Abstract

Zomato Ltd. (rebranded as Eternal) is more than just a food delivery company. It is now a diversified digital commerce platform, it runs quick commerce (Blinkit), provides B2B supplies (Hyperpure), and sells event tickets (District). While its main food delivery business remains profitable, Blinkit is burning their cash due to heavy spending. Hyperpure faces thin margins and credit risks. Profits dropped in FY25 as the company invests heavily to expand.

The stock is expensive (trading at 419x P/E), meaning investors expect huge future growth. For Zomato to succeed, Blinkit must start making money, food delivery needs to stay strong, and new businesses like events must grow. It’s a risky but high-potential stock—only for investors who can handle ups and downs while waiting for results. Keep an eye on execution!

Introduction

Zomato Ltd. (now rebranded as Eternal) stands as a pioneering force in India’s online food delivery and quick commerce sectors. Since its landmark IPO in July 2021, Zomato has transitioned from a high-burn startup to a multi-vertical platform, achieving its first-ever profitable quarter in June 2023—a milestone that triggered a sharp rally in its stock.

However, by September 2024, sentiment around the stock has moderated. A combination of declining profits, aggressive capital deployment, and heightened competition—especially in the hyper-competitive quick commerce segment—has led to a significant correction in its share price. Investors now find themselves reassessing Zomato’s long-term valuation narrative amid short-term financial headwinds, while traders often look at the stock for swing stock trading tips in India, given its high volatility around earnings and market news.

Today, Zomato is not just India’s leading food delivery platform but a diversified digital consumption ecosystem with strategic plays in:

- Food Delivery (core business and profit engine)

- Quick Commerce (Blinkit, fast-growing but margin dilutive)

- B2B Restaurant Supplies (Hyperpure, synergistic but operationally intensive)

- Event Discovery & Ticketing (District, nascent but promising for lifestyle integration)

Zomato commands:

- 55% market share in food delivery

- 35% market share in quick commerce (via Blinkit)

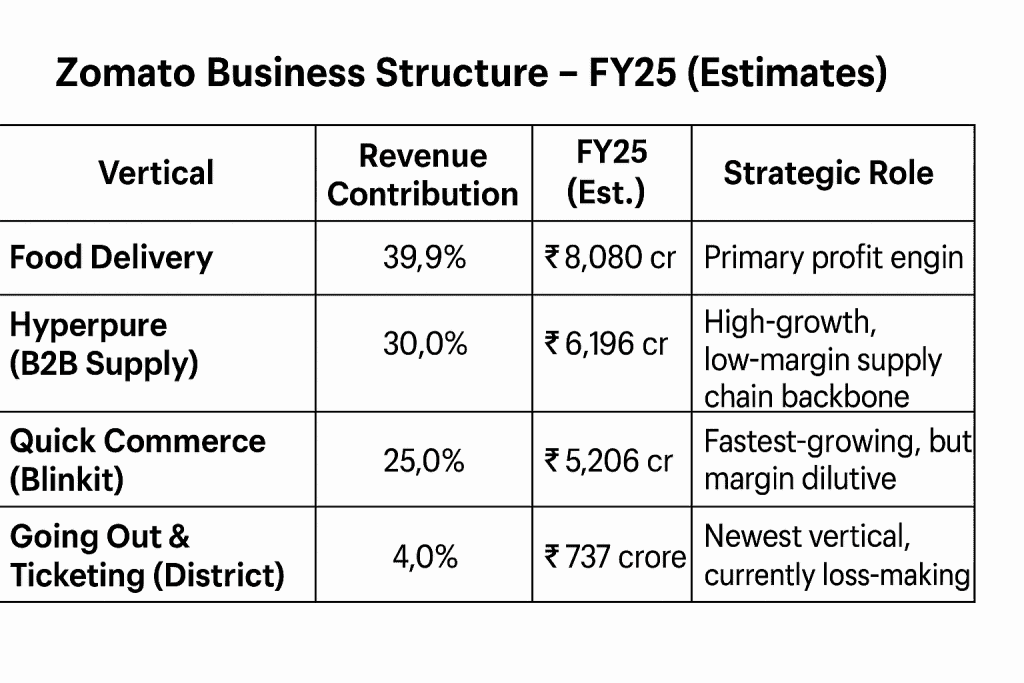

Zomato’s Business Structure

Deep Dive: Zomato’s Four Strategic Business Segments

Segment 1: Food Delivery — The Core Profit Engine

Zomato’s food delivery business remains its most mature and profitable segment, delivering strong operating leverage and robust unit economics.

