Simple Pricing Plans

Choose the Best Plan for you

₹1,900 OFF on any service + 20% OFF on two or more services!

Save big with the combo pack!

Premium Plans

Features

- 10—12 swing trade advice / month

- expected upside 6%—8% per trade

- short term trade holding 1-2 weeks

- minimum capital required ₹2.5 lakh

- receive trade advice before 9:00 am

- trade ideas by blackbox system, relied on statistics, technical, fundamental, macroeconomics and sentiment

- Stocks only — no intraday or F&O

Select Subscription

Months

01

Price

₹ 6666

Months

03

20% OFF

₹ 20000

Price

₹ 15900

Months

06

35% OFF

₹ 40000

Price

₹ 25900

Months

12

Price

₹ 39900

Months are referred as calendar months

- e.g. 12 January — 12 April (3 Months)

- 20 June — 20 December (6 Months)

Looking for more information?

Our FAQ section covers everything you need to know about Premium Swing Trade Advice

Looking for more information?

Our FAQ section covers everything you need to know about Premium Swing Trade Advice

Swing Trade Advice Benefits

- ideal for short term positional traders

- receive trading advice via Whatsapp

- precise Entry, Target and StopLoss

- preferred largecap & midcap stocks

- revised targets & stoploss if required

- alert message for target or stoploss hit

Swing Trade Advice Samples

-

Buy Piramal Pharma

nse: pplpharma

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 190 - 194

- : 204 - 207

- : below 180

- : 7% - 8%

- : 12-14 days

-

Buy Le Travenues Technology

nse: ixigo

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 215 - 220

- : 240 - 240

- : below 195

- : 10% - 13%

