Swing Trading 3 | Premium (Locked) | 31 Aug

- August 31, 2025

- 9:15 am

- Goodluck-Capital

# CMP on Aug 10, 2025

* Maintain recommended StopLoss by daily closing basis.

Once 1st target hit, reset StopLoss at 243.

^ The returns are calculated based on CMP#

New wpDataTable

| Company | CMP | 52W High | 52W Low | PE | PB | ROCE | ROE | PAT TTM | Div Yield | NP-CAGR | NS-CAGR | PEG |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| HLE Glascoat | 530.30 | 553.00 | 218.00 | 64.36 | 8.40 | 14.07 | 9.78 | 74 | 0.27 | 19.00 | 40.00 | 3.39 |

| Bharat Heavy Electricals Ltd. | 211.50 | 300.00 | 176.00 | -137.90 | 0.90 | 4.90 | 2.20 | 231 | 0.20 | -9.50 | -0.80 | -14.52 |

| Thermax Ltd. | 3,258.70 | 5,721.20 | 2,067.00 | 62.00 | 16.20 | 16.20 | 13.40 | 659 | 0.40 | 11.70 | 7.30 | 5.30 |

| Jyoti CNC Automation Ltd. | 927.80 | 1,511.60 | 750.20 | 139.90 | 15.50 | 21.30 | 20.90 | 337 | 0.00 | 0.00 | 0.00 | 0.00 |

| Triveni Turbine Ltd. | 529.80 | 805.50 | 370.20 | 47.00 | 10.30 | 45.40 | 33.00 | 331 | 0.40 | 14.70 | 11.10 | 3.20 |

| Kirloskar Oil Engines Ltd. | 923.60 | 1,405.00 | 544.20 | 28.20 | 4.40 | 14.60 | 16.60 | 454 | 0.90 | 13.10 | 9.90 | 2.15 |

| Elcon Engineering Company Ltd. | 555.60 | 738.80 | 380.00 | 30.00 | 6.20 | 30.50 | 28.20 | 511 | 0.20 | 38.20 | 5.30 | 0.79 |

| Tega Industries Ltd. | 1,843.00 | 2,327.40 | 1,205.80 | 63.30 | 10.30 | 20.30 | 17.30 | 194 | 0.20 | 10.40 | 8.20 | 6.09 |

| Nesco Ltd. | 1,439.00 | 1,475.00 | 1,024.00 | 30.90 | 2.90 | 16.00 | 15.70 | 242 | 0.20 | 14.80 | 8.20 | 2.09 |

| Azad Engineering Ltd. | 1,534.60 | 1,928.00 | 1,128.40 | 169.20 | 14.10 | 18.30 | 18.00 | 99 | 0.00 | 0.00 | 0.00 | 0.00 |

| Lloyds Engineering Works Ltd. | 64.90 | 84.20 | 31.40 | 13.40 | 13.40 | 25.60 | 25.00 | 239 | 0.40 | 42.60 | 25.20 | 0.31 |

| Ajax Engineering Ltd. | 689.10 | 756.80 | 550.60 | 30.90 | 6.30 | 21.00 | 20.50 | 274 | 0.00 | 11.10 | 9.00 | 2.00 |

| Praj Industries Ltd. | 399.40 | 874.30 | 292.00 | 53.50 | 5.30 | 23.90 | 16.50 | 140 | 1.10 | 10.00 | 0.00 | 5.20 |

| Balu Forge Industries Ltd. | 630.50 | 942.00 | 429.00 | 76.70 | 12.20 | 30.70 | 25.70 | 227 | 0.00 | 173.40 | 40.00 | 0.44 |

| HMT Ltd. | 57.40 | 95.00 | 45.60 | -53.10 | -1.20 | 0.00 | 0.00 | -142 | 0.00 | 0.00 | -4.90 | 0.00 |

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi. Aenean vulputate eleifend tellus. Aenean leo ligula, porttitor eu, consequat vitae, eleifend ac, enim. Aliquam lorem ante, dapibus in, viverra quis, feugiat a, tellus. Phasellus viverra nulla ut metus varius laoreet

wpDataTable with provided ID not found!

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi. Aenean vulputate eleifend tellus. Aenean leo ligula, porttitor eu, consequat vitae, eleifend ac, enim. Aliquam lorem ante, dapibus in, viverra quis, feugiat a, tellus. Phasellus viverra nulla ut metus varius laoreet

wpDataTable with provided ID not found!