- Current Market Size (2025): ₹66,000 crore

- Projected Size (2030): ₹1.6 lakh crore

- Zomato’s Market Share: 54%–56%

- Operating Margin: ~19%

Profitability Drivers:

A. Cost Optimization

- Proprietary algorithms improve route planning and delivery partner allocation.

- Higher order density reduces per-order fulfillment costs.

B. Platform Monetization

- Restaurants pay for visibility, placement, and targeted advertising.

- High-margin, scalable revenue stream.

C. Zomato Gold Program

- Drives customer retention and repeat orders with exclusive benefits.

D. Discount Rationalization

- Deep discounts restricted to new users.

- Returning users incentivized less, boosting margins.

E. Quality Assurance

- Over 19,000 low-rated or unhygienic outlets delisted.

- Builds consumer trust and lowers refund rates.

Unit Economics:

- Average Order Value (AOV): ₹400–₹450

- Commission (Take Rate): 22%–25%

- Ad Revenue Uplift: +5%–6%

- Delivery Cost: ₹20–₹25 per order

- Contribution Margin: 6%–7%

- Adjusted EBITDA Margin: ~19%

Outlook Risk:

- As Zomato penetrates Tier-3 and Tier-4 cities, lower order values and thinner margins may dilute profitability.

Segment 2: Quick Commerce (Blinkit) — The Hyper-Growth Bet

Blinkit is Zomato’s fastest-scaling vertical, playing in the high-frequency, low-ticket quick commerce space. However, it remains capital intensive and structurally margin-challenged in the near term.

- Industry Size (2025): ₹30,000 crore

- 2030 Estimate: ₹1 lakh crore+ (25% CAGR)

- Market Share: ~35%

- Q4 FY25 Revenue: ₹526 crore (+126% YoY)

- Gross Order Value (GOV): ₹22,000 crore

- Monthly Transacting Users: 13.7 million (up from 10.6M)

Revenue Model:

- Product markups (low-margin)

- Delivery fees

- Emerging revenue from FMCG brand partnerships and ads

Operational Shifts:

- Rapid expansion of dark stores

- Underutilized capacity (~40% unused)

- Strategic move from marketplace to inventory-led model:

- Now stocks high-value electronics and perishables in-house

- Aims to boost margins through pricing control

- Raises inventory and working capital risk

Key Concern:

- High cash burn, inventory obsolescence, and intense competition from Zepto, Instamart, and BigBasket pose near-term risks to breakeven timelines.

Segment 3: Hyperpure — B2B Infrastructure with Thin Margins

Hyperpure supplies fresh ingredients and kitchen staples to restaurants and Blinkit’s dark stores, positioning itself as the backbone of Zomato’s broader ecosystem.

- Industry Size: ₹50,000–₹60,000 crore

- Growth Rate: 10–12% CAGR

- FY25 Revenue: ₹6,196 crore (+95% YoY)

- Adjusted EBITDA: -₹43 crore

Client Mix:

- 60%: Independent and chain restaurants

- 40%: Blinkit dark stores

Key Challenges:

- High working capital due to credit-led business model

- Delayed payments from restaurant partner

- Write-offs on receivables rising

- Competitive threats from Amazon, Udaan, Jumbotail, Reliance

Strategic Synergy:

- Increased internal consumption via Blinkit improves utilization and margin profile

- Farm-direct and ESG-compliant sourcing gaining traction with premium chains

Investor Note:

- Hyperpure complements Zomato’s ecosystem but remains a margin drag. Scalable only with improved payment cycles and tighter cost controls.

Segment 4: Zomato Live / District — Early-Stage Lifestyle Experiment

Zomato’s entry into event discovery and ticketing via the District App reflects a long-term vision to build a lifestyle commerce platform.

