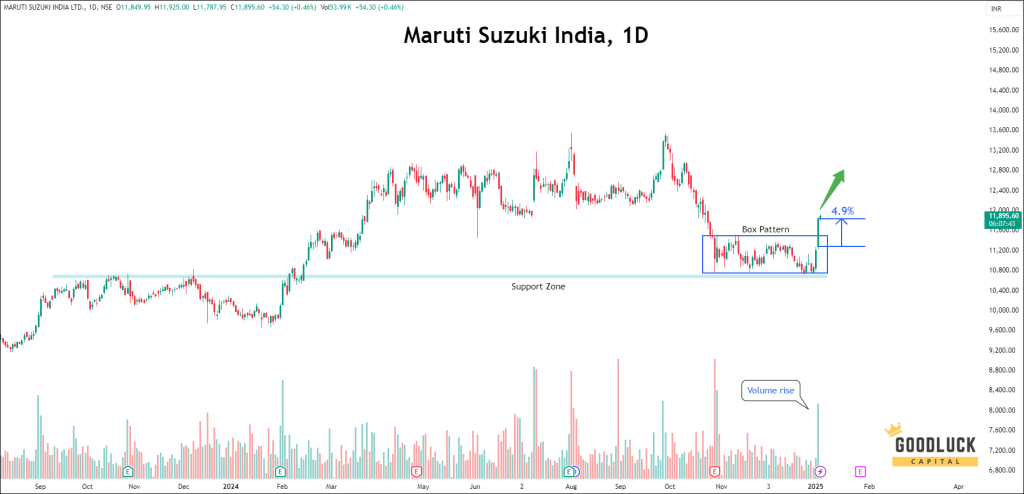

3. Maruti Suzuki India

- Extended gains for the second straight day, rallying 5%, driven by strong December car sales and bullish management commentary.

4. Mahindra & Mahindra

- Up over 3% for the second consecutive day, with December SUV sales jumping 18% YoY to 41,424 units, driven by strong demand.

Overall Outlook

The Indian automotive market is poised for continued growth, driven by a resilient economy and robust consumer demand. Potential interest rate cuts are expected to further fuel this growth, making vehicle financing more accessible and affordable for consumers. As a result, the road ahead looks promising for FY26, with expectations of sustained growth and increased sales in the automotive sector. For retail and institutional investors alike, combining sector momentum with expert positional stock trading advice in India can help identify the most promising auto stocks for medium-term gains.