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi. Aenean vulputate eleifend tellus. Aenean leo ligula, porttitor eu, consequat vitae, eleifend ac, enim. Aliquam lorem ante, dapibus in, viverra quis, feugiat a, tellus. Phasellus viverra nulla ut metus varius laoreet

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi. Aenean vulputate eleifend tellus. Aenean leo ligula, porttitor eu, consequat vitae, eleifend ac, enim. Aliquam lorem ante, dapibus in, viverra quis, feugiat a, tellus. Phasellus viverra nulla ut metus varius laoreet

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi. Aenean vulputate eleifend tellus. Aenean leo ligula, porttitor eu, consequat vitae, eleifend ac, enim. Aliquam lorem ante, dapibus in, viverra quis, feugiat a, tellus. Phasellus viverra nulla ut metus varius laoreet

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi. Aenean vulputate eleifend tellus. Aenean leo ligula, porttitor eu, consequat vitae, eleifend ac, enim. Aliquam lorem ante, dapibus in, viverra quis, feugiat a, tellus. Phasellus viverra nulla ut metus varius laoreet

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi. Aenean vulputate eleifend tellus. Aenean leo ligula, porttitor eu, consequat vitae, eleifend ac, enim. Aliquam lorem ante, dapibus in, viverra quis, feugiat a, tellus. Phasellus viverra nulla ut metus varius laoreet

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi. Aenean vulputate eleifend tellus. Aenean leo ligula, porttitor eu, consequat vitae, eleifend ac, enim. Aliquam lorem ante, dapibus in, viverra quis, feugiat a, tellus. Phasellus viverra nulla ut metus varius laoreet

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi. Aenean vulputate eleifend tellus. Aenean leo ligula, porttitor eu, consequat vitae, eleifend ac, enim. Aliquam lorem ante, dapibus in, viverra quis, feugiat a, tellus. Phasellus viverra nulla ut metus varius laoreet

MONEY MANAGEMENT AND TRADING RULES

Buy within the recommended price range. You may allow up to 1% flexibility beyond the range if needed.

No need to rush. The recommendation remains valid for up to 7 days, not just at market open.

Use a trailing stop-loss to protect and lock in profits.

Diversify your trading capital across our other recommended stocks to reduce risk.

Invest responsibly. Trade only with funds you can afford to lose and hedge positions where appropriate.

Analyst Summary

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi. Aenean vulputate eleifend tellus. Aenean leo ligula, porttitor eu, consequat vitae, eleifend ac, enim. Aliquam lorem ante, dapibus in, viverra quis, feugiat a, tellus. Phasellus viverra nulla ut metus varius laoreet

Your Return Could be Much Better

- Swing Trading Advice

- 10—12 swing trade advice / month

- expected upside 6%—8% per trade

- short term trade holding 1-2 weeks

- minimum capital required ₹2.5 lakh

- receive trade advice before 9:00 am

- trade ideas by blackbox system, relied on statistics, technical, fundamental, macroeconomics and sentiment

- Stocks only — no intraday or F&O

Months

01

Price

₹ 6666

Months

03

20% OFF

₹ 20000

Price

₹ 15900

Months

06

35% OFF

₹ 40000

Price

₹ 25900

Months

12

50% OFF

₹ 80000

Price

₹ 39900

Months are referred as calendar months

- e.g. 12 January — 12 April (3 Months)

- 20 June — 20 December (6 Months)

Looking for more information?

Looking for more information?