- : 14-15 days

-

Buy Privi Speciality Chemicals

nse: priviscl

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 1845 - 1875

- : 1975 - 2000

- : below 1770

- : 6% - 8%

- : 12-14 days

-

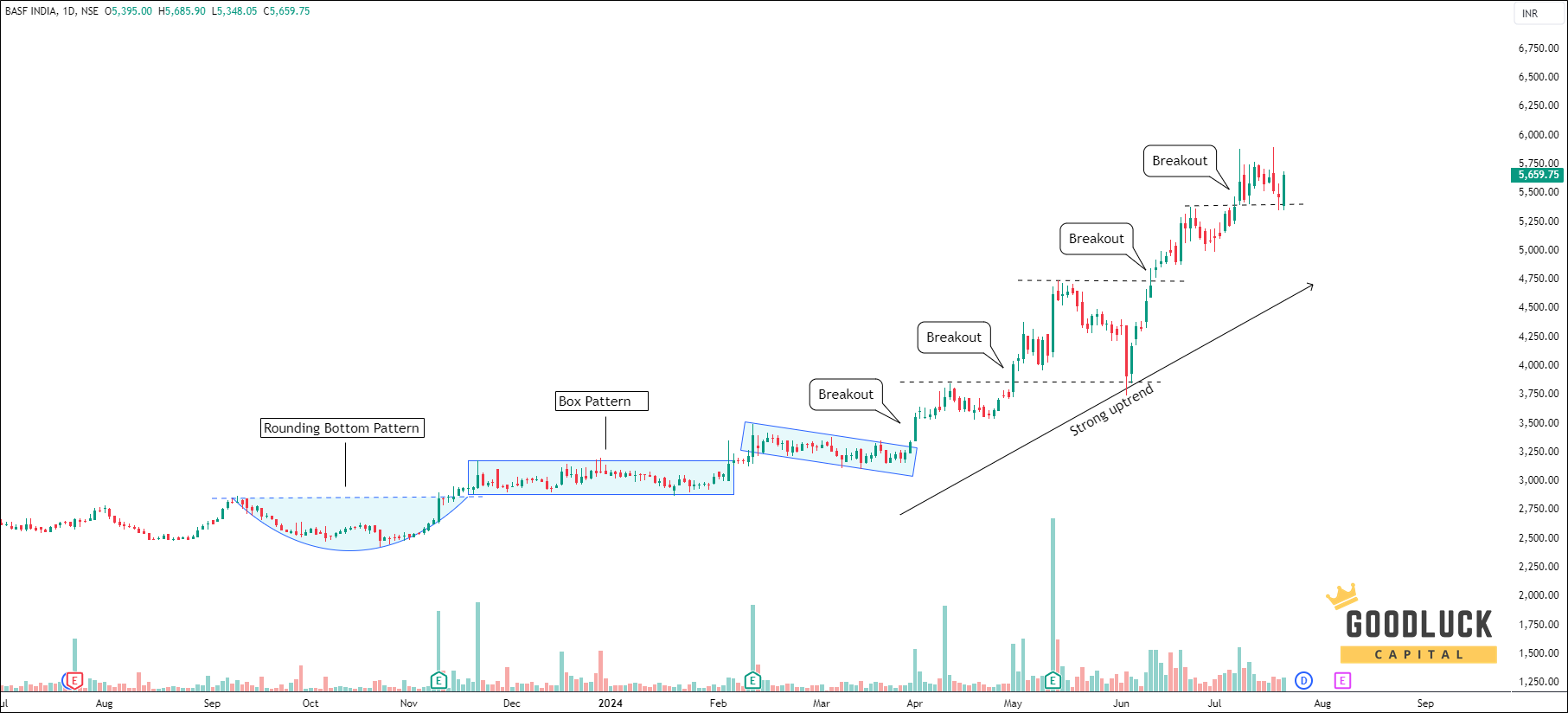

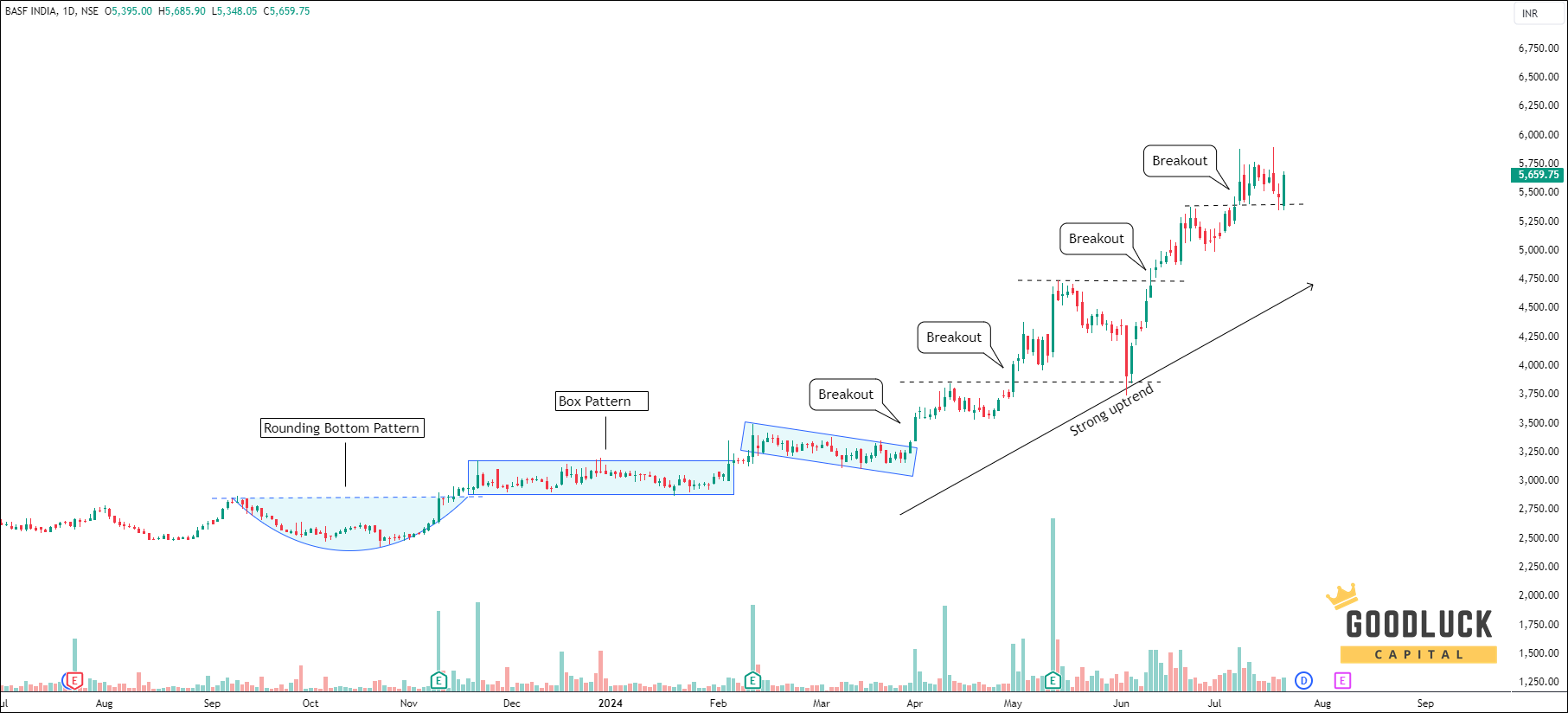

Buy BASF India

nse: basf

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 5450 - 5600

- : 6050 - 6200

- : below 5200

- : 10% - 12%

- : 12-14 days

-

Buy S H Kelkar

nse: shk

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 285 - 300

- : 330 - 340

- : below 270

- : 13% - 16%

- : 14-15 days

- Investment Advice

Features

- total 6 / 12 investment advice

- invest holding 6—18 months

- fundamentally strong undervalued stock

- expected upside 20%—50% per stock

Select Subscription

Quantity

06

35% OFF

₹ 35000

Price

₹ 22900

Quantity

12

50% OFF

₹ 70000

Price

₹ 34900

Quantity refers the number of investment advice

Example: A subscription of 12 advice remains active until all 12 recommendations have been delivered.

Looking for more information?

Our FAQ section covers everything you need to know about Premium Investment Advice

Looking for more information?

Our FAQ section covers everything you need to know about Premium Investment Advice

Investment Advice Benefits

- ideal for short/medium term investors

- preferred largecap & midcap stocks

- get investment advice via Whatsapp

- precise Entry, Target and StopLoss

- high potential reward, low downside risk

- invest in value stocks at a significant discount to their intrinsic value

- combining technical for precise entry