- Acquisition Price: ₹2,014 crore (from Paytm in March 2024)

- Q4 FY25 Revenue: ₹737 crore (+186% YoY)

- Monthly Transactions: 1.2 crore+

- Adjusted EBITDA: -₹30 crore

Market Outlook:

- Estimated industry size: ~12,500 crore

- Expected CAGR: 15–18%

- Highly seasonal, with significant dominance by BookMyShow (~90% market share)

Key Challenges:

- High working capital due to credit-led business model

- Delayed payments from restaurant partners

- Write-offs on receivables rising

- Competitive threats from Amazon, Udaan, Jumbotail, Reliance

Strategic Initiatives:

- Exclusive early access for Zomato Gold users

- Curated events (chef’s tables, food festivals, music gigs)

- Partnerships with local creators and event managers

Early Read:

- High growth potential, but long gestation period. Strong synergy with dining and lifestyle branding—but scaling remains challenging due to entrenched competition and seasonal volatility.

Segment-Wise Growth Opportunities & Strategic Levers

Despite near-term headwinds, Zomato’s diversified business model offers significant medium- to long-term growth potential across all four operating segments. The following outlines the structural opportunities that could fuel Zomato’s next phase of value creation.

1. Blinkit (Quick Commerce) — High-Frequency Habit, High-Scale Upside

Strategic Tailwinds:

A. Massive Urban TAM:

Demand for sub-30-minute delivery in top Indian cities continues to surge, especially for daily essentials like milk, snacks, fresh produce, and household items.

B. Aggressive Expansion Roadmap:

Blinkit is targeting 700+ dark stores by FY26, focusing on Tier-1 and Tier-2 city densification, optimizing delivery reach and cost efficiency.

C. Repeat Usage Drives Stickiness:

Users transact ~4.5x/month—far exceeding average food delivery frequency—indicating deeply embedded consumption behavior.

D. Ad Monetization Kicks In:

Leading FMCG brands (e.g., Nestlé, HUL, ITC) are paying for visibility and premium product placement, driving incremental high-margin revenue.

E. Inventory-Led Model = Margin Leverage:

Direct control over pricing and procurement allows margin expansion as scale improves. Sourcing from local producers and farm gates may further compress input costs.

Long-Term Vision:

- If executed efficiently, Blinkit can evolve into a ₹10,000–₹15,000 crore topline business over the next 3–5 years, with sustainable 5–7% EBITDA margins.

2. Food Delivery — Resilient Cash Flow, Still Room to Expand

Strategic Tailwinds:

A. Premiumization & Dining Recovery:

Urban consumers are shifting toward high-value meals, curated menus, and dine-in offers via Zomato Gold. This is lifting AOVs in mature markets.

B. Ad Revenue Scaling Faster than Orders:

Restaurant partners are increasingly investing in visibility through promoted listings, performance marketing, and platform fees—driving high-margin revenue.

C. Back-End Efficiency via AI & Logistics Tech:

AI-driven partner routing and order batching are optimizing delivery costs. Contribution margin improved from 6.5% to 7.1% YoY, with room to cross 10%.

D. Rural/Tier-3 Rollout in Progress:

Zomato is piloting low-CAC delivery models in smaller towns. With infrastructure support, these markets offer long-term incremental demand from over 400 emerging cities.

Long-Term Vision:

- Food delivery remains the stable cash cow. Its profits and platform scale are expected to fund high-growth verticals like Blinkit without immediate capital raises.

3. Hyperpure — Strategic Supply Backbone with Ecosystem Benefits

Strategic Tailwinds:

A. Cross-Sell Potential to Existing Restaurant Network:

Over 70% of top-performing restaurants on Zomato already use Hyperpure partially. Strong platform trust supports deeper wallet share expansion.

B. Data Loop Enhances Forecasting:

Hyperpure’s full-stack visibility (from end-customer demand to supplier procurement) enables intelligent inventory planning and waste minimization.

C. Sustainable & Traceable Sourcing Advantage:

Hyperpure is carving out an ESG-friendly brand by offering pesticide-free, traceable produce and seafood. This appeals to premium chains and may improve pricing power.