Swing Trade Advice Benefits

- ideal for short term positional traders

- receive trading advice via Whatsapp

- precise Entry, Target and StopLoss

- preferred largecap & midcap stocks

- revised targets & stoploss if required

- alert message for target or stoploss hit

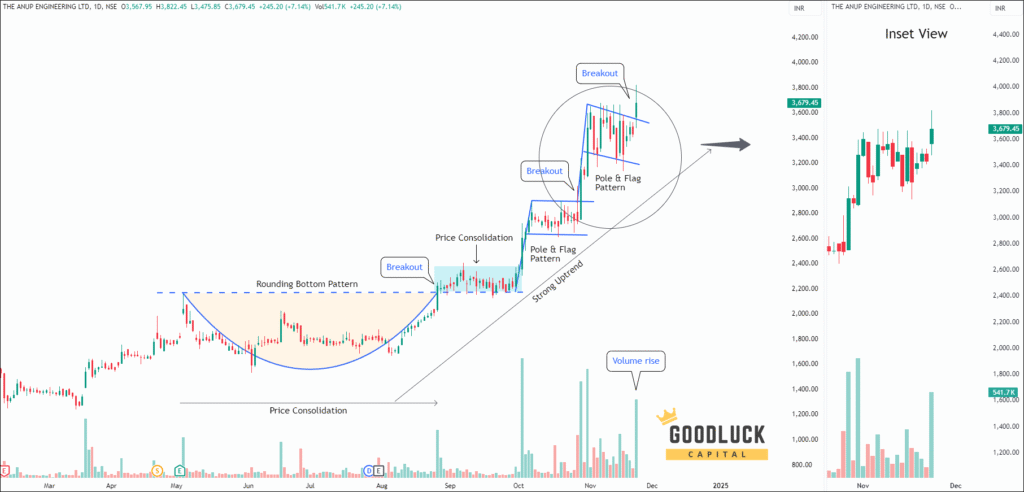

Swing Trade Advice Samples

-

Buy Piramal Pharma

nse: pplpharma

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 190 - 194

- : 204 - 207

- : below 180

- : 7% - 8%

- : 12-14 days

-

Buy Le Travenues Technology

nse: ixigo

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 215 - 220

- : 240 - 240

- : below 195

- : 10% - 13%

- : 14-15 days

-

Buy Privi Speciality Chemicals

nse: priviscl

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 1845 - 1875

- : 1975 - 2000

- : below 1770

- : 6% - 8%

- : 12-14 days

-

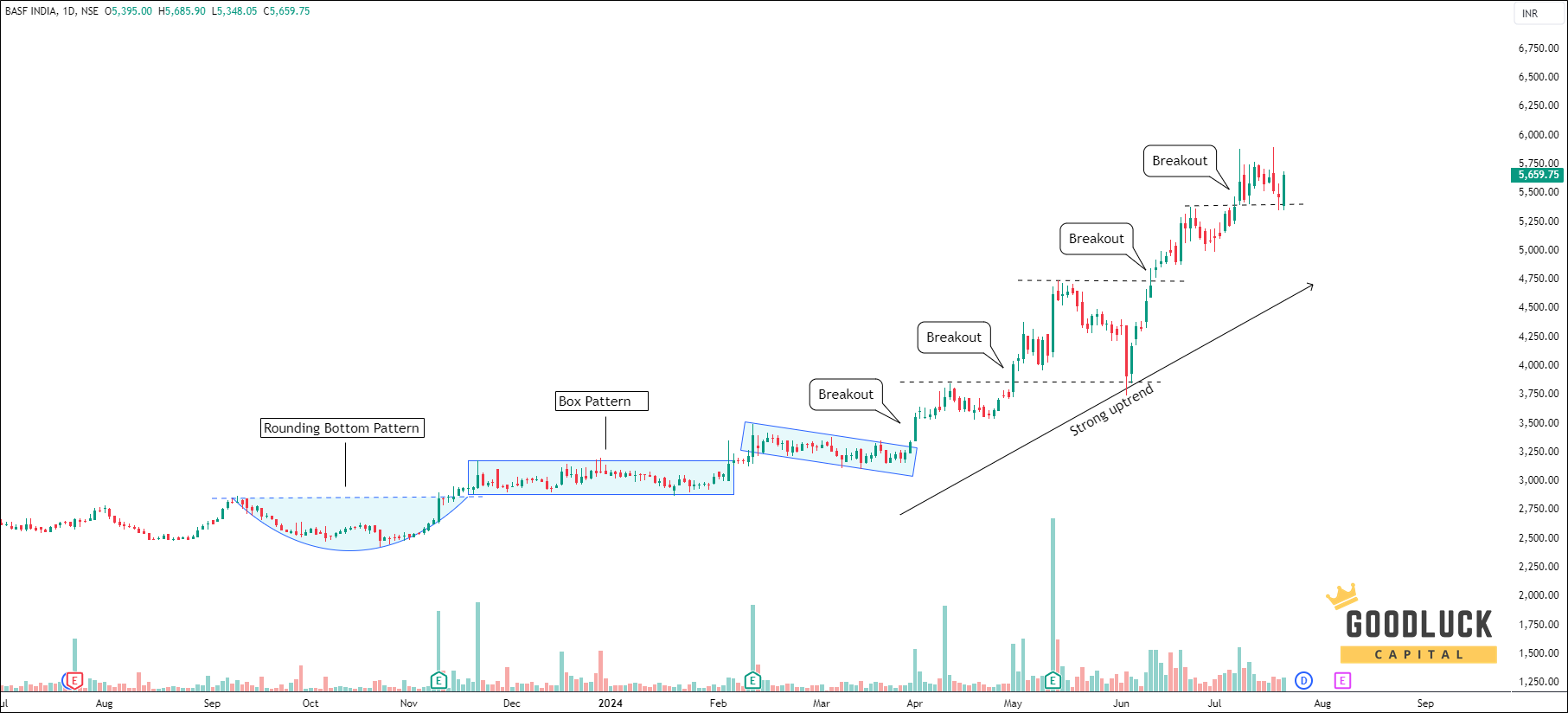

Buy BASF India

nse: basf

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 5450 - 5600

- : 6050 - 6200

- : below 5200

- : 10% - 12%

- : 12-14 days

-

Buy S H Kelkar

nse: shk

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 285 - 300

- : 330 - 340

- : below 270

- : 13% - 16%

- : 14-15 days

More Trading & Investment Advice

- Premium (unlocked)

- January 28, 2026

- Premium (unlocked)

- January 28, 2026

- Premium (unlocked)

- January 20, 2026