Investment Advice Samples

-

Buy Zen Technologies

nse: zentec

- Best Buy Range

- Sell Target (1st)

- Potential Upside

- Sell Target (2nd)

- Potential Upside

- Approx Invest Period

- : 2000 - 2050

- : 2500 - 2600

- : 25% - 30%

- : 2800

- : 40%

- : 12-14 months

-

Buy CreditAccess Grameen

nse: creditacc

- Best Buy Range

- Sell Target

- Potential Upside

- Approx Invest Period

- : 990 - 1030

- : 1200 - 1250

- : 20% - 25%

- : 25-40 days

-

Buy Saksoft

nse: saksoft

- Best Buy Range

- Sell Target (1st)

- Potential Upside

- Sell Target (2nd)

- Potential Upside

- Approx Invest Period

- : 170 - 172

- : 207 - 210

- : 23% - 25%

- : 247 - 250

- : 47% - 50%

- : 12-14 months

-

Buy Caplin Point Lab

nse: caplipoint

- Best Buy Range

- Sell Target

- Upside Potential

- Approx Invest Period

- : 2100 - 2150

- : 2550 - 2600

- : 19% - 20%

- : 4-6 months

-

Combo Advice

(Swing Trading + Investment)

Swing Trading Features

- 10—12 swing trade advice / month

- expected upside 6%—8% per trade

- short term trade holding 1-2 weeks

- all features of swing trading advice

Investment Advice Features

- total 6 / 12 investment advice

- invest holding 6—18 months

- expected upside 20%—50% per stock

- all features of investment advice

Select Subscription

Swing Trading

06 Months

Investment

06 Quantity

From

₹ 75000

Promo

35% OFF

Price

₹ 48500

Swing Trading

12 Months

Investment

12 Quantity

From

₹ 150000

Promo

55% OFF

Price

₹ 67500

A Combo subscription has two parts: Swing Trade and Investment advice. Swing advice is based on time, and Investment advice is based on quantity.