Long-Term Vision:

- While margin-light, Hyperpure could emerge as Zomato’s strategic moat—cementing loyalty from cloud kitchens and top-tier restaurant chains, and strengthening the company’s B2B backbone.

4. Zomato Live / District — Lifestyle Extension with Ecosystem Synergy

Strategic Tailwinds:

A. Zomato Gold Integration:

Early-access passes and exclusive event perks for Gold subscribers could drive upgrades and increase app engagement.

B. Bundled Food + Event Experiences:

Curated offerings (e.g., chef’s tables, beer festivals, live performances) align naturally with Zomato’s brand identity and enhance basket value.

C. Creator & Niche Event Partnerships:

Collaborations with local artists, colleges, and micro-creators help Zomato compete in niches underserved by BookMyShow.

Long-Term Vision:

- Though still nascent, Zomato Live has the potential to evolve into a hyperlocal entertainment layer—positioning Zomato as a hybrid between “Swiggy Dineout” and “BookMyShow.”

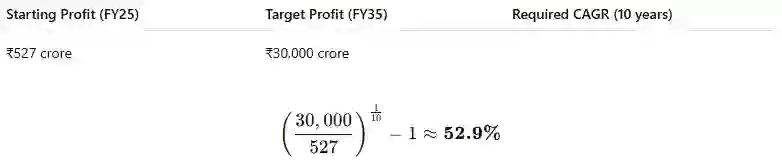

Valuation & Investment Outlook

Current Valuation

- Market Capitalization: ₹2.21 lakh crore

- FY25 Reported Net Profit: ₹527 crore

- Trailing P/E Ratio: ~419x

Interpretation:

- At a P/E multiple of ~419x, Zomato’s current valuation is anchored not in present-day fundamentals but in aggressive assumptions of future growth. This level of pricing implies that the market is already discounting substantial future profitability, leaving limited room for underperformance or execution errors.

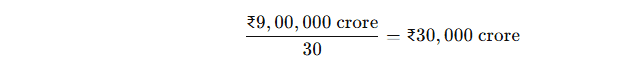

Long-Term Scenario: Path to ₹9 Lakh Crore Market Cap by FY35

To understand what Zomato must deliver to justify long-term bullish expectations, we assess a hypothetical scenario where the company’s market cap grows at a 15% CAGR over the next 10 years — a trajectory often associated with high-growth compounders.

Core Assumptions:

- Target Market Cap (FY35): ₹9,00,000 crore

- Assumed Terminal P/E: 30x (reasonable for mature, profitable tech or platform businesses)

Required Net Profit (FY35):

Profit Growth Trajectory:

Implication:

- Zomato must grow its net profit at ~53% CAGR for 10 consecutive years — an extremely rare feat, even among the most successful global technology firms. This puts the current valuation firmly in “hypergrowth or bust” territory.

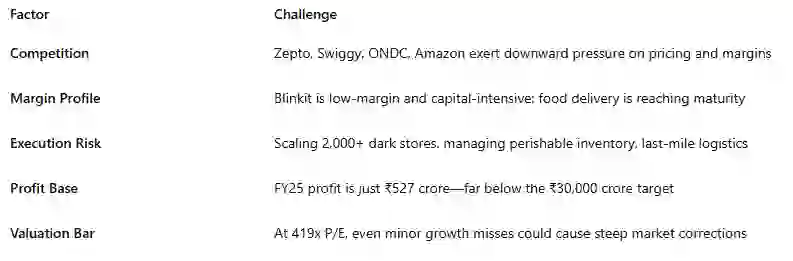

Key Structural Challenges

Investor Lens: Strategic Takeaways

1. Priced for Perfection:

Zomato’s current market valuation implies flawless execution across food delivery, quick commerce, B2B supply, and entertainment.

2. Growth Already Embedded in Price:

Much of the expected upside from Blinkit, Hyperpure, and platform monetization is likely factored in. Future gains will require meaningful over-delivery.

3. Not Yet a “Classic Compounder”:

Unlike stalwarts such as Titan or Asian Paints, Zomato lacks stable margins, cash flow predictability, and pricing power across verticals.

4. High-Risk, High-Reward Bet:

Zomato is best viewed as a venture-style equity play within a public market context — with substantial upside if successful, but no room for missteps.

