SHORT TERM TRADING ADVICE

OUR RECOMMENDATION

| CP# | 4300 |

| Idea | BUY |

| Buy Range | 4260 – 4300 |

| Target | 4450 – 4500 |

| StopLoss* | 4200 |

| Duration | 12 – 14 days |

| Potential Upside^ | 4 – 5% |

| CP# | Idea | Buy Range | Target | StopLoss* | Duration | Potential Upside^ |

| 4300 | BUY | 4260 – 4300 | 4450 – 4500 | 4200 | 12 – 14 days | 4 – 5% |

Company Overview

Britannia Industries is a flagship FMCG company specializing in packaged foods, with a strong presence in biscuits, bakery, dairy, and snacks. Home to popular brands like Good Day and Tiger, it enjoys deep consumer trust and extensive reach across both urban and rural India. The company continues to grow through innovation, premiumization, and a focus on expanding its product portfolio, reinforcing its leadership in the Indian food industry

Q3 FY23 Financial Performance

- Revenue growth of 16% YoY—driven by a mix of pricing initiatives and low single-digit volume growth.

- Operating profit (EBITDA) surged by 55% YoY, supported by strong pricing leverage and cost optimization.

- Gross margin reached a record-high of 42.3%, a YoY improvement of 521 bps.

- Net profit more than doubled—from ₹369 crore to ₹932 crore—fueled by an exceptional ₹359 crore gain from its cheese JV.

Strategic Highlights & Growth Drivers

1. Robust Pricing & Cost Management

- Strategic pricing moves and commodity hedging (wheat, palm oil) enhanced profitability.

- Operational efficiency programs delivered significant margin improvements.

2. Market Share Expansion

- Britannia continued to gain share for 39 consecutive quarters, underpinned by improved rural reach.

3. Strong Rural Growth

- Enhanced direct access to rural markets helped sustain volume growth despite consumption softness.

4. Strategic JV in Cheese

JV with Bel SA led to the divestment of its cheese business, delivering a one-off profit of ₹359 crore while maintaining a stake in the future business

Management Commentary

- Varun Berry (VC & MD) highlighted strong performance due to “go-to-market strategy and investments in brands and innovation”, reinforcing long-term market dominance.

- The company expects future margin normalization but remains confident of growth, particularly from promotions and category expansion.

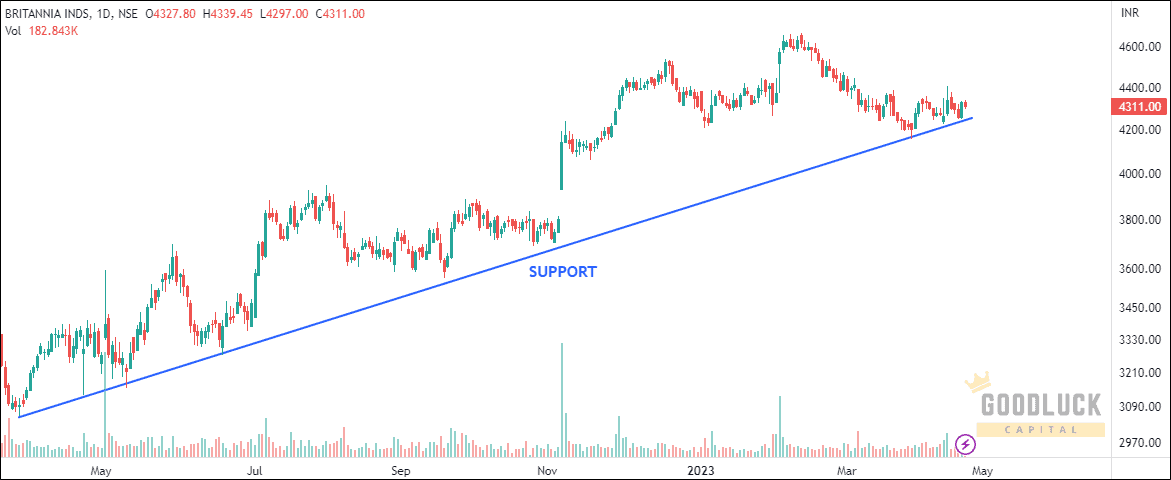

Technical Analysis

- The stock is in a strong uptrend, forming consistent higher highs and higher lows.

- After recently bouncing off its long-term trendline support, it is well-positioned for a continued upward move.

Short-term Outlook

Britannia’s strong Q3 show—powered by margin expansion, cost control, and rural reach—has reinforced investor confidence. Coupled with a bullish chart structure, the stock is well-placed for short-term momentum despite broader market volatility.