For example, a combo having 12-months swing trade part has a set expiration date after 12 months, while it's 12-quantity investment part ends after all the 12 recommendations are delivered.

Swing Trading

06 Months

Investment

06 Quantity

From

₹ 75000

Promo

35% OFF

Price

₹ 48500

Swing Trading

12 Months

Investment

12 Quantity

From

₹ 150000

Promo

55% OFF

Price

₹ 67500

A Combo subscription has two parts: Swing Trade and Investment advice. Swing Trade is based on time, and Investment advice is based on quantity.

For example, a combo having 12-months swing trade part has a set expiration date, while it's 12-quantity investment part ends after all the 12 recommendations are delivered.

Looking for more information?

Our FAQ section covers everything you need to know about Premium Combo Advice

Looking for more information?

Our FAQ section covers everything you need to know about Premium Combo Advice

Combo Advice Benefits

- ideal for short/medium term investors

- receive advice via Whatsapp

- preferred largecap & midcap stocks

- precise Entry, Target and StopLoss

- revised targets & stoploss if required

- alert message for target or stoploss hit

Combo Advice Samples

-

Buy Piramal Pharma

nse: pplpharma

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 190 - 194

- : 204 - 207

- : below 180

- : 7% - 8%

- : 12-14 days

-

Buy Le Travenues Technology

nse: ixigo

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 215 - 220

- : 240 - 240

- : below 195

- : 10% - 13%

- : 14-15 days

-

Buy BASF India

nse: basf

- Best Buy Range

- Sell Target

- StopLoss

- Potential Upside

- Approx Trade Duration

- : 5450 - 5600

- : 6050 - 6200

- : below 5200

- : 10% - 12%

- : 12-14 days

-

Buy Zen Technologies

nse: zentec

- Best Buy Range

- Sell Target (1st)

- Potential Upside

- Sell Target (2nd)

- Potential Upside

- Approx Invest Period

- : 2000 - 2050

- : 2500 - 2600

- : 25% - 30%

- : 2800

- : 40%

- : 12-14 months

-

Buy CreditAccess Grameen

nse: creditacc

- Best Buy Range

- Sell Target

- Potential Upside

- Approx Invest Period

- : 990 - 1030

- : 1200 - 1250

- : 20% - 25%

- : 25-40 days

- Stock Option Advice

Features

- 5—6 trade advice / month based on different buy-sell option strategies

- expected upside 3%—15% per trade

- short term option trade 1-4 weeks

- required minimum capital ₹2.5 Lakh

- receive trade alerts during market hours (IST 9:15am — 3:00 pm)

- option strategies for every market conditions: up, down, or sideways

Select Plans

Months

01

Price

₹ 5000

Months

03

20% OFF

₹ 15000

Price

₹ 11900

Months

06

35% OFF

₹ 30000

Price

₹ 19900

Months

12

50% OFF

₹ 60000

Price

₹ 29900

Months are referred as calendar months

- e.g. 12 January — 12 April (3 Months)

- 20 June — 20 December (6 Months)

Looking for more information?

Our FAQ section covers everything you need to know about Premium Stock Option Advice

Looking for more information?

Our FAQ section covers everything you need to know about Premium Stock Option Advice

Stock Option Advice Benefits

- receive trading advice via Whatsapp

- trade idea relied heavily on data, technical and sentiment

- ideal for short term positional traders

- precise Entry, Target and StopLoss

- Only FnO stocks

- in-depth research for every advice

- alert message for target or stoploss hit

- revised targets & stoploss if required

Stock Option Advice Samples

- Buy Concept Therapeutics nasdaq: cort

- Best Buy Range

- Sell Target

- StopLoss

- Potential Return

- Approx Trade Duration

- : 45.5 - 46.5

- : 49.5 - 50

- : below 43.75

- : 6% - 8%

- : 12-14 days

- Buy Concept Therapeutics nasdaq: cort

- Best Buy Range

- Sell Target

- StopLoss

- Potential Return

- Approx Trade Duration

- : 45.5 - 46.5

- : 49.5 - 50

- : below 43.75

- : 6% - 8%

- : 12-14 days

- Buy Concept Therapeutics nasdaq: cort

- Best Buy Range

- Sell Target

- StopLoss

- Potential Return

- Approx Trade Duration

- : 45.5 - 46.5

- : 49.5 - 50

- : below 43.75

- : 6% - 8%

- : 12-14 days

Pricing

Your cart is empty.

Trusted and certified by the best degree in trading and investment

How to receive our advice?

Tips and Advice

Follow-ups

Detailed Report

Why Goodluck Capital?

Focused research, No gimmicks and Complete transparency

Features

✅ Goodluck Capital

⚠️ Other Stock Advisors

Core Philosophy

✅️ Transparency, ethics, and a client-first approach

⚠️ Marketing-heavy, often sales-driven focus

Ideas Frequency & Quality

✅️ Fewer, high-quality trading ideas to reduce unnecessary risk and maximize clarity in decision-making

Transparency

✅️ Past trade records are available on our website, with every detail verified on TradingView with Timestamp

⚠️ No verified track records. Often hide or manipulate their past performance

Research Methodology

✅️ Every call explained in Analysis — so you can understand the ‘why’ behind them.

Demo or Trials

✅️ Free advice is always available on our website — open to everyone for life. This lets you evaluate our research quality over the long period, not just through a few days trial

⚠️ Free Trials as a marketing gimmick. No verified proven track records. 2-3 demo calls can be misleading, especially in the favorable market conditions and cannot prove the reliability or expertise of an advisor

Compliance

✅️ SEBI registered, BSE enlisted, follows all regulatory guidelines

⚠️ Many operate without proper compliance, posing a risk to investors

Communication

✅️ We prioritize your privacy with a strict no-spam policy. You will never receive unsolicited calls or messages

⚠️ Repeated promotional calls/messages

Specialization

✅️ Deep expertise in Swing Trades & Investments — our sole focus over the last 15+ years

⚠️ Lack of specialization, offer a wide range of services — including intraday, btst, F&O, commodities, index trading etc. Often bundled with fancy levels like Gold, Diamond, Platinum to sell the same service at different prices.

Client Retention

⚠️ Often experience a high churn rate due to client dissatisfaction

Enjoy all the PREMIUM Benefits in our 2 in 1 subscription.

Save big with the combo pack!

Trusted by Investors Across India

I joined for short-term calls, but I also started following their long-term investment advice. The balance between the two strategies really works for me.

Suresh Iyer

Chennai

The transparency is unmatched. I can cross-check every past recommendation on TradingView, and the accuracy speaks for itself. No fake claims—just solid research and real results.

Kolkata

I was new to trading, and Goodluck Capital gave me the confidence to start small. The accuracy rate is high, and their approach is very transparent.

Gurgaon

Earlier I used to rely on social media groups, but there was no accountability. With Goodluck Capital, every call has a timestamp and an update—it feels professional and trustworthy.

Dubai

My long-term portfolio has grown steadily thanks to their investment ideas. No overpromises, just clear entry and exit levels backed by research.

Jaipur

Feel free to Contact Us for any query or explanation

Frequently Asked Questions

Free Calls, Trials, and Subscriptions — Answered

Yes, we do provide free calls from time to time, and these are available to everyone without any limit. You can follow us on our website, WhatsApp channel, or Telegram channel, where these calls are openly shared for life. These free calls are equally good as our premium advice, backed by the same research methodology and data-driven approach.

However, our premium advice is not distributed for free to individuals who are only exploring whether to subscribe. There are strong ethical reasons behind this. Our premium calls are crafted through dedicated research and provided to existing subscribers who trust us. Offering the same advice freely for promotional purposes would be unfair to them.

We believe that free advice should be freely accessible to everyone, so you can evaluate our research quality over the long term — not just through a gimmicky trial.

While the research behind free and premium calls is the same, free calls are limited in frequency, irregular, and do not include any personalized support, timely updates, or capital allocation guidance.

Premium calls, on the other hand, provide regular guidance, timely alerts, ongoing assistance, and portfolio management advice—all designed to help you make informed decisions and stay on track in the long run. Subscribing premium ensures you get the full range of services, support, and tools needed to navigate the market effectively—not just individual trade ideas.

Free calls and demo calls may look similar, but they serve very different purposes. Our free calls are open to everyone and are designed to reflect the consistency of our research over the long term.

Demo calls, on the other hand, are often used by some advisors to attract clients by offering a few trial calls for a limited time. However, 3 or 4 such trials cannot prove the reliability or expertise of an advisor. A demo call might succeed just because the market was favorable at that moment— which doesn’t reflect real performance over time.

We want you to evaluate advisors based on real, verified results, not temporary trends. That’s why our free calls are open to all and represent the same methodology we use for our subscribers.

We deliberately do not offer demo calls or short-term trials, because such trials are misleading. A few successful calls during a market upswing can give the illusion of expertise, but trading and investing are long-term pursuits that require tested strategies, risk management, and disciplined execution.

Instead, we encourage every trader and investor to check an advisor’s credibility by reviewing their verified past records, client testimonials, and regulatory compliance (like SEBI registration). These are far more reliable indicators than temporary trial calls.

We believe in helping clients make informed decisions based on facts, not gimmicks that may eventually hurt their hard-earned money.

Great question — your hesitation is completely natural and we respect that. But confidence must be built on proof, not promises.

👍 Here’s how you can independently verify us before subscribing:

We make every effort to be fully transparent so you can decide with confidence:

✅ Verified records on TradingView — time-stamped past trades so you can check each recommendation, entry, and outcome yourself.

✅ Client reviews & testimonials — read what our clients say about us on Google and our website. These reviews are independent and reflect real user experiences.

✅ Regulatory credentials — we are a SEBI-registered Research Analyst. You can verify our registration details directly on the SEBI portal.

✅ Open, free calls — regular public recommendations that show how we think and trade.

✅ Fair premium policy — Premium advice is locked and exclusively for subscribers. We do not give away paid calls for free. Once targets/Stoploss are hit, the advice is unlocked publicly — so everyone can verify fairness and accuracy.

No gimmicks — Complete Transparency

We encourage you to study this data carefully and understand our research philosophy before subscribing. Our goal is to empower you with information, so you feel secure investing with us — not pressured by gimmicks or false promises.

Our pricing reflects the quality, integrity, and transparency of our services — not aggressive promotions or discount tactics to push subscriptions at any cost.

The fee structure is transparent and straightforward, inclusive of all taxes. What you see is exactly what you pay — there are no hidden charges or surprise add-ons at checkout. Unlike others, there are no confusing labels like Gold, Platinum, or Diamond to sell the same service at different prices.

While other advisors may charge ₹1000–₹1500 per call, our yearly plans reduce the cost to as low as ₹350 per call, and never exceed ₹600 per call. This is far more affordable over the long term, given the level of detail and expertise we provide.

Our aim is straightforward—focusing clients who value long-term growth and ethical investing. With Goodluck Capital, you’re not just buying calls—you’re joining a community built on trust, verified results, and sustainable wealth creation.

All You Need to Know About Our Recommendations

All recommendations including the follow-ups for active positions, will be sent instantly to your WhatsApp number registered with us.

To protect your privacy, we send advice directly to your WhatsApp and never added you to group chats, keeping your details confidential.

Beyond these real-time updates, you can always access the detailed research reports on our website.

We focus only on large-cap and mid-cap companies that are fundamentally strong and stable. We do not recommend penny stocks under any circumstances.

As a SEBI registered Research Analyst, we cannot and do not assure or guarantee any fixed percentage of return. The stock market is influenced by many external factors such as market conditions, global events, and company fundamentals, which are beyond anyone’s control.

What we do provide is well-researched recommendations with defined entry price, target, and stop-loss levels. This helps you manage both risk and potential reward in a disciplined manner.

Past Trade Records can give you an idea of how our research has worked over time, but it is not a promise of future results. The actual return you achieve will depend on how closely you follow the calls, your risk profile, and overall market conditions.

All past free & premium recommendations are available on our Stock Analysis page, listed by date.

Yes. Goodluck Capital is a SEBI-registered Research Analyst firm led by Mr. Arijit Banerjee. Our SEBI Registration Number is INH300006582. You can check our registration details and find more in the About Us page of our website.

We offer multiple secure payment options for your subscription. You can pay through our integrated gateways such as Razorpay, Paytm, or Instamojo. We also accept direct bank transfers via UPI ID or QR code.

Your subscription period starts on the day you receive the first advice from us, not from your payment date. This ensures you get the full value of your subscription period.

Example:

- Payment date: January 1st

- First advisory call: January 5th

Your subscription will become active on the January 5th onwards.

Welcome aboard! Here’s what to expect:

- Check Your Email: You should have already received an invoice confirmation shortly after payment. 💡 Tip: If you don’t see it, please check your spam or promotions folder just in case.

- Complete KYC: We’ll send a quick KYC form to your registered email—please fill it out to help us onboard you securely.

- Gain Access to Membership: After we review and approve your KYC submission, we'll add you to our member lists and grant you full access to your subscription benefits.

If you don't receive any emails within 24 hours, please contact our support team for assistance.

Swing Trading Subscription

The minimum subscription period is one month.

However, we strongly recommend a minimum subscription of three months. This duration is crucial to capture a full market cycle and allows you to accurately assess the effectiveness of our strategies and get the best possible results from the service.

Minimum 2.5 lacs of capital is required to effectively use our service.

- Weekly: You will typically receive 2-3 trading calls per week.

- Monthly: This averages out to about 10-12 calls per month.

The exact number depends on market opportunities, as we always prioritize quality over quantity.

We strongly advise against investing all your capital in a single stock. A proper capital allocation strategy is extremely beneficial to optimize overall portfolio returns. And diversifying your capital will help to:

- Minimize risk across multiple positions

- Protect against individual stock losses

However, access to this capital management strategy is available only for 3-months or longer subscription plans.

We use a combination of both fundamental and technical analysis. Fundamentals help us understand the value of a company, while technical guide us on the right timing for entry and exit. Using both together allows us to find out correct stock.

All You Need to Know About Our Recommendations

The minimum subscription period for the Ultra Swing Trading service is one month.

However, we strongly recommend a minimum subscription of three months. This duration is crucial to capture a full market cycle and allows you to accurately assess the effectiveness of our strategies and get the best possible results from the service.

Minimum 2.5 lacs of capital is required to effectively use our service.

- Weekly: You will typically receive 2-3 trading calls per week.

- Monthly: This averages out to about 10-12 calls per month.

The exact number depends on market opportunities, as we always prioritize quality over quantity.

We strongly advise against investing all your capital in a single stock. A proper capital allocation strategy is extremely beneficial as it helps to optimize overall portfolio returns. And diversifying your capital will help to:

- Minimize risk across multiple positions

- Protect against individual stock losses

However, access to this strategy is available only for 3-months or higher subscription plans.

We use a combination of both fundamental and technical analysis. Fundamentals help us understand the value of a company, while technical guide us on the right timing for entry and exit. Using both together allows us to find out correct stock.