Management Commentary Highlights — Q4 FY25

1. Blinkit Expansion Strategy

Deepinder Goyal (Founder & CEO):

“Our confidence in Blinkit is stronger than ever. We’re not just growing stores—we’re building a new behaviour in India. We’ll keep investing aggressively in infrastructure over the next 6–8 quarters.”

Highlights:

- Blinkit will remain in investment mode through FY26, indicating a continued phase of elevated capital deployment.

- The focus is firmly on densification in India’s top 30 cities, not expansion into Tier-3 or Tier-4 geographies.

- Dark store footprint surged from 1,007 to 1,301 in Q4 FY25 — marking the highest-ever quarterly net addition (294 stores).

- The company aims to scale to 2,000 dark stores by FY26, reinforcing its long-term bet on ultra-fast commerce in urban clusters.

2. Profitability Trajectory

“While consolidated profits declined this quarter, our core food delivery and ad businesses remain healthy. Quick commerce drag is planned, not accidental.”

Highlights:

- Zomato reported a 15% YoY decline in consolidated Adjusted EBITDA in Q4 FY25, down to ₹165 crore — largely due to Blinkit’s infrastructure ramp-up.

- Management reaffirmed confidence in the core food delivery unit, citing improving contribution margins and stable cash flows.

- The company is targeting:

- Blinkit breakeven by Q4 FY26

- Positive consolidated free cash flow (FCF) by FY27

3. Hyperpure & Platform Monetization

“Hyperpure will continue to grow with our restaurant ecosystem. Ads on Zomato and Blinkit are growing faster than we expected.”

Highlights:

- Hyperpure is expected to scale in lockstep with Zomato’s restaurant network, though management acknowledges it will not be a high-margin business.

- Platform monetization—especially ad revenue from restaurant partners and FMCG brands—is evolving into a key growth lever.

- A significant ad-tech revamp is planned for FY26, aimed at unlocking higher ad yields across both Zomato and Blinkit platforms.

4. Competitive Landscape: Swiggy, Zepto, ONDC

“We’re not obsessed with competitors. We focus on building a long-term brand and user trust. Others will come and go, but habits are sticky.”

Highlights:

- Management downplayed the impact of Swiggy’s upcoming IPO and Zepto’s discount-heavy strategy, signaling confidence in Zomato’s market positioning.

- ONDC (Open Network for Digital Commerce) was dismissed as “irrelevant for curated experiences”, reinforcing Zomato’s focus on quality-driven user journeys over price-led commoditization.

- Blinkit is being positioned as a trusted convenience partner, not the lowest-price player—indicating a preference for long-term customer retention over price wars.

Final Conclusion

Zomato’s transformation into Eternal marks a bold evolution from a pure-play food delivery startup to a multi-vertical digital consumption ecosystem with significant long-term potential. Its dominant position in India’s food delivery market, coupled with aggressive expansion in quick commerce, B2B supplies, and lifestyle events, positions the company at the nexus of evolving consumer behavior and urban convenience.

However, the journey ahead is laden with challenges. The high valuation demands near-flawless execution, sustained rapid profit growth, and effective management of operational complexities—particularly in Blinkit’s cash-intensive quick commerce segment and Hyperpure’s margin-sensitive supply chain business. Competition is fierce, and internal cannibalization risks in core food delivery add further strategic complexity.

For investors, Zomato offers a compelling but high-risk growth narrative. While its diversified business model provides multiple levers for future value creation, the company remains in a “hypergrowth or bust” phase where execution discipline, cost controls, and margin improvement are critical. Near-term financial volatility is expected as Zomato invests aggressively to capture market share and build new revenue streams.

In summary, Zomato’s FY25 results reflect both the promise and perils of scaling India’s leading food-tech platform into a holistic lifestyle commerce powerhouse. Investors with a long-term horizon and high risk tolerance may find the company’s growth story attractive, while active traders could also view the stock for short term stock trading recommendations, given its volatility around earnings, profitability updates, and competitive dynamics. Valuation discipline and continuous monitoring of operational execution remain paramount to navigating this complex investment